On Thursday, Eastern Time, Cleveland Federal Reserve President Beth Hammack reiterated her concerns about inflation, saying it was unclear whether the central bank should cut interest rates further.

Hammark stated at the Economic Club of New York: "I remain optimistic about Qualcomm." They expressed concern about inflation and believed that policies should lean towards curbing it.

“ Following last week’s meeting, I believe that even if monetary policy has a limiting effect, it is almost negligible, and in my view, it is not clear whether monetary policy should take further measures at present. But the future is inherently uncertain, and I will closely monitor developments,” she added.

This week, amid the US federal government shutdown and lack of data, Chicago Fed President Austan Goolsbee, Fed Governor Lisa Cook, and San Francisco Fed President Mary Daly all stated that no decision has yet been made on whether to cut interest rates again in December.

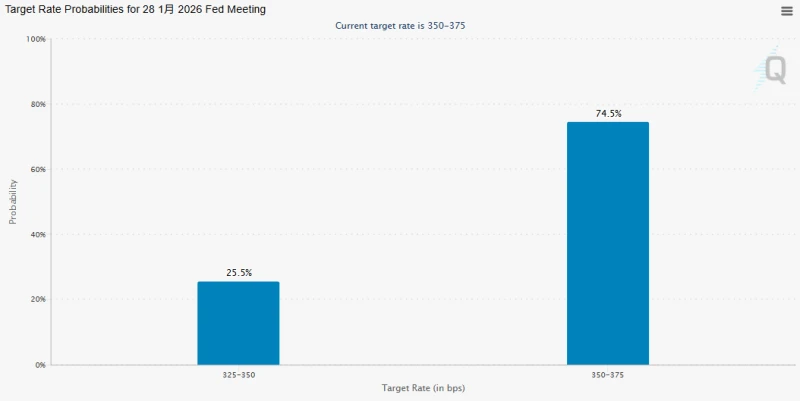

Last week, the Federal Reserve lowered its target range for the federal funds rate by 25 basis points to between 3.75% and 4.00%, as expected. This is the Fed's second rate cut this year (2025) and the second consecutive rate cut since September. For the first eight months of this year, the Fed remained on hold, awaiting an assessment of the impact of tariffs and other policy adjustments on the economy.

Harmark also stated that she believes the current interest rate range is close to her estimate of the neutral interest rate.

The neutral interest rate will neither stimulate nor slow economic growth. She said it would make her nervous if it fell below that level because she believes "inflation is worse than employment."

She further pointed out that the current inflation rate is too high compared to the Federal Reserve's 2% inflation target, and the trend is wrong. Hammark believes that the Fed has deviated from its target by a full percentage point in terms of inflation, and it is unlikely to return to the target level for several years, while the unemployment rate is not as alarming.

Regarding the labor market, Hammark expects the unemployment rate to rise slightly starting next year, then decline over the next two to three years. She said a range of other indicators, including consumer spending and GDP growth, suggest that the overall economy remains healthy, reducing the likelihood of a job market downturn.

“At this point, I think monetary policy can’t do any more without risking a cliff-like fall,” she added.

Tariff impact

On the other hand, while Hammark stated that economic theory suggests tariffs should lead to a one-off price increase, she did not see or expect this to be the case.

“Tariff changes are huge, dynamic, and ongoing, far from what textbooks portray. Based on all these considerations, I don’t believe rising inflation is a purely temporary phenomenon that I should ignore, ” she added.

Hammark also said that the business owners she spoke with were making difficult decisions about which costs to absorb and which to pass on to customers.

Cleveland Federal Reserve Bank A survey found that the more dependent a company is on imports, the greater the expected cascading effect. Hammark said this helps explain why more than two-thirds of her contacts in the construction industry told her they expect to pass on all or most of the tariff-related cost increases to their clients.

Hammark also pointed out that businesses are most concerned about health and property insurance. The sharp rise in fees and electricity costs. In the short term, artificial intelligence... This actually increases the company's costs.

She also mentioned that some inflation indicators that should be relatively unaffected by tariffs are sticky, noting that the core services inflation rate, excluding housing, was 3.4% in August, almost unchanged from 3.6% in August 2024.

(Article source: CLS)