An OpenAI executive's statement that "government guarantees are needed for AI investment" sent shockwaves through the US stock market. On Thursday, US tech stocks plummeted, with the combined market capitalization of the six major tech giants and several computing power providers partnering with OpenAI wiping out nearly $500 billion overnight.

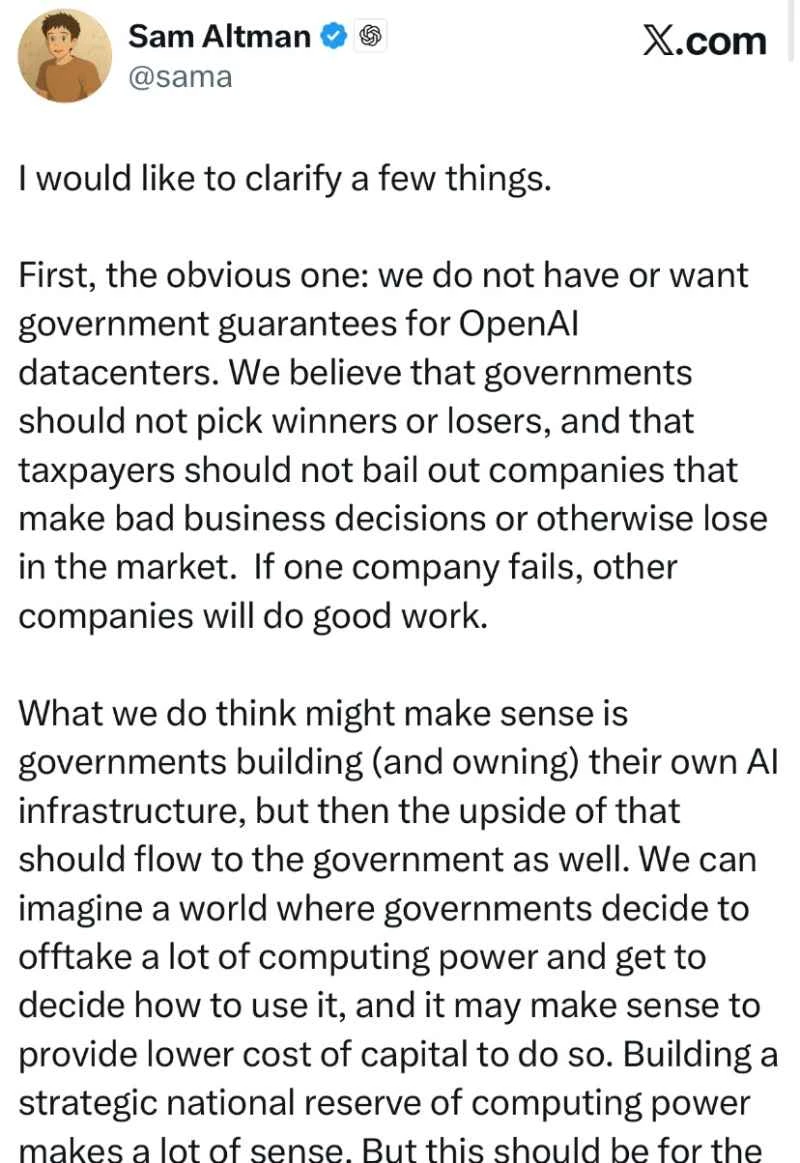

In the early hours of November 7, OpenAI CEO Sam Altman released a nearly 2,000-word response, clarifying that the company "needs and does not want government guarantees" and disclosing its revenue forecast for the first time—expecting annualized revenue to exceed $20 billion this year and reach hundreds of billions of dollars by 2030, in an attempt to restore market confidence.

Despite a slight rebound in some tech stocks in after-hours trading, such as Nvidia... Microsoft shares rose approximately 0.85% in after-hours trading. It rose 0.12% in after-hours trading, but compared to the huge market value that evaporated overnight, such a rebound was nothing more than a drop in the ocean.

US stocks have been rising all year, gaining more than 30% since their lows in April, but the market has never shaken off its concerns about an AI bubble in the tech sector and is worried about a repeat of the dot-com bubble of the late 1990s. The attitudes and actions of many Wall Street institutions have confirmed this, which is the fundamental reason why these remarks have triggered a huge shock in US stocks.

Nearly $500 billion evaporated overnight

The storm began with a speech by OpenAI CFO Sarah Friar at a public event. She mentioned that the company was seeking to build a partnership with private equity firms and banks. And an ecosystem of federal government "backstops" or "guarantees" to finance its massive chip investments.

The market reacted strongly, interpreting it as "AI giants need government bailouts," further exacerbating existing concerns about an AI bubble.

In the preceding months, OpenAI, NVIDIA , and several major computing power vendors reached a series of collaborations based on data centers . The company has signed $1.4 trillion in order commitments, but OpenAI's current revenue capacity is far from covering this capital expenditure, which is considered a gamble. The "circular transactions" between giants have also raised questions about an AI bubble.

On November 7th, the three major U.S. stock indexes all fell, with technology stocks being the hardest hit. The Wind U.S. Tech Seven Giants Index fell 1.91%. Specifically, Nvidia fell 3.65%, and Tesla... Amazon fell 3.5%. Apple fell 2.86%, and Meta fell 2.67%, leading the decline among the seven major tech giants. Microsoft has also fallen for seven consecutive trading days, dropping 1.98% last night, marking its longest losing streak since 2022. It fell slightly by 0.14%. Among the seven giants, only Google rose slightly by 0.21%.

Nvidia lost $173 billion overnight, and the combined market capitalization of the six major tech giants evaporated by nearly $430 billion in a single night. Furthermore, AI stocks that have partnered with OpenAI on computing power were not spared either, with AMD falling 7.27% and Intel... Oracle fell 2.97%. Broadcom fell 2.6%. The price dropped 0.94%, and four computing power companies lost more than $63 billion overnight.

According to the latest closing prices, these tech stocks have lost a total of nearly $500 billion, equivalent to nearly 3.3 trillion yuan.

As the situation escalated, David Sacks, an AI advisor to the U.S. government, responded on social media, stating that there are at least five major cutting-edge AI model companies in the United States, and if one goes bankrupt, the others will take its place.

Freer also responded, stating that using the term "backstop" obscured the issue. Her point was that America's technological strength will come from building genuine industrial capacity, requiring both the private sector and the government to fulfill their respective responsibilities. The US government has been very proactive and truly understands that AI is a national strategic asset.

Altman also posted an emergency message in the early hours of the 7th to "put out the fire." The post was nearly 2,000 words long, in which Altman stated that he "needs and does not want the US government to provide guarantees for the OpenAI data center ."

Regarding the market's biggest concern, "how to pay for the $1.4 trillion infrastructure order," he disclosed the company's revenue forecast for the first time: annualized revenue this year will exceed $20 billion, and will grow to hundreds of billions of dollars by 2030.

“Every time revenue doubles, it presents a huge challenge, but we are full of confidence,” Altman revealed, adding that the company is about to launch an “enterprise-level product” and will also be involved in consumer electronics. and robots Expanding business scope.

Regarding why he chose to invest heavily all at once instead of taking a gradual approach, he explained: "The future prospects we see from our research indicate that now is the best time to increase investment and scale up the technology." He believes that OpenAI faces "a risk of insufficient computing power far outweighing the risk of excess computing power."

Concerns about an AI bubble

While these responses led to a slight rebound in after-hours trading, market sentiment has not truly calmed down. In after-hours trading, Nvidia rose approximately 0.85%, AMD rose 0.42%, and Microsoft rose 0.12%, with most gains being less than 1%.

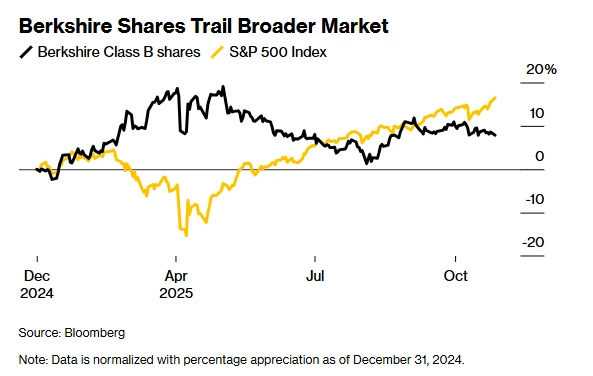

Since the beginning of this year, US stocks have risen more than 30% from their lows in April, but doubts about whether AI is a bubble have not dissipated, with the market worried about a repeat of the dot-com bubble of the late 1990s.

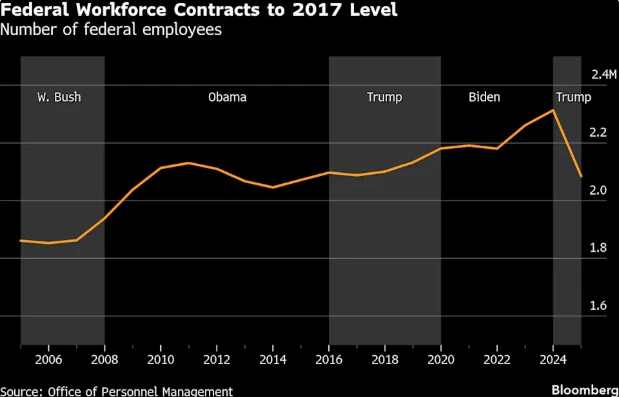

In addition to the controversy sparked by OpenAI, the US job market is also sending unfavorable signals. Data released by the US employment consulting firm Challenger shows that as of September this year, the number of layoffs announced by US companies has approached 950,000, the highest level for the same period since 2020.

The "Buffett Indicator" is also flashing a red flag—the size of the US stock market has exceeded twice the total GDP, surpassing historical records set during the pandemic. The Buffett Indicator is used to assess whether stock valuations are too high; while not perfect, it remains a useful reference tool.

Michael Burry, a well-known American short seller, expressed his bearish sentiment through his actions. Last week, he wrote, "Sometimes we can sense a bubble, sometimes we can act on it, and sometimes the only way to win is to choose not to participate." According to foreign media reports, Burry's Scion Asset Management disclosed in its third-quarter report that it has spent approximately $1.1 billion shorting Nvidia and Palantir in the US AI sector.

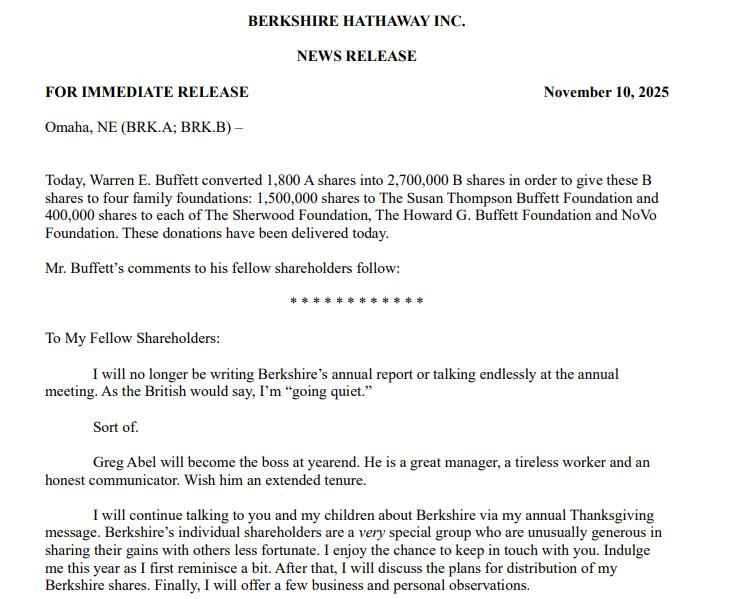

Before handing over the reins, Warren Buffett's disclosure of cash reserves is also sending a cautious signal to the market. On November 1, Berkshire Hathaway disclosed in its Q3 2025 financial report that as of the end of the third quarter, Berkshire's cash reserves had surged to $381.67 billion, setting a new record high.

This financial report is significant because it's Buffett's last earnings report before stepping down. Given the generally high valuations of US stocks, Buffett opted for a defensive strategy of "holding cash and waiting." In the third quarter, Berkshire Hathaway continued its net selling of other companies' stocks, continuing the company's recent trend of reducing its stock holdings, indicating that Buffett believes the market lacks attractive investment targets.

At the recent Italy Tech Week, Goldman Sachs CEO David Solomon also warned that the stock market will not rise in a straight line, and many people betting on ever-increasing returns may be disappointed in the next year or two.

Solomon believes that stock returns are often highest when a technology is just emerging and not yet widely accepted by the public, but there will always be winners and losers. He cites the dot-com bubble as an example, saying that as a Wall Street professional, he made a lot of money and lost a lot of money during that period, "It was definitely the best and the worst of times."

Solomon points out that one positive argument is that today's bubble isn't as severe as in 1999 because most of the best-performing companies are genuinely profitable. However, investors should remember that the stock market is volatile and, over time, it will follow a circuitous upward path rather than a straight one.

(Article source: CBN)