The US market is once again facing challenges from the Pacific Ocean. The threat from the other side...

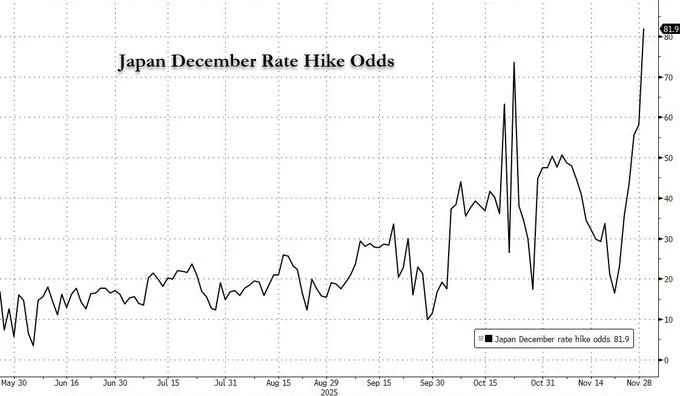

Japanese government bond yields surged after Bank of Japan Governor Kazuo Ueda gave his clearest signal yet on Monday—hinting at a possible rate hike later this month—followed by a rapid rise in yields on global sovereign bonds from the U.S. to Europe and other parts of Asia.

During a meeting with Japanese business leaders in Nagoya that day, Ueda stated that the Bank of Japan would "weigh the pros and cons" at its policy meeting, which concludes on December 19, and consider whether to raise the policy interest rate. The Bank of Japan last raised interest rates in January of this year—when the rate was increased from 0.25% to 0.5%, bringing Japan's borrowing costs to their highest level in 17 years.

Undoubtedly, the prospect of a Bank of Japan rate hike this month has surprised investors —who had initially thought the central bank might postpone the hike under pressure from new Prime Minister Sanae Takaichi. However, with Kazuo Ueda indicating that the possibility of a rate hike will be discussed in depth at the next meeting, many have begun to revise their views.

At a press conference in Nagoya, Ueda stated that Japan's economic outlook has improved following the recent trade agreement reached with the Trump administration. As uncertainty surrounding the impact of US tariffs gradually subsides, the likelihood of the Bank of Japan achieving its economic and price forecast targets is increasing. This statement indicates that the Bank of Japan is confident that conditions for raising interest rates are gradually maturing.

"The uncertainty surrounding U.S. tariff policies and the U.S. economy, which we are particularly concerned about, has significantly decreased compared to several months ago," Ueda said.

Dow Jones market data showed that Kazuo Ueda's hawkish comments pushed the yield on Japan's 10-year government bond to 1.879% on Monday, the highest closing level since June 2008. The yield on Japan's two-year government bond—one of the most sensitive indicators to changes in monetary policy—broke the 1% mark for the first time in 17 years.

This bond market turmoil, originating in Japan, quickly triggered a global bond market sell-off on Monday, affecting bond trading in Australia, New Zealand, France, Italy, Greece, and the United States. The yield on the 10-year U.S. Treasury note also surged overnight to 4.095%, from just below 4% last week.

In the bond market, yields move inversely to prices, so yields rise whenever government bonds are sold off.

Some on Wall Street are concerned that rising Japanese bond yields will lead to capital flight from the United States, thereby pushing up the yield on 10-year U.S. Treasury bonds—a key indicator of global asset pricing that determines borrowing costs for consumers and businesses.

Market concerns about a repeat of last August's disaster scenario?

Before Ueda's speech on Monday, investors were primarily focused on the aggressive fiscal stimulus policies to be rolled out under Japan's first female prime minister, Sanae Takaichi, and whether the resulting rise in yields would make the Japanese bond market more attractive relative to the US and the rest of the world. However, Ueda's speech on Monday gave investors another reason to push up Japanese bond yields.

“The market widely expected before the weekend that the Bank of Japan would be more cautious in deciding its next move given the new prime minister’s inauguration. But the opposite has happened; the Bank of Japan seems poised to raise interest rates in December,” said Daniel Tenengauzer, senior macro analyst at InTouch Capital Markets in New York.

Tenengauzer stated that Ueda's comments about a possible rate hike this month prompted some investors to rebuild long yen positions, as the yen remains undervalued. "If the Bank of Japan adopts a more hawkish stance, people will want to reflect that factor in other markets."

Data from the U.S. Treasury Department shows that Japan, the world's third-largest economy, is the largest foreign holder of U.S. government debt, holding approximately $1.2 trillion in U.S. Treasury bonds as of September. In recent years, Japanese private investors have poured hundreds of billions of dollars into U.S. and other foreign bonds in search of higher returns than domestically.

“ After decades of ultra-loose monetary policy, the Bank of Japan is finally signaling the end of an era ,” said Ryan Jacobs, founder of Florida-based consulting firm Jacobs Investment Management. “US investors should pay close attention. A stronger yen and rising Japanese government bond yields could draw funds out of US bond and stock markets, thus tightening global financial conditions.”

For most of this year, this dynamic was not actually apparent—Japanese bond yields climbed as Japanese investors prepared for higher interest rates. Meanwhile, U.S. Treasury yields declined as the Federal Reserve moved in the opposite direction. Nevertheless, many analysts warn that this divergence may have its limits.

"The market had previously widely expected U.S. Treasury yields to continue their downward trend, but today's performance reminds us that several factors could break that expectation," said Zach Griffiths, head of investment-grade bonds and macro strategy at CreditSights.

For a long time, investors and economists have paid close attention to the yield on U.S. Treasury bonds, as it plays a key role in determining borrowing costs across the economy and the prices of various financial assets.

The decline in U.S. Treasury yields this year is largely attributed to a cooling U.S. labor market, which prompted the Federal Reserve to resume its interest rate cutting cycle. These rate cuts, in turn, have pushed down mortgage rates, boosting U.S. stocks—stocks typically benefit from low-yield environments because investors can no longer obtain substantial risk-free returns by holding Treasury bonds to maturity.

However, on Monday, US stocks also fell, following the decline in US Treasury prices —by the close of trading, the S&P 500 fell 0.5%, the Dow Jones Industrial Average fell approximately 427 points, a drop of 0.9%, and the Nasdaq... The composite index fell 0.4%.

Analysts say that given the Bank of Japan's control over global yen liquidity, U.S. Treasury traders remain highly sensitive to the Bank of Japan's policies. Rising interest rates in Japan could prompt domestic investors to allocate more funds to Japanese local government bonds rather than investing in higher-yielding overseas assets.

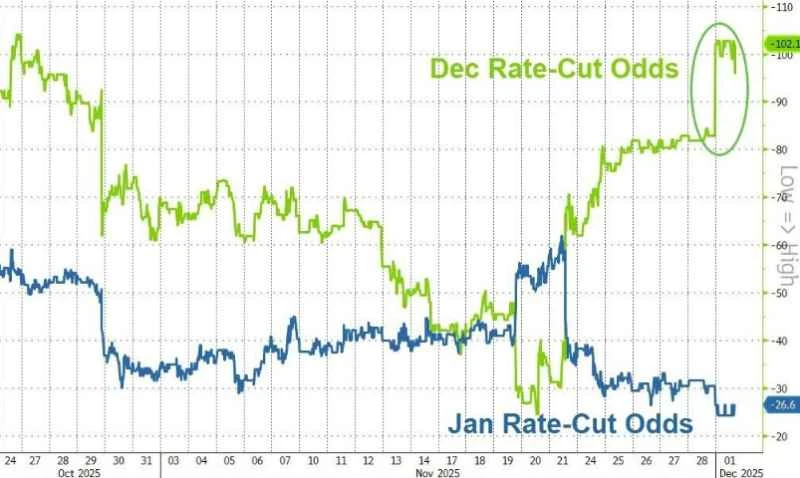

In fact, it wasn't just the Bank of Japan that affected the US Treasury market on Monday —traders also believe the probability of the Federal Reserve cutting interest rates for the third time this year next week has risen further to 80%. Many might wonder, shouldn't rising expectations of a Fed rate cut be putting downward pressure on US Treasury yields?

However, the focus for long-term US Treasury bonds may now extend beyond this. Jack McIntyre, portfolio manager at Brandywine Global Investment Management, stated that the market widely expects the Federal Reserve to cut interest rates again next week, while some policymakers are concerned that inflation may persist above the central bank's 2% target—exacerbating the headwinds. He noted that long-term Treasury yields are currently "driven by inflation expectations"—and a rate cut while inflation remains above target raises questions.

The aforementioned scenarios have naturally exacerbated concerns that the unwinding of yen carry trades in August 2024 might be repeated—when the unwinding of yen carry trades triggered violent fluctuations in global markets, with the Nikkei 225 index plummeting by 12% in a single day.

Similar to the situation this month, people also witnessed a combination of rising and falling interest rates within just two months: the Bank of Japan raising interest rates in August 2024 and the Federal Reserve cutting rates in September of the same year.

(Article source: CLS)