The signal is incredibly significant!

Breaking news! SoftBank Group released its earnings report on November 11th, showing that its holdings of 32.1 million shares of Nvidia... The shares (including those held by the asset management subsidiary) were sold in October 2025 for $5.83 billion (approximately RMB 41.5 billion). Meanwhile, SoftBank also sold $9.17 billion worth of T-Mobile shares between June and September.

According to foreign media reports, multiple recent indicators show that AI investment has reached extreme levels, and market risks are accumulating rapidly. From institutional shareholdings to household asset allocation, from options market sentiment to credit risk, a series of data points warn that this AI-driven investment boom may be approaching a tipping point. The impact of this on the US economy and even the global economy will be enormous.

SoftBank liquidation

According to SoftBank's earnings report released this afternoon (November 11), the company sold all of its Nvidia shares in October for $5.83 billion. Meanwhile, SoftBank sold $9.17 billion worth of T-Mobile shares between June and September.

SoftBank also signed a revised agreement with OpenAI, pledging to invest an additional $22.5 billion, with the full investment to be completed in December through Vision Fund 2.

Previously, the Bloomberg Billionaires Index showed that SoftBank Group founder Masayoshi Son's personal net worth surged 248%, reaching $55.1 billion (approximately 392.8 billion yuan), regaining his title as Japan's richest person and ending Uniqlo founder Tadashi Yanai's long-standing lead.

Behind the soaring wealth is the skyrocketing market value of SoftBank Group: since April, its stock price has soared from a low of 5,700 yen/share to 25,000 yen/share, an increase of more than 338%, and its market value once exceeded 38 trillion yen (about 1.7 trillion yuan), making it the most impressive-performing component stock in the Nikkei 225 index.

In the first quarter of fiscal year 2025-2026, SoftBank's revenue reached 1.82 trillion yen, a year-on-year increase of 7%; pre-tax profit was 689.94 billion yen, a year-on-year surge of 205.7%, of which the Vision Fund division turned a profit, contributing 451.39 billion yen in pre-tax profit.

SoftBank's net profit continued its meteoric rise in the second quarter, reaching a staggering 2.5 trillion yen, exceeding market expectations of 418.23 billion yen. Net sales for the second quarter were 1.92 trillion yen, compared to market expectations of 1.89 trillion yen. First-half net profit was 2.92 trillion yen, and net sales were 3.74 trillion yen. SoftBank will implement a 4-for-1 stock split on January 1, 2026.

In 2017, SoftBank acquired nearly 5% of Nvidia's shares for $4 billion, becoming one of its major shareholders. However, in 2019, it chose to sell all its shares for $7 billion, missing out on the company's meteoric rise from a market capitalization of hundreds of billions to $4 trillion. Starting last year, SoftBank aggressively increased its Nvidia holdings, reaching $1 billion in the fourth quarter. In the first quarter of this year, it further increased its Nvidia stake to approximately $3 billion, until this latest sell-off. Notably, Nvidia founder Jensen Huang also sold his Nvidia shares as planned, accumulating over $1 billion in cash since he began selling in June.

Are the risks of AI no longer hidden?

As of now, holdings of large-cap growth stocks and technology stocks have returned to multi-quarter highs.

According to Deutsche Bank Data shows that funds are pouring into the sector at an unprecedented rate, and hedge funds' stock preferences are highly similar to those of retail investors. Household stock holdings have also reached record highs. According to The Economist's estimates, if AI technology valuations falter, the wealth effect alone could drag down US GDP by 2.9%, indicating that the economy's dependence on AI is on the verge of collapse.

The options market sentiment is equally euphoric. According to LSEG data, the skewness of 3-month 25 Delta call options on the seven major U.S. tech stocks is at the 91st percentile, reflecting investors' extreme optimism about further gains.

But the current situation is different from Goldman Sachs's. The observed historical patterns are in stark contrast. AI-related stocks have previously experienced multiple sharp pullbacks followed by bargain hunting, making the current narrative of "only rising, never falling" appear fragile, and the risks extend beyond the stock market. Credit risk in the technology sector is rising sharply, impacting banks ... The industry is relatively calm, leading to differentiation.

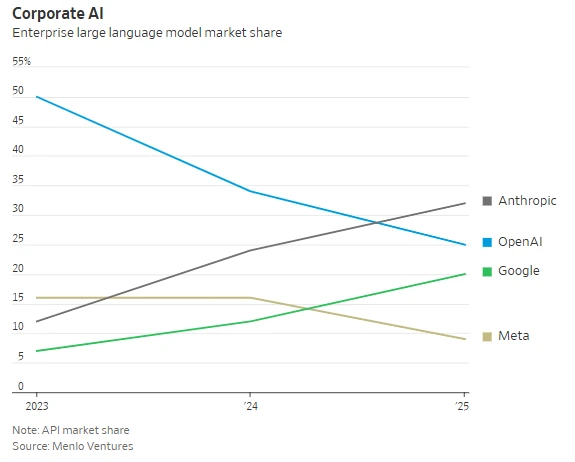

The high concentration of industry players is even more alarming. According to CB Insights data, Nvidia supports almost all major AI players, except for Anthropic, and this high concentration of the supply chain amplifies systemic risks.

The market narrative has also reversed dramatically in a short period. The 180-degree shift in public opinion from "search is dying" to "Google has become the AI leader" exposes the instability of market sentiment. According to TopDown data, the current situation is highly similar to historical bubble periods, and such extreme situations rarely end well.

Observers believe that when all investors believe in the same story, a turning point may be quietly brewing, and the AI investment boom is at a crossroads, shifting from "opportunity" to "risk".

(Source: Securities Times) (Times.com)