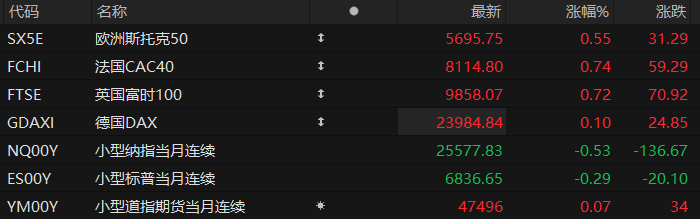

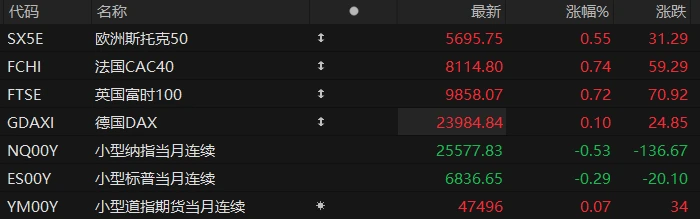

U.S. stock index futures were mixed in pre-market trading on Monday, while major European indices generally rose. As of press time, the Nasdaq... S&P 500 futures fell 0.53%, S&P 500 futures fell 0.29%, and Dow Jones futures rose 0.07%.

In terms of individual stocks, many high-performing stocks rose pre-market, with BigBear.ai surging 15% after Q3 revenue exceeded expectations; Rocket Lab, a rocket company, jumped over 8%. (Memory chip sector... ) Shares fell slightly, SanDisk The stock fell by more than 1%, after surging 12% to a new high yesterday.

Chinese concept stocks rose in some areas, with XPeng Motors among them . Hesai NIO shares rose more than 6%. Pony.ai rose more than 4%. It rose by more than 1%.

Meta shares extended their losses in pre-market trading, falling as much as 1.7%. According to the Financial Times, Meta Platforms' chief artificial intelligence... Scientist Yann Lecun plans to leave his job to start his own startup.

Nvidia The stock fell 1.71% in pre-market trading after SoftBank Group sold all of its Nvidia shares.

Spot gold rose 0.47% to $4,135 per ounce. Spot silver rose nearly 1% to $50.95 per ounce. Bitcoin fell 1.15% to $105,225, and Ethereum fell 1.31% to $3,562.3.

The U.S. government shutdown, which has now lasted a record 41 days, is expected to end as early as Wednesday after the Senate passed a temporary funding bill supported by eight centrist Democrats. On Monday, the Senate passed the Continuing Funding and Extension Act by a vote of 60 to 40, but the bill still needs approval from the Republican-controlled House of Representatives.

House Speaker Mike Johnson said he expects the bill to pass soon. According to offices of both Republican and Democratic leaders, the House, which has not voted since the government shutdown began, is expected to consider the bill on Wednesday. If passed, the bill will be sent to President Trump for his signature, and the president has previously expressed his support for it.

Hot News

AI Data Center How expensive is this construction project? JPMorgan: Financing needs could reach $7 trillion within five years!

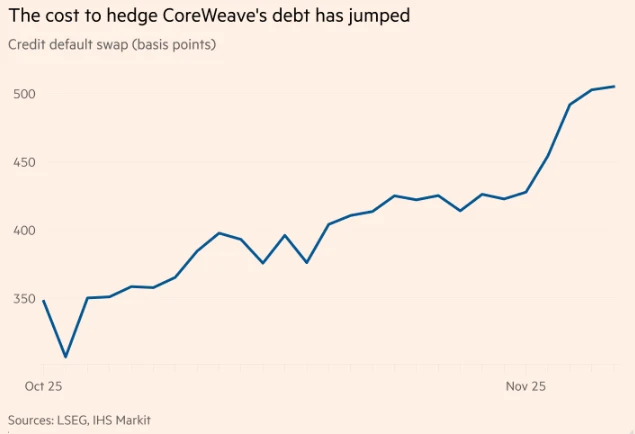

JPMorgan Chase The latest analysis shows that as artificial intelligence (AI) giants build data center projects on a massive scale, financing needs are expected to reach at least $5 trillion and possibly as high as $7 trillion over the next five years.

The bank noted that it needs to issue approximately $1.5 trillion in investment-grade bonds and obtain substantial funding from other sectors of the market.

"The question isn't 'Which market will fund the AI boom?' Rather, it's 'How to structure funding to get into every capital market?'" wrote JPMorgan strategists, led by Tarek Hamid, in a report released Monday.

They stated that leveraged financing is expected to provide approximately $150 billion in funding over the next five years. Strategists added that even with financing from the investment-grade and high-yield bond markets, and up to $40 billion annually in data center securities... Even with financing, it is still insufficient to meet the demand.

The US stock market has received a major boost after each of the last 15 government shutdowns! The S&P 500 is poised to reach 7000 points.

The US stock market has overcome numerous obstacles this year, and now it faces the longest US government shutdown in history. In the 40 days since the US government shutdown began on October 1st, the S&P 500... The 500 index rose 0.6%, after surging on Monday following reports that the government shutdown appeared to be ending within days.

Historically, this benchmark index is poised for a steady rise ahead of the holiday season. Data compiled by CFRA Chief Investment Strategist Sam Stovall shows that in the month following the end of the previous 15 US government shutdowns, the S&P 500 rose by an average of 2.3%. Such a rise would push this US stock market benchmark index close to 7,000 points by mid-December.

The latest deadlock in the US government shutdown could end as early as Wednesday (November 12) after Senate Democrats agreed to hold a full Senate vote on an agreement that still needs House approval. Investors welcomed the easing of tensions, speculating that widespread damage to the US economy and corporate profits has been avoided.

Now, investors can return their attention to the path of monetary policy—the Federal Reserve is expected to cut interest rates for the third time in a row next month—and the impact of tariffs on inflation.

The International Organization of Securities Commissions (IOSCO) warns that the tokenization of financial assets may bring new risks.

The International Organization of Securities Commissions (IOSCO) stated in a report on Tuesday that crypto tokens pegged to mainstream financial assets may pose new risks to investors. Currently, the financial industry remains divided on the pros and cons of tokenization.

The term "tokenization" refers to the process of transcoding real-world assets such as stocks or bonds using blockchain technology. Based on this, corresponding tokens are created. This concept has regained attention from cryptocurrency enthusiasts this year, and some new tokenized products have been sold to the public through online brokers.

IOSCO's members include regulators from virtually all securities markets globally. IOSCO states that most risks associated with tokenization remain within the scope of existing regulatory frameworks, but the underlying technology may introduce new risks and vulnerabilities.

“While current adoption remains limited, tokenization has the potential to reshape how financial assets are issued, traded, and served,” said Tuang Lee Lim, chair of the IOSCO Board of Directors’ Fintech Working Group.

Currently, some mainstream financial institutions, including Nasdaq , are pushing for tokenization, but other participants on Wall Street remain cautious.

US Stocks Focus

SoftBank unexpectedly liquidates its Nvidia holdings, cashing out over 40 billion.

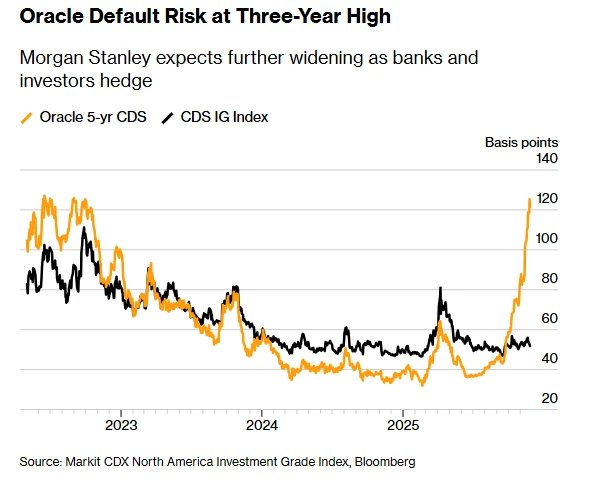

Amid growing market concerns about the high valuations of AI concept stocks, SoftBank Group, a well-known Japanese technology investment company, made a surprising move: it liquidated its entire stake in " AI chips." Nvidia, the "dominant player," cashed out $5.8 billion.

SoftBank released its financial results for the second quarter of fiscal year 2025, ending in September, on Tuesday. The report showed that the company's second-quarter profit far exceeded expectations, driven by substantial returns from aggressive investments in artificial intelligence.

SoftBank also stated that it sold all of its Nvidia shares in October, totaling approximately 32.1 million shares, for a total value of approximately $5.83 billion (approximately RMB 41.5 billion). This sale was not reflected in SoftBank's second-quarter financial report, and the company did not disclose the reasons for the sale.

The stake in Nvidia, coupled with profits from SoftBank's Vision Fund, helped SoftBank achieve a net profit of 2.5 trillion yen (approximately US$16.2 billion) in the second quarter of fiscal year 2025, far exceeding the average analyst expectation of 418.2 billion yen.

Nvidia's stock price has risen more than 40% this year. Since the launch of ChatGPT in 2022, which sparked the AI craze, Nvidia's stock price has increased more than tenfold. Some analysts are beginning to worry about the risk of an AI bubble behind Nvidia's high valuation.

Meta is reportedly experiencing another personnel shake-up, with Chief AI Scientist Yang Likun reportedly planning to leave.

According to sources, Yann LeCun, Meta's chief artificial intelligence (AI) scientist, plans to leave the company to start his own business. Following this news, Meta's pre-market stock price fell by more than 1%. Sources familiar with the matter revealed that LeCun has informed colleagues that he will be leaving Meta within the next few months. It is understood that LeCun is currently in early-stage talks with potential investors to raise funds for his startup.

Yang Likun's departure comes at a time when Meta CEO Mark Zuckerberg is readjusting the company's AI strategy. In order to compete with rivals like OpenAI and Google in the AI field, Zuckerberg is shifting the focus away from the long-term research direction of Meta's Foundational AI Research Lab (FAIR) and towards more rapidly launching AI models and products.

Zuckerberg's shift was partly due to the poor performance of Meta's previously released Llama 4 model, which lagged behind the latest products from Google, OpenAI, and Anthropic, while Meta's AI chatbot... It also failed to gain user favor. Reportedly, Yang Likun and Zuckerberg have increasingly diverged on the direction of AI development. Yang Likun has long believed that while the large language models (LLMs) that Zuckerberg considers the core of his strategy are "practical," they will never be able to achieve human-like reasoning and planning capabilities.

When its competitors are caught in an "AI money-burning race," Apple It has become a hedge for the technology sector.

As Wall Street begins to question the astronomical sums tech giants are investing in artificial intelligence, Apple, previously criticized for insufficient AI spending, has suddenly become a safe haven for investors. The iPhone maker, with its low capital expenditures and ample cash reserves, has demonstrated unique defensive value amidst the tech sector's volatility. On November 11th, it was reported that investors were eyeing OpenAI, Meta, and Microsoft. As companies scrutinize their massive spending on AI, it has caused significant volatility in some of the strongest-performing tech stocks in recent years. Meanwhile, Apple 's strategic positioning is being reassessed—it can provide AI capabilities to millions of users by integrating other companies' models without incurring the enormous investments required to develop its own.

Apple demonstrated remarkable resilience last week when tech stocks were pressured by concerns about AI spending. While other tech stocks were mired in declines, Apple remained virtually flat for five trading days. In fact, Apple's stock price has risen 31% since the second half of the year, far outperforming the S&P 500, Nasdaq 100, and most of its tech giant competitors. This divergence was particularly evident in the latest earnings season. Despite mixed results and an unexpected decline in revenue in the Chinese market, Apple's stock price rose nearly 3% the day after the earnings release. In contrast, members of the "Big Seven," including Meta and Microsoft , were sold off due to massive capital expenditures and disappointing revenue outlooks. Meta's stock price plummeted more than 11% on October 30, marking its biggest single-day drop in three years.

(Article source: Hafu Securities )