Investors have recently been selling off bonds of U.S. tech giants, indicating a lack of confidence in Silicon Valley's prospects in artificial intelligence. Bubble fears fueled by massive spending in the sector are raging in the bond market. In recent weeks, concerns have been fueled by so-called hyperscale cloud service providers—including Google, Meta, and Microsoft. and oracle bone script A massive data center is under construction. The bond portfolios issued by companies in the center continue to face pressure.

Bank of America Data shows that the spread on this type of bond (the premium investors are willing to pay for the bond relative to the yield on U.S. Treasuries) has climbed to 78 basis points, the highest level since the market turmoil triggered by Trump's tariff plan in April, and also a significant widening from the spread of about 50 basis points in September.

The widening spread highlights investors’ growing concerns about the model of technology companies using debt market financing to support the construction of artificial intelligence infrastructure.

Brij Khurana, a fixed-income portfolio manager at Wellington Management, noted, "The most important thing the market has realized in the past two weeks is that the funding for this AI boom will primarily come from the public markets."

JPMorgan Chase On Monday, it was stated that building artificial intelligence infrastructure would cost more than $5 trillion, "and may require the joint support of all public capital markets, private credit, alternative capital providers, and even governments."

Such a massive investment in AI infrastructure has raised concerns about overcapacity, long-term profitability, and energy demand in the field.

Google, Amazon Microsoft and Meta will be in the data center this year. With over $350 billion already invested, that figure is projected to surpass $400 billion by 2026. Despite their massive cash reserves, tech giants are rapidly issuing bonds to finance their AI expansion plans, raising concerns among some investors that this could signal rising leverage levels.

JPMorgan Chase points out that "hyperscale servicers collectively hold approximately $350 billion in liquid cash and investments, and are expected to generate approximately $725 billion in operating cash flow by 2026. Even so, these high-quality issuers will still inject a significant amount of new debt into the credit market."

In recent weeks, Meta, Google's parent company Alphabet, and Oracle have all launched massive bond issuance plans, with some bonds having maturities of up to 40 years.

Last month, Meta entered into a $27 billion private debt agreement with investors including Pimco and Blue Owl Capital to fund the development of its Hyperion data center in Louisiana. The company also issued $30 billion in bonds at the end of October, its largest corporate bond transaction since 2023.

In early November, Alphabet auctioned $25 billion in bonds, of which $17.5 billion was issued in the United States and $7.5 billion in Europe.

Oracle also issued $18 billion in bonds in September to fund infrastructure leasing projects, such as OpenAI’s Stargate data center in Abilene, Texas.

Analysts point out that Oracle's debt has been particularly hard hit in recent months. An industry-compiled bond index that tracks Oracle's latest bond offerings traded on the market before their issuance has fallen nearly 5% since mid-September, while the Ice Data Services Composite Index, which tracks U.S. high-tech debt, has fallen only about 1%.

Oracle currently has approximately $96 billion in long-term debt, and the company has rapidly expanded its debt this year to lease computing power for OpenAI. Although the American software group claims this move will generate $300 billion in revenue over the next five years, Moody's ... Rating agencies have recently warned that Oracle's over-reliance on large commitments from a few artificial intelligence companies to support growth poses significant risks.

At the same time, small businesses at the heart of the artificial intelligence boom are also being impacted.

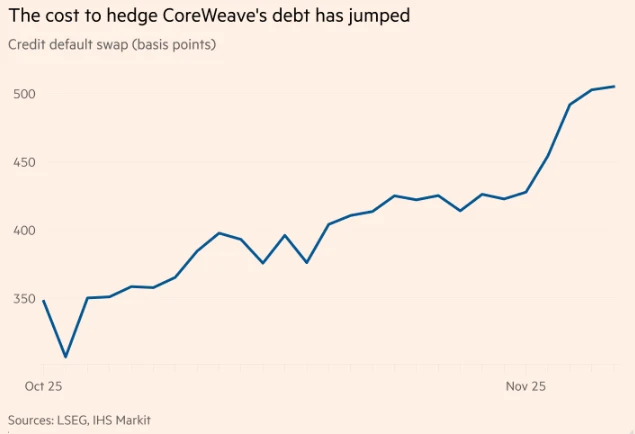

Shares of data center operator CoreWeave have fallen more than 20% in the past two weeks, following tech giants. On Tuesday, the company's shares dropped another 16% after it lowered its annual revenue forecast due to anticipated delays in data center construction.

As the stock price falls, the cost of hedging against a CoreWeave debt default has risen sharply—LSEG data shows that the price of a CoreWeave five-year credit default swap (CDS) has risen from less than 350 basis points in early October to 505 basis points.

Of course, not everyone is pessimistic at the moment. Some analysts still believe that the decline in corporate bonds after massive issuance is a healthy phenomenon.

“As long as the market continues to price in new risks, it’s a positive sign. What I’m worried about is the irrational frenzy driven by increased supply rather than a sell-off,” said George Pearkes, macro strategist at Bespoke Investment Group. “The debt cycle in the AI sector is still in its early stages.”

(Article source: CLS)