A regulatory filing suggests that Warren Buffett's Berkshire Hathaway may have quietly reduced its Apple holdings again in the third quarter. Shares.

In its latest quarterly report, Berkshire Hathaway noted that the cost benchmark for its consumer goods stock holdings decreased by approximately $1.2 billion compared to the previous quarter. This category of holdings primarily consists of Apple stock held by the large conglomerate, and the decrease in the cost benchmark likely reflects further reductions in Apple stock inventory .

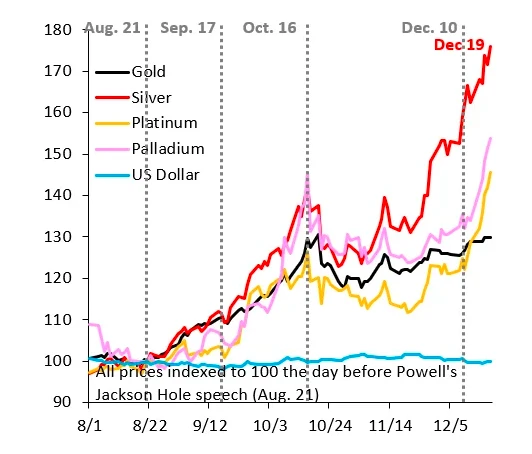

Apple's stock price surged more than 24% in the third quarter, providing Buffett with an attractive opportunity to take profits.

In 2024, Buffett launched a notable and intensive sell-off of Apple, cutting Berkshire Hathaway's Apple holdings by two-thirds. This move was unexpected for the investor known for his long-term investments.

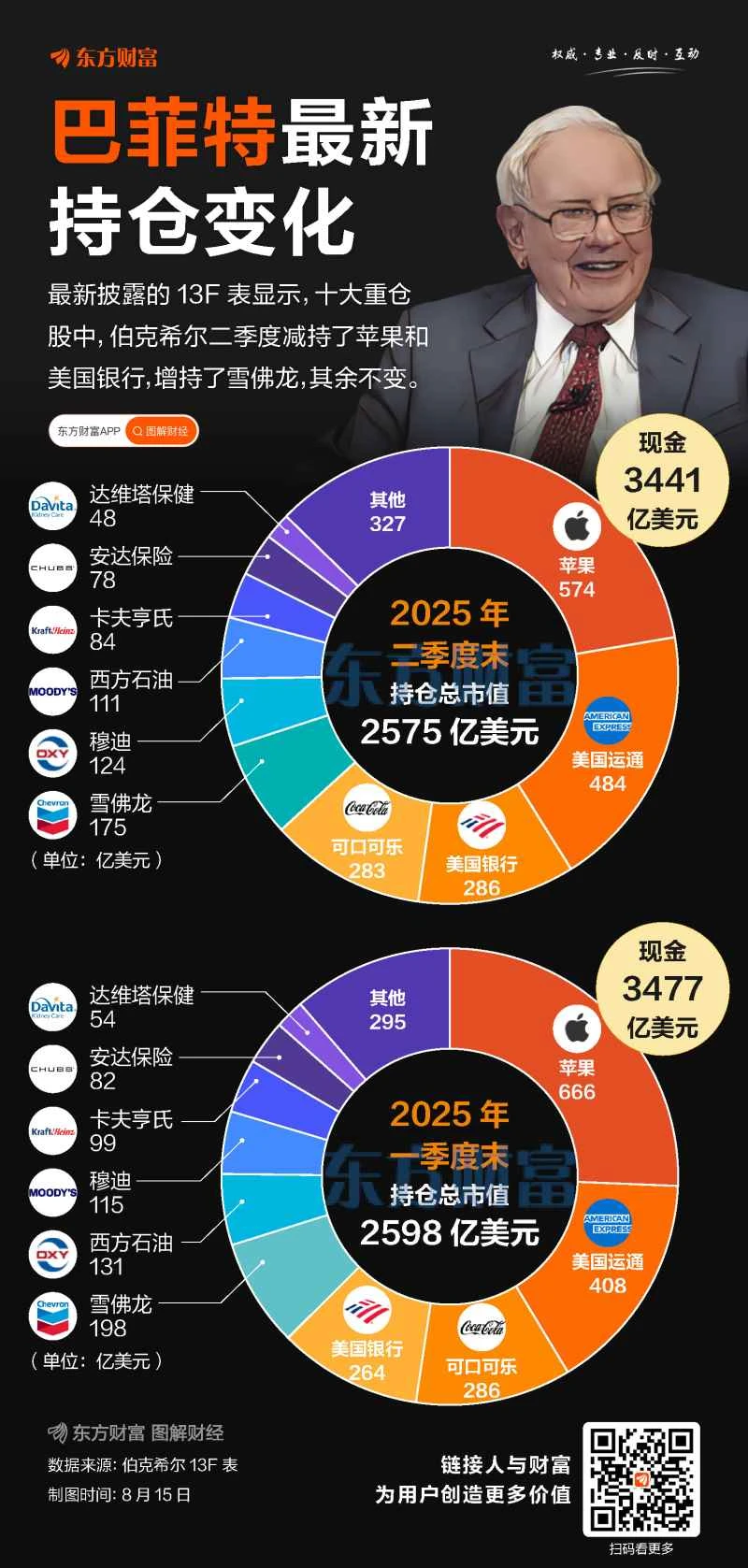

Berkshire Hathaway reduced its Apple stake again in the second quarter of this year. However, as of the end of June, the iPhone maker remained Berkshire's largest holding, with 280 million Apple shares worth $57 billion.

It is worth noting that, according to relevant estimates, with the recent surge in Apple's stock price, Buffett's decision to sell two-thirds of his Apple holdings has caused Berkshire Hathaway to miss out on potential gains of approximately $50 billion .

In mid-month, Berkshire Hathaway will issue a report to the U.S. Securities and Exchange Commission . A detailed 13F filing with the SEC will give investors a clearer picture of the size of their Apple stock holdings. The filing will disclose all changes in Berkshire Hathaway's individual stock holdings as of September 30.

Buffett had previously hinted that the reduction of his Apple stock holdings was for tax reasons, but some speculate that such a large-scale sell-off indicates that the "Oracle of Omaha" is also concerned about Apple's high valuation.

However, including Goldman Sachs Several Wall Street investment banks, including Bank of America, have recently raised their target prices for Apple, citing reasons such as strong iPhone demand and the gradual implementation of an AI-driven "super upgrade cycle."

Some argue that Berkshire Hathaway's reduction of its Apple holdings is part of its portfolio management strategy—Apple's holdings once accounted for more than 50% of the company's portfolio.

Berkshire Hathaway has been a net seller of stocks for 12 consecutive quarters, raising over $6 billion in cash through stock sales in the third quarter alone. One of Buffett's favorite stock market valuation metrics—the ratio of the total market capitalization of all publicly traded stocks in the United States to the U.S. Gross National Product (GNP)—has climbed to a record high, reaching a level he once described as "playing with fire."

Dongcai Illustrated Guide: Some Useful Tips

After 11 consecutive quarters of selling, Buffett's cash holdings have shrunk to $257.5 billion, leaving him with $344.1 billion in cash.

(Article source: CLS)