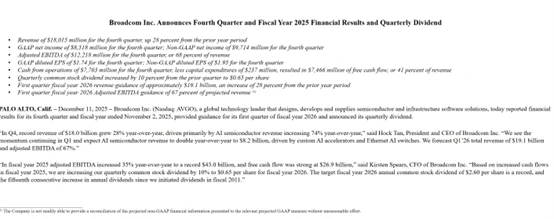

After the US stock market closed on Thursday (December 11), the world's leading semiconductor... With technology solutions provider Broadcom The company announced its fourth quarter results for fiscal year 2025, ending November 2, 2025.

The financial report shows that, driven by strong demand for AI, the company's revenue and profit both exceeded expectations in the fourth fiscal quarter .

Specifically, Broadcom reported fourth-quarter revenue of $18.02 billion, up approximately 28% year-over-year, compared to analysts' expectations of $17.49 billion in a survey by LSEG.

Net income was $9.71 billion, up 39% year-over-year; adjusted earnings per share (EPS) were $1.95, up 37% year-over-year, compared to analysts’ expectations of $1.86.

Broadcom attributed its fourth-quarter revenue growth primarily to AI chips . Sales increased by 74% , which is equivalent to $8.2 billion in actual AI-related revenue for the quarter.

Looking at the breakdown by segment, Broadcom's Semiconductor Solutions business generated $11 billion in sales, a 22% year-over-year increase, exceeding the $10.77 billion forecast by financial data platform StreetAccount. AI chip sales were included in this segment.

Broadcom's other major division, Infrastructure Software, saw sales grow 26% to $6.94 billion, exceeding Wall Street's expectations. This division includes sales of VMware-related products.

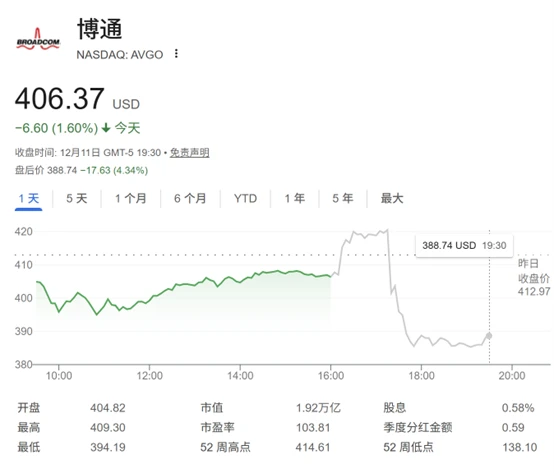

Following the release of its earnings report, Broadcom's stock price initially rose by 5% in after-hours trading on Thursday, but subsequently reversed course and fell by more than 4% as of press time .

Some analysts believe the stock price decline was due to Broadcom CEO Hock Tan's statement in the earnings call that the company currently has a backlog of $73 billion in AI product orders, a figure that disappointed some investors. Furthermore, Broadcom's expectation that its first-quarter gross margin would contract by 1% due to AI products also fueled investor caution .

AI chip sales doubled in the current fiscal quarter

Looking ahead, Broadcom has provided optimistic guidance for its performance in the current fiscal quarter (first quarter of fiscal year 2026).

Broadcom stated that its revenue for the first quarter of fiscal year 2026 is expected to reach $19.1 billion, a 28% year-over-year increase, exceeding the average analyst estimate of $18.3 billion.

Broadcom CEO Hock Tan said in a statement that he expects AI chip sales to double year-over-year in the current fiscal quarter, reaching $8.2 billion . This revenue will come from custom AI chips and products used in artificial intelligence. Semiconductors in networks.

Benefiting from the AI boom, Broadcom and Nvidia Broadcom has become one of the biggest winners in the US semiconductor industry. Following a doubling of its stock price in 2024, Broadcom's stock has risen another 75% since 2025. Its custom chips (such as the TPU built for Google) are gaining increasing recognition in the market, becoming a strong competitor to Nvidia 's GPUs.

Broadcom stated in its earnings call that it has secured its fifth customer for custom chips, who has placed a $1 billion order with delivery expected by the end of 2026.

The company also stated that the previously unnamed customer is Anthropic. Broadcom revealed in its last earnings call that it had added a fourth customer for its custom AI accelerator, placing a $10 billion order for custom chips, but did not disclose the name at the time.

Currently, investors are closely watching whether these customers will continue to advance their collaborations and complete the procurement and deployment of custom chips as planned.

During the earnings call, Hock Tan stated that Anthropic is using the latest Google TPU called Ironwood. Meanwhile, Broadcom's other customers "prefer to take control of their own development, continuing their multi-year self-development plans to create custom AI accelerators—what we call XPUs."

Chen Fuyang also stated that within the next 18 months, Broadcom will focus on AI custom chips, switches, and other data center technologies. The backlog of orders for hardware products has reached $73 billion.

(Article source: CLS)