Nvidia Leading artificial intelligence (AI) trading rebounded earlier this week after recent setbacks, however, news of SoftBank's divestment of its Nvidia stake and the impact of AI cloud computing... The pressure signals from service provider CoreWeave further dampened market sentiment on Tuesday.

On Tuesday, Eastern Time, AI concept stocks, including Nvidia , collectively declined due to concerns about overvaluation. At the close, the tech-heavy Nasdaq fell 58.87 points, or 0.25%, to 23,468.30.

Recently, investors have been caught in a dilemma: they are worried about missing out on the benefits of AI trading, but also worried that the market will repeat the mistakes of the dot-com bubble.

In response , Wells Fargo Investors are advised to reduce their holdings in technology stocks and shift their funds to the other three major sectors .

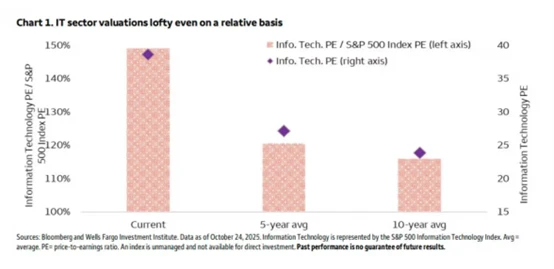

Wells Fargo Investment Institute has included the S&P 500 Information Technology sector (Nvidia, Microsoft, etc. ) in its list. Broadcom The rating for AI-related leading companies (which all belong to this sector) has been downgraded from "positive" to "neutral," with the main reason being that the valuation is too high.

This latest research report from Wells Fargo marks the first rating adjustment since the bank upgraded the sector's rating on April 4. Douglas Beath, Global Investment Strategist at Wells Fargo Investment Institute, pointed out that from then until October 24, the S&P 500 Information Technology sector rose by 60%, significantly outperforming the S&P 500 index.

According to Beath, the sector still has some favorable factors. He believes that the AI tailwind will drive revenue and profit growth, the sector has relatively low debt levels and strong free cash flow generation capabilities. Moreover, AI-related capital expenditures are on a rapid growth trajectory, and the third-quarter earnings reports of major technology companies have all exceeded market expectations.

So where does the problem lie?

“However, valuations in the IT sector have surged, and we are concerned that excessive optimism and high expectations for the sector could make it vulnerable to underperformance in the short term,” Beath said, providing the following chart:

He stated that the IT sector has consistently been a focal point of international trade negotiations, and tensions have not completely dissipated. Furthermore, despite some leading companies announcing significant increases in AI-related capital expenditures, investor concerns about return on investment and debt financing frequently trigger market volatility.

“This pullback may ultimately prove to be short-lived, but we believe the sector remains vulnerable to negative surprises, which could be as simple as slightly weaker-than-expected corporate earnings,” Beath said. “We tend to lock in gains by reducing our allocation to the IT sector to its market weight.”

We recommend focusing on these three areas.

Beath suggests reducing some investments in tech stocks and recommends allocating funds to three sectors that have received his "positive" rating .

Industry and Utilities The sector allows investors to access rapidly growing auxiliary data centers. “We believe that financial stocks will benefit from a steeper yield curve and a more favorable regulatory environment, and can also support AI through M&A activity and debt financing, while having a significant valuation discount relative to the S&P 500,” Beath said.

Japanese tech investment giant SoftBank recently disclosed that it has sold off its entire stake in Nvidia, cashing out $5.8 billion, exacerbating concerns that the AI boom may have peaked. This, coupled with CoreWeave, a cloud computing company invested in by Nvidia, lowering its full-year revenue guidance due to slow data center construction, further amplified the selling pressure on AI-related stocks.

In addition, Michael Burry, the investor who gained fame for betting on the US subprime mortgage crisis and the inspiration for the novel "The Big Short," once again turned his fire on the AI sector on Monday. He accused several of the largest US tech companies of "inflating" their profits during the AI boom through aggressive accounting practices.

(Article source: CLS)