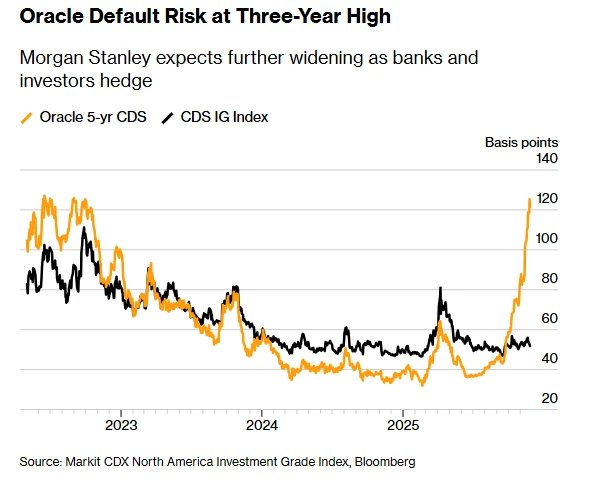

Morgan Stanley It is pointed out that oracle bone script The company's debt risk indicator hit a three-year high this month if the database giant cannot alleviate investor concerns about its massive artificial intelligence... Concerns about spending plans are expected to worsen further in 2026.

In a recent report released Wednesday, Morgan Stanley credit analysts Lindsay Tyler and David Hamburger pointed out that widening funding gaps, an bloated balance sheet, and the risk of technological obsolescence are just some of the hidden risks facing Oracle . According to data from ICE Data Services, Oracle 's five-year credit default swap (CDS) index rose to 125 basis points on Tuesday.

Morgan Stanley analysts warned that banks ... Investors are ramping up hedging operations, and the price of its five-year CDS may break the record high set in 2008.

Morgan Stanley predicts that Oracle's CDS may break through 150 basis points in the short term, and if communication surrounding its financing strategy remains limited as the new year approaches, it may approach 200 basis points.

According to ICE data, Oracle CDS once set a record of 198 basis points in 2008.

Oracle is one of the companies participating in the AI investment race, a race that has propelled this data center... Oracle has quickly become a bellwether for the credit market in assessing the risks of artificial intelligence. In September, the company raised $18 billion in the U.S. high-grade bond market. Then, in early November, about 20 banks jointly arranged a project financing loan of approximately $18 billion to build a data center campus in New Mexico, where Oracle will be a tenant.

According to industry reports last month, banks also provided a separate $38 billion loan portfolio to finance projects developed by hyperscale data center provider Vantage Data Centers in Texas and Wisconsin. These projects are part of the artificial intelligence infrastructure plan announced by OpenAI and Oracle in July.

Morgan Stanley points out that banks involved in Oracle's construction loans may be a key driver of the recent surge in Oracle credit default swap transactions, and this trend may continue.

Morgan Stanley analysts wrote, "Over the past two months, it has become clearer that construction loans for projects already on the agenda with Oracle as a future tenant are likely to be a more significant hedging driver in the near and future."

They pointed out that if banks resell these loans to other institutions, some banks' hedging operations may face the risk of liquidation. However, even if the demand for construction debt financing continues after the Vantage campus and New Mexico projects, other institutions may still conduct hedging operations at some point.

Morgan Stanley analysts stated last month that short-term credit deterioration and uncertainty would drive bondholders, lenders, and thematic investors to further engage in hedging activities. "Both bondholder hedging dynamics and thematic hedging dynamics are likely to become more important in the future," they added.

With surging hedging demand and weak market sentiment, Oracle CDS is currently underperforming the broader investment-grade CDX index, and its corporate bonds are also lagging behind the Bloomberg High-Rated Bond Index.

Although Oracle's stock price rebounded by about 4% on Wednesday, it is still down 21% so far this month. Analysts believe that the sluggish stock performance may prompt Oracle management to disclose details of its financing plans—including information on the Stargate project, data centers, and capital expenditures—during the next earnings call.

It's worth noting that Morgan Stanley analysts previously advised investors to simultaneously buy Oracle bonds and CDSs through basis trading, hoping to profit from the widening of credit derivative spreads compared to the expected bond spreads. However, they now believe that directly buying CDSs is a purer trading strategy.

"Therefore, we will terminate the 'buy bonds' portion of basis trading and retain the 'buy CDS protection' component," the report stated. "Currently, direct CDS trading is simpler and can lead to greater spread volatility."

(Article source: CLS)