"Big Short" Burry issues multiple warnings!

On Wednesday local time, Michael Burry, the real-life inspiration for the film "The Big Short," posted on social media that the Federal Reserve's resumption of purchases of short-term Treasury bonds highlights the influence of U.S. banks. The system's fragility. Burry also expressed concern about the consistency of action between the Federal Reserve and the U.S. Treasury.

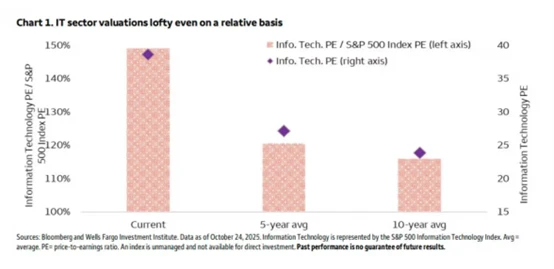

Furthermore, last weekend, Burry warned US AI giants that OpenAI would be the next Netscape and was destined to fail. Burry's remarks targeted the most sought-after tech stocks in the US stock market, implying that such trades were extremely risky. Prior to making these comments, Burry recently disclosed short positions and criticized AI chips. giant Nvidia .

It is worth noting that in recent months, British pension funds have been reducing their exposure to US stocks due to concerns about a large bubble in the US AI sector.

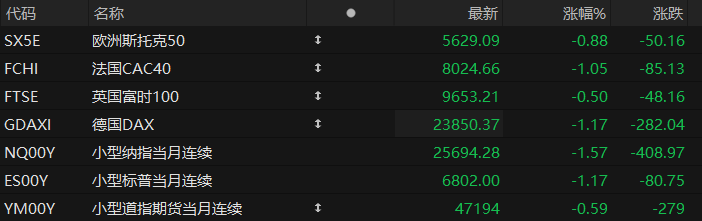

In pre-market trading on December 11, US tech stocks collectively plunged. As of press time, Oracle... Nvidia and Micron Technology both fell by more than 11%, with Nvidia dropping nearly 2%. Qualcomm fell 1.50%. Microsoft fell more than 1%. Amazon fell 0.62%. Oracle fell 0.76%, and Google fell 0.77%. This followed Oracle 's disappointing earnings report, reigniting market concerns about a valuation bubble in the AI industry. Futures for the three major US stock indices also declined across the board, with the Nasdaq... Index futures fell 0.68%, S&P 500 futures fell 0.48%, and Dow Jones futures fell 0.15%.

"Big Short" Burry's Latest Warning

Michael Burry, the real-life inspiration for the film "The Big Short," warned on Wednesday on the social media platform X that the Federal Reserve's resumption of purchases of short-term Treasury bonds is less about stability and more about the financial system's increasing reliance on the Fed's support.

Burry cited a blog post from the Financial Times, stating that the Federal Reserve's initiation of its "reserve management purchases" program signals an increasing vulnerability in the U.S. banking system.

Burry specifically mentioned the Federal Reserve's decision to halt its balance sheet reduction and prepare to purchase approximately $35 billion to $45 billion in Treasury bills per month. Analysts expect this operation by the Fed to begin in January. Burry said, "I would like to add that the U.S. banking system cannot function without the support of the Fed's reserves of over $3 trillion; that is not a sign of strength, but a sign of fragility." Burry pointed out that in 2023, U.S. banks... Before the industry turmoil, the financial system only needed about $2.2 trillion, and in 2007 it only needed $45 billion. He added, "So I would say that the U.S. banking sector weakened far too quickly."

Burry also questioned the timing of the Fed's actions, pointing out that the U.S. Treasury has been issuing more short-term Treasury bonds to avoid pushing up 10-year yields. He said the Fed's decision to focus its purchases on these same short-term notes seemed "extremely coincidental."

Burry believes that the Federal Reserve now appears to expand its balance sheet after each crisis to avoid funding pressures on the banking system, and he says this dynamic helps explain the strength of the stock market.

"The practical limit of this approach might be the complete nationalization of the U.S. bond market—that is, the Federal Reserve holding all $40 trillion of U.S. debt. So, keep the party going, I guess," Burry wrote.

The Federal Reserve officially ended its quantitative tightening program earlier this month. Since 2022, its balance sheet has shrunk by approximately $2.4 trillion. This move comes as funding markets, particularly the $12 trillion repurchase agreement market, are showing increasing volatility.

Short-term repo rates have repeatedly fallen below the Federal Reserve's target range, triggering market concerns about liquidity. Evercore ISI, Bank of America, and Goldman Sachs... Economists have indicated that the Federal Reserve is likely to launch reserve management purchases to rebuild the reserve buffer and stabilize overnight interest rates.

Is the hottest deal brewing a crisis?

Burry posted several messages on social media over the weekend, targeting his critics and the most sought-after tech deals on the U.S. stock market.

This investor, known for accurately predicting the 2008 financial crisis, recently launched a Substack column and is discussing artificial intelligence. The article offers new insights. It reiterates that the most sought-after trades in the US stock market are brewing a crisis, targeting a top player in the field—OpenAI.

“OpenAI is the next Netscape, doomed to fail, and burning through a lot of money,” Burry wrote late Friday in response to a post by Salesforce CEO Marc Benioff about large language models. Netscape was one of the world’s most widely used web browsers and most valuable internet companies in the mid-1990s, but ultimately became a prime example of the dot-com bubble bursting and then fading away.

“ Microsoft is struggling to keep it running while taking it off its balance sheet and siphoning off its IP. So why are they constantly getting funding? The entire industry needs a $500 billion IPO,” Burry said. He later added in another post last Saturday that the $60 billion raised by OpenAI would be “far from enough” to meet the company’s cash needs.

Before Burry posted about OpenAI, he had recently criticized another major AI player. Last month, he announced a short position and launched a scathing attack on Nvidia , forcing the company to send a memo to analysts defending itself. In his post Sunday afternoon, Burry wrote: “I’m collecting photos and evidence of massive stockpiling of Nvidia GPUs (graphics processing units) in the U.S. and overseas. I’ve already been contacted, things are getting interesting, but I need more.”

On November 23, Burry reiterated his bearish stance on Nvidia in an article published on a paid subscription platform. Besides issues such as "circular investment" among US AI companies, Bloomberg News asked on November 24 how long it would take for Nvidia's GPUs to become obsolete. Furthermore, many questioned the sustainability of Nvidia's spending on AI infrastructure.

It is worth noting that British pension funds are reducing their exposure to US stocks due to concerns that the US AI sector has become too overvalued.

According to a CCTV News report on December 3, several British pension funds... The projects stated that in recent months they have been shifting investments to markets outside the US or strengthening protections against potential declines in US stocks. These pension projects manage over £200 billion in assets for millions of British savers.

UK defined contribution superannuation schemes are particularly vulnerable to stock market volatility because younger savers typically invest heavily in US stock indices dominated by large-cap tech stocks. Savers with 30 years to retirement usually allocate 70% to 80% or even all of their assets to global equities, with the majority of their portfolios dominated by large US tech companies.

Callum Stewart, head of investment solutions at Standard Life Investments, said, "We recognize the unique risks associated with U.S. equities, such as tariffs and the concentration of large technology companies in the stock market."

Stewart said the firm is reducing its allocation to US equities and increasing its holdings in the UK and Asian markets. The firm manages a £36 billion sustainable multi-asset fund, with approximately 60% of its equity assets located in North America.

The European Central Bank recently stated that US tech stocks such as Nvidia, Alphabet, Digits, and Microsoft are overvalued as investors are driven by a "fear of missing out." The Bank of England (the UK's central bank) and the International Monetary Fund have also issued similar warnings, emphasizing that high valuations of AI stocks could expose portfolios to significant risks if market optimism fades.

(Source: Securities Times)