I. Overview of US Stock Index Options

Trading volume in the US stock index options market is currently declining, the put/call ratio is decreasing, and short sellers are exiting the market.

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with put orders peaking at 6900 points and call orders peaking at 6850 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 25750, Put single peak at 25200.

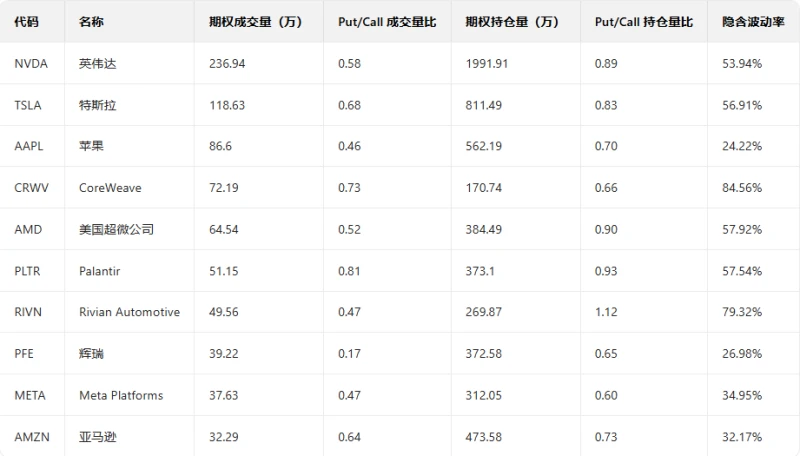

II. US Stock Options Trading Volume Ranking

1. CoreWeave fell 16.31% in the previous trading day. The put/call ratio rose slightly the day before, and trading volume increased significantly.

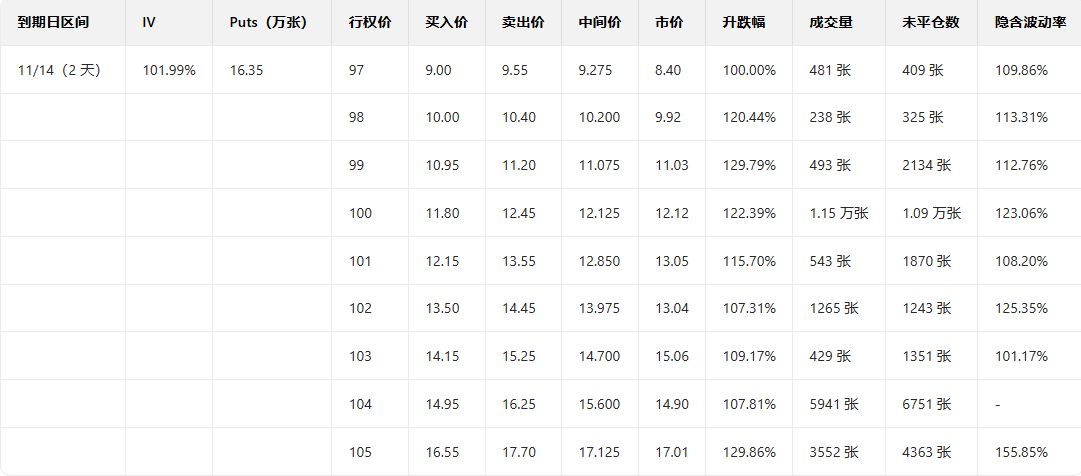

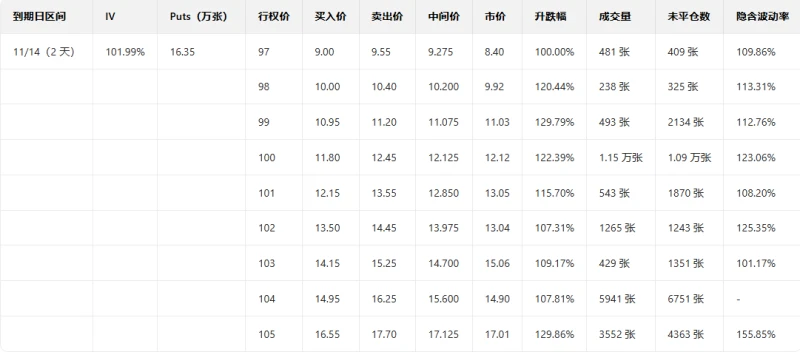

Looking at the put orders expiring this Friday, many have more than doubled in price.

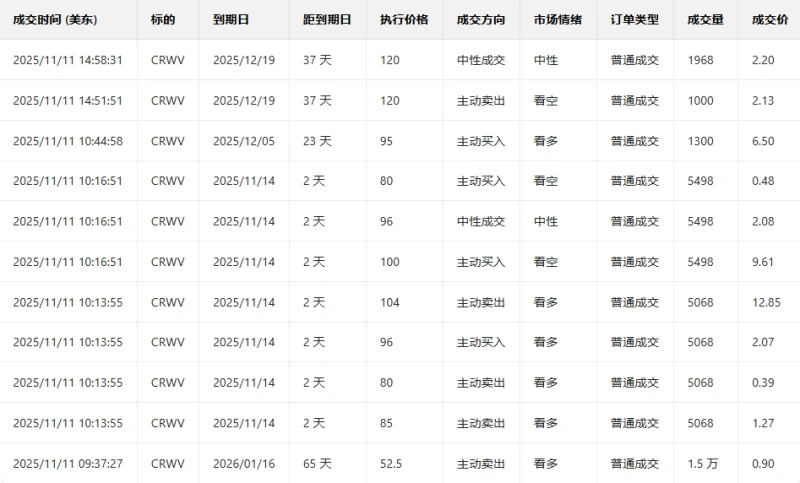

Observing large orders with unusual activity in options trading, it appears that large traders were trading in a neutral direction before the market closed.

2. Rivian Automotive rose 9.81% in the previous trading day. The put/call ratio rose slightly the day before, and trading volume increased significantly.

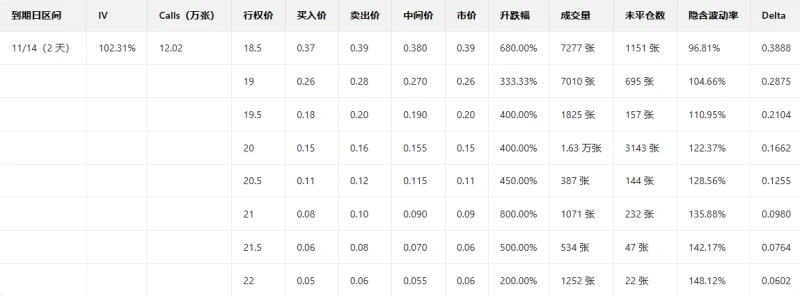

Looking at the call orders expiring this Friday, the highest increase was over 8 times.

Observing large orders with unusual activity in options trading, it appears that large traders tend to favor the bullish direction before the market closes.

Electric vehicle maker Rivian Automotive, Inc. ( NASDAQ : RIVN) announced significant changes to its CEO Robert Scaringe's compensation plan, a move similar to Tesla's. ( NASDAQ : TSLA) How Elon Musk is rewarded.

Scaringe's new compensation package includes options to purchase 36.5 million shares at $15.22 per share—an increase of approximately 16 million shares from his previous award. For these shares to vest, Rivian must achieve a share price target of $40 to $140 over the next ten years, while also meeting new operating profit and cash flow targets by 2032.

Previously, Rivian had granted Scaringe stock options linked to higher share prices ($110 to $295); however, these options were cancelled due to their low likelihood of realization. In addition to stock options, the Rivian board also doubled Scaringe's annual salary to $2 million to ensure his compensation is better aligned with shareholder returns; this decision was made under the guidance of independent advisors.

Top 10 US Stock Options Trading Volume Ranking

Top 10 US Stocks by Implied Volatility (Underlying Asset Market Cap > $10 Billion, Options Trading Volume > $100,000)

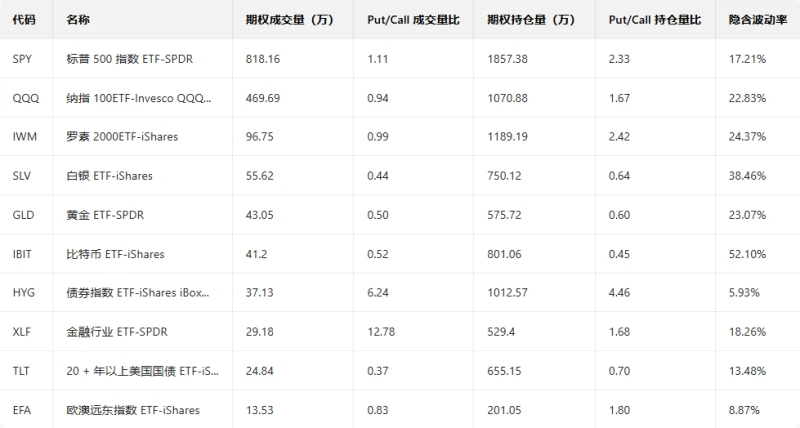

III. Top Ten US Stock ETF Options Trading Volume Ranking

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )