Berkshire Hathaway invests in tech stocks!

On November 15th, Beijing time, Berkshire Hathaway, owned by Warren Buffett, released its 2025 third-quarter holdings report (13F). Following Buffett's announcement that he will officially hand over the reins at the end of this year, Berkshire made a purchase of a major U.S. technology stock— Google— in the third quarter. Meanwhile, Berkshire Hathaway continued to reduce its stake in Apple . Stocks, and overall, there was a net selling of stocks in the third quarter.

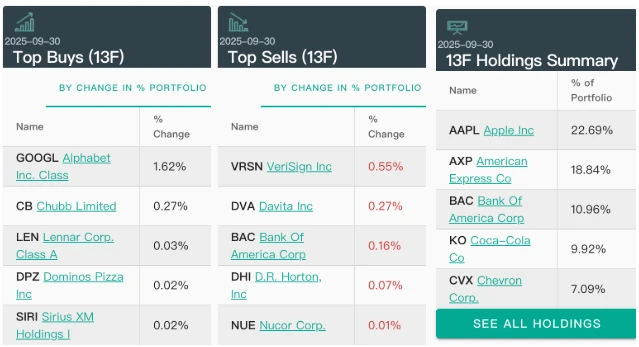

Berkshire Hathaway's Shareholding Changes in the Third Quarter of 2025

Image source: WhaleWisdom.com

As of the end of the third quarter of this year, Berkshire Hathaway's holdings were valued at $267.3 billion, compared to $257.5 billion at the end of the second quarter. According to statistics from the third-party website WhaleWisdom, Berkshire Hathaway was a net seller of stocks in the third quarter.

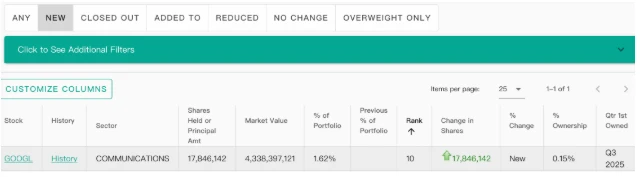

Building a position in Google

According to disclosures, Berkshire Hathaway established a position in Google-A (GOOGL) in the third quarter, purchasing nearly 17.85 million shares, with a market value of approximately $4.3 billion at the end of the quarter. This was Berkshire Hathaway's largest purchase in the third quarter and its only new holding.

Berkshire Hathaway to buy Google-A in Q3 2025

Image source: WhaleWisdom.com

Berkshire Hathaway, under Warren Buffett's management, has always been known for its value investing style and has rarely invested in technology stocks. However, this third-quarter holdings report (13F) reveals that Buffett's succession has indeed brought about a certain degree of style change to the company.

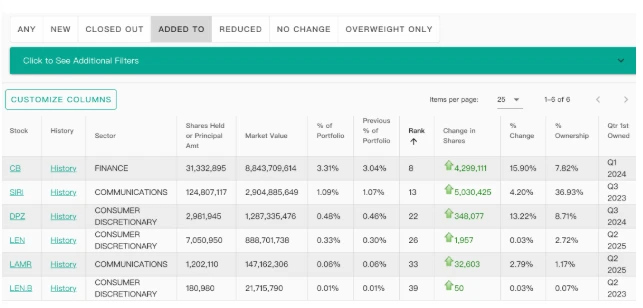

In terms of increasing its holdings, Berkshire Hathaway also increased its stake in Chubb Insurance in the third quarter. (CB), Lennar Architecture (LEN), Domino's Pizza (DPZ), Sirius XM (SIRI), Lamar Outdoor Advertising (LAMR) and other targets.

Berkshire Hathaway's acquisitions in the third quarter of 2025

Image source: WhaleWisdom.com

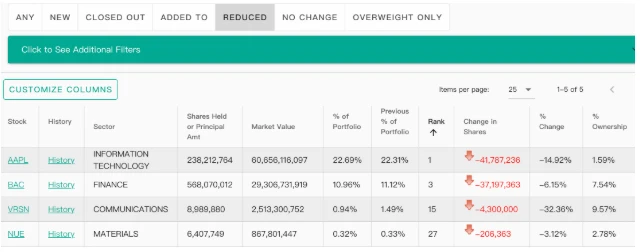

Continue to reduce holdings in Apple

Berkshire Hathaway continued to reduce its Apple stock holdings, selling nearly 41.79 million shares in the third quarter. At the end of the third quarter, it held 238.21 million Apple shares, a decrease of about 15% compared to the 28,000 shares held at the end of the second quarter.

In the third quarter, Berkshire also reduced its holdings in Bank of America. (BAC) sold approximately 37.2 million shares, representing about 6% of its holdings; it also sold shares in VeriSignal. (VRSN) 4.3 million shares, representing a reduction of approximately 32%; reduction of holdings in Nucor Steel. (NUE) approximately 210,000 shares, representing a reduction of approximately 3%.

Berkshire Hathaway's share reductions in the third quarter of 2025

Image source: WhaleWisdom.com

Greg will take over as CEO at the end of the year.

In May of this year, at Berkshire Hathaway's 2025 annual shareholders meeting, Buffett announced that he would step down as chief executive officer (CEO) at the end of the year and recommended that his previously announced successor, Greg Abel, the company's vice chairman, take over as CEO at the end of the year.

In his farewell letter released on November 10th (Eastern Time), Buffett reaffirmed that Greg will become the head of Berkshire Hathaway at the end of this year. Buffett praised Greg as an excellent manager, a hard worker, and an honest communicator, and emphasized that he, the board of directors, and his family have "100% support for him."

In his shareholder letter, Buffett stated, "I will no longer write Berkshire's annual report, nor will I speak endlessly at the annual meeting. In British terms, I'm going to 'quiet down.' Greg Abel will become the head at the end of the year. He is an excellent manager, a tireless worker, and an honest communicator. I wish him a long tenure. I will continue to communicate with you and my children about Berkshire through my annual Thanksgiving message."

Buffett stated, "I want to retain a significant number of Class A shares until Berkshire shareholders develop the same level of trust in Greg that Charlie and I have enjoyed for so long. This trust shouldn't take too long to build. My children have 100% support for Greg, and so do the directors of Berkshire."

He expressed high praise and trust for Greg. Buffett said, "Greg far exceeded my initial high expectations of him when I thought he should be the next CEO of Berkshire. He understands many of our businesses and people far better than I do now, and he learns very quickly on many issues that even CEOs don't consider. I couldn't choose anyone other than Greg to manage your and my savings."

(Source: China Securities) (Report)