As US institutional investors release their third-quarter (13F) holdings data, the overseas investment trends of Chinese private equity firms such as Hillhouse Capital and Greenwoods Holdings have come to light.

Overall, increasing holdings of Chinese concept stocks became a common strategy for many Chinese private equity firms in the third quarter, with Alibaba being a prime example. Pinduoduo Chinese tech stocks listed in the US have become a common choice for many Chinese private equity firms to increase their holdings.

Meanwhile, similar to Warren Buffett's choice, Gaoyi and Jinglin also opted to make significant investments in Alphabet, Google's parent company. Alphabet has been the biggest winner in the US stock market this year. With the development of artificial intelligence... The surge in popularity has fueled the steady growth of Alphabet's cloud business, with the company's stock price rising by a cumulative 46%.

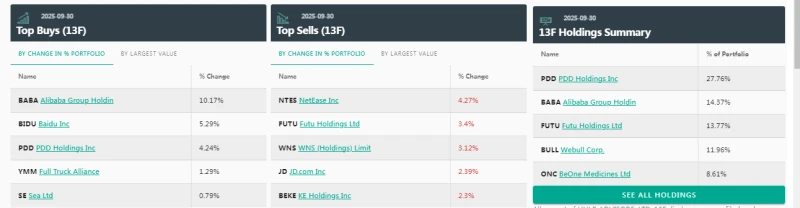

Hillhouse Capital: Makes significant purchases of Alibaba and Pinduoduo

As of the end of the third quarter, HHLR Advisors, a subsidiary of Hillhouse Capital, held a total of $4.1 billion in US stocks, an increase of $990 million or 32% from the previous quarter, with Chinese assets accounting for more than 90%.

Pinduoduo remained HHLR Advisors' largest holding in its top ten holdings for the third quarter, with its share price rising 39% year-to-date. Other major holdings of HHLR Advisors have also performed strongly this year, with Futu's share price rising 125% and BeiGene's share price also showing strong performance. It reached 99%, and Alibaba also reached 92%.

It is worth noting that Baidu in the third quarter Baidu made its debut on HHLR Advisors' list of new additions and quickly rose to become their sixth largest holding. Fueled by the accelerated commercialization of its AI strategy and breakthroughs in its self-developed chips, Baidu's stock price surged 54% in the third quarter.

In terms of portfolio changes, HHLR Advisors increased its holdings in Alibaba and Pinduoduo in the third quarter, with these two companies seeing share price increases of 58% and 27%, respectively. HHLR Advisors also increased its holdings in Futu and Yatsen Global , which have seen significant gains this year. NetEase They reduced their holdings to lock in profits in a timely manner.

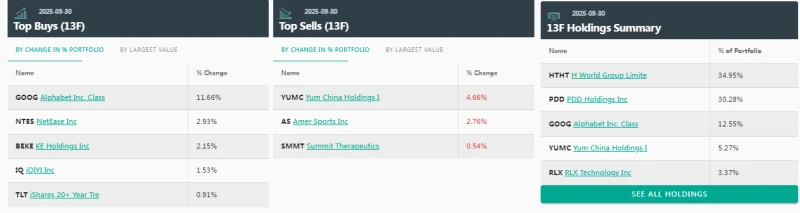

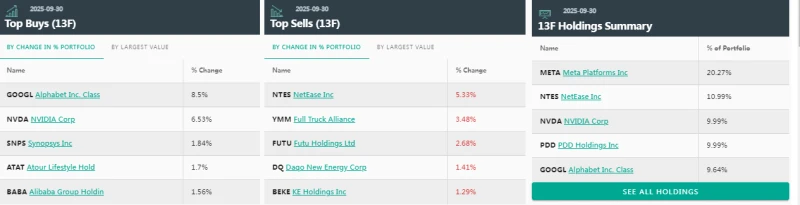

Gao Yi: Increase holdings in Alphabet, NetEase , and Beike

According to Gaoyi Asset Management's 13F filing, as of the end of the third quarter of 2025, its US stock holdings climbed to $580 million, a significant increase from $397 million in the second quarter.

In the third quarter, Gaoyi Asset Management made a significant purchase of 280,000 shares of Alphabet, Google's parent company, making it its third-largest holding. At the same time, Gaoyi also increased its holdings in Beike , NetEase , and iQiyi. Several Chinese concept stocks, including [list of companies listed in the US].

Gaoyi reduced its holdings in Yum China. Amer Sports Inc., the parent company of Arc'teryx The fact that stocks like these may indicate some concerns about the consumer sector.

As of the end of the quarter, Huazhu Pinduoduo remains its two largest holdings, accounting for more than 60% of its portfolio.

Jinglin: Makes a large-scale purchase of Atour. Alibaba and Pinduoduo

According to Greenwoods Asset Management's 13F filing, as of the end of the third quarter of 2025, its US stock holdings climbed to $4.44 billion, a significant increase from $2.873 billion in the second quarter.

Like Gaoyi Asset Management, Greenwoods Asset Management also made a large-scale purchase of Alphabet, Google's parent company, in the third quarter, indicating its optimism about the prospects of artificial intelligence .

At the same time, Greenwoods also acquired Nvidia shares. Synopsys Meanwhile, it is also increasing its holdings in the hotel and e-commerce sectors— Atour became the company's second largest increase in holdings in the third quarter, with more than 2.08 million new shares added. Combined with Huazhu 's increased holdings, Jinglin is systematically positioning itself to become China's leading chain hotel company.

Meanwhile, Greenwoods also increased its holdings in e-commerce giants Alibaba and Pinduoduo. Alibaba's stock price has soared 94% this year, and the strong cash flow generated by its main business provides a solid foundation for the company's cloud computing business. Streaming media and AI chips It provides financial support for investments in fields such as [unspecified].

Jinglin has liquidated its holdings in several key stocks, including Daqo New Energy. Ctrip BeiGene and Hesai science and technology.

Jinglin also established a position in WeRide during that quarter. With a shareholding of 2.68 million shares, WeRide , a leading company in China's autonomous driving field, is accelerating its transformation from technology research and development to commercialization.

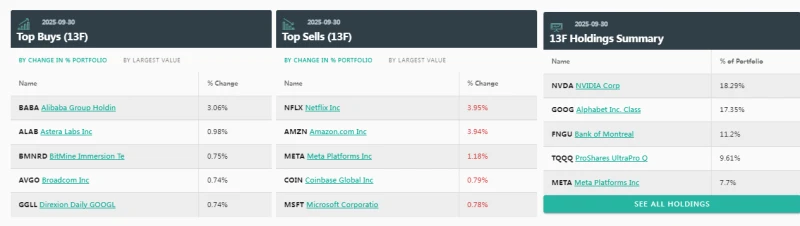

Oriental Harbor: First investment in Alibaba

The Oriental Harbor Investment Fund, managed by Dan Bin, saw its market capitalization increase from $1.13 billion to $1.29 billion in the third quarter, with its holdings increasing from 13 in the second quarter to 17.

Oriental Harbor bought 221,000 shares of Alibaba for the first time this quarter, accounting for 3.06% of the portfolio, and entered the top ten holdings list for the first time.

It's worth mentioning that on September 17th, Dan Bin stated on social media, "It's very meaningful that internet giants like Alibaba and Tencent can reach new historical highs!"

He also cited Alibaba as an example, saying that its market capitalization was once similar to that of major US tech companies, but now it is only comparable to Amazon's. 15.25% of respondents believed that Chinese internet companies have significant potential for value revaluation relative to US stock market giants.

At the same time, Dan Bin sold Netflix, Amazon , Meta, and Microsoft. Many tech stocks, especially Amazon and Netflix, were reduced by 50% and 71.5% respectively, causing them to drop out of the top ten holdings.

However, even after these moves, Nvidia remains its largest holding, and its top ten holdings are still dominated by leading US technology companies: Nvidia , Google C, 3x leveraged FANG+ index ETN, and 3x leveraged Nasdaq. 100ETF, Meta, Microsoft , Tesla , apple COINBASE and Alibaba account for as much as 92% of its holdings.

Duan Yongping: Buy Berkshire Hathaway shares, reduce Apple holdings

According to the 13F report of H&H International Investment, managed by renowned "value investing believer" Duan Yongping, its total holdings valued at $14.7 billion, up from $11.5 billion in the previous quarter.

Overall, Duan Yongping bought a significant amount of Berkshire Hathaway shares during the quarter and drastically reduced his Apple holdings —a move very much in sync with that of Warren Buffett himself.

In fact, prior to the second quarter of this year, Duan Yongping had already reduced his Apple holdings for four consecutive quarters. However, even so, Apple remains Duan Yongping's largest holding. As of the end of the third quarter, H&H, which he manages, held Apple shares worth US$8.869 billion, representing 60.42% of its portfolio.

Duan Yongping also established a position of 80,000 shares of ASML. The company owns a number of stocks, but the market value of its holdings is only $77.45 million, accounting for 0.53%, which is not a high percentage.

In addition to reducing his holdings in Apple, Duan Yongping also reduced his holdings in Nvidia, Alibaba, and Pinduoduo. He also reduced his holdings in Occidental Petroleum . Microsoft , Disney and TSMC Positions remain unchanged.

(Article source: CLS)