HHLR Advisors, a fund under Hillhouse Capital, has released its latest US stock holdings.

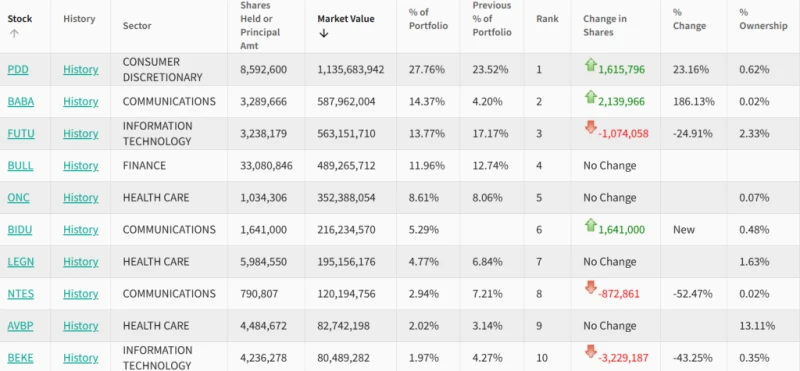

On November 15, the latest 13F filing showed that as of the third quarter of 2025, HHLR Advisors' total portfolio value was $4.09 billion, a significant increase of 31.72% from $3.105 billion at the end of the previous quarter. HHLR Advisors is a hedge fund invested in US stocks by Hillhouse Capital, managed and operated by its secondary market investment team.

According to data from the 13F data platform Whalewisdom, HHLR Advisors increased its holdings in 4 stocks, reduced its holdings in 4 stocks, newly added 5 stocks, and completely sold off 8 stocks. It significantly increased its holdings in Pinduoduo. Alibaba Wait, new entrants to Baidu Group, Full Truck Alliance Group and other companies, but reduced their holdings in Futu Holdings. NetEase Yixian E-commerce Wait, JD.com is clearing out its inventory. Vipshop Li Auto wait.

The top ten holdings are Pinduoduo , Alibaba , Futu Holdings , and Webull. Securities BeiGene Baidu , Legend Biotech, NetEase , ArriVent Biopharma, and Beike Chinese concept stocks accounted for 8 of the seats, highlighting their long-term optimism about high-quality Chinese assets.

The top ten holdings account for 93.46% of the total holdings, concentrated in leading companies in internet technology, consumer goods, and biopharmaceuticals.

Pinduoduo remained HHLR Advisors' largest holding in the third quarter. During the reporting period, the fund increased its holdings in Pinduoduo by 1.62 million shares, significantly raising its stake by 23.16%, with a market value of $1.14 billion, accounting for 27.76% of the entire portfolio. Pinduoduo's stock price has risen by 39% year-to-date.

Meanwhile, HHLR Advisors' holdings in Alibaba surged by 186.13%, adding 2.14 million shares to bring its total holdings to 3.2897 million shares, making it the fund's second-largest holding with a market value of $588 million. Year-to-date, Alibaba's stock price has risen 84.46%, with a roughly 58% increase in the third quarter.

Futu Holdings is HHLR Advisors' third-largest holding. However, HHLR Advisors reduced its holdings in Futu Holdings by 1.0741 million shares in the third quarter, decreasing its stake to 3.2382 million shares, with a market value of $563 million. The stock has risen over 107% year-to-date, and HHLR Advisors' sale may have been an attempt to lock in profits.

Notably, Baidu appeared on HHLR Advisors' holdings list in the third quarter of this year, with HHLR Advisors purchasing 1.641 million shares, valued at $216 million, making it the sixth largest holding. On November 13th, at the 2025 Baidu World Conference, Baidu officially released its new generation AI chip. Kunlun Chips M100 and M300. In addition, Baidu also released Baidu Tianchi 256 supernode and Baidu Tianchi 512 supernode, and announced Kunlun Chi's five-year roadmap. Baidu's stock price rose 54% in the third quarter.

In addition, HHLR Advisors cleared out its ZTO Express inventory in the third quarter of this year. Vipshop , Li Auto , JD.com , BOSS Zhipin Several targets, including...

(Source: The Paper)