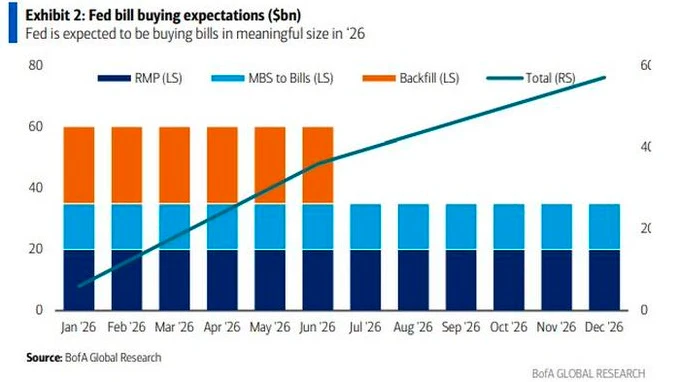

① Bank of America’s global interest rate strategy team said over the weekend that it expects the Federal Reserve to announce the launch of its “reserve management purchases” program this week; ② Under the program, the Federal Reserve will purchase $45 billion per month in short-term Treasury bills with maturities of one year or less, starting in January next year.

Besides the market's expectation of a third rate cut this year, when the Federal Reserve concludes its interest rate meeting at 3 a.m. Beijing time this Thursday, industry insiders may also focus on one thing: Will the Federal Reserve, which just finished its balance sheet reduction process on December 1, immediately start expanding its balance sheet?

Michael Kelly, global head of multi-asset management at PineBridge Investments, an investment firm that manages $215.1 billion in assets, said, "The Fed's current interest rate policy is clearly still restrictive, but that may not be important."

Kelly argues that the United States is currently implementing a dual-track monetary policy: one is a balance sheet monetary policy targeting the "wealthy class," which has been increasing the "wealth effect," stimulating spending, and helping to keep the economy running; the other is a traditional interest rate policy targeting ordinary people.

Kelly points out that high interest rates over the past few years have impacted small businesses, leading to frequent layoffs and exacerbating the pressure on lower-income families in the "K-shaped economy," while the situation for upper-income families has improved.

Recent credit card data has confirmed this trend. A report from Oxford Economics last Friday noted that "lower-income Americans are becoming more prone to defaulting on their credit card bills and are at risk of hitting their credit limits. Meanwhile, higher-income consumers typically do not default on their credit card bills and are driving consumer spending."

Kelly stated that this dual economic landscape makes any statement from the Federal Reserve this week regarding its $6.5 trillion balance sheet crucial – "Will they maintain the status quo or resume expansion?"

Industry speculation: Will the Federal Reserve buy $45 billion in bonds per month?

Currently, despite the Federal Reserve having reduced its balance sheet, which peaked at approximately $9 trillion during the pandemic, to about $2.5 trillion, the US capital markets remain relatively stable. Following pressure in the overnight funding market in recent weeks, the Fed ended its balance sheet reduction process on December 1st – a move that could be significant, as the Fed had explicitly stated its intention to avoid repeating the 2019 repurchase crisis.

But as we have discussed several times last month, signs of liquidity strain have been intensifying in the $12 trillion money market, which provides crucial funding for Wall Street's daily operations. This has led to increasing calls from market participants for the Federal Reserve to take further action to alleviate the pressure…

Responsible for supervising the central bank's securities Roberto Perli, a New York Fed official who manages investment portfolios, said in mid-last month that the recent rise in funding costs indicates that banks... With the system's reserves no longer plentiful, the Federal Reserve can purchase assets "without having to wait too long," a situation consistent with his superior—New York Fed President Williams. This echoed similar comments from Williams , who also reiterated at the time that the Fed was getting closer to restarting bond purchases as part of a technical measure to maintain control over short-term interest rates.

In response, some radical doves expect the Federal Reserve to take action as early as this week.

Bank of America's global interest rate strategy team said over the weekend that it expects the Federal Reserve to announce this week the launch of a "reserve management purchases" program—purchasing $45 billion per month in short-term Treasury bills with maturities of one year or less, starting in January next year.

In its client report, the team emphasized that its assessment of the timing and scale of the (bond purchases) was earlier than the market consensus, and that investors may have generally underestimated the extent of the Federal Reserve's actions regarding its balance sheet.

According to Bank of America, the aforementioned $45 billion monthly bond purchase program will come from two parts: the Federal Reserve will purchase at least $20 billion in Treasury bills each month to achieve "natural growth of the balance sheet," and an additional $25 billion each month "to reverse excessive reserve outflows, for at least the first six months."

Other institutions believe the process may be slower, and the Federal Reserve may intervene less to maintain smooth market operation.

Roger Hallam, global head of rates at Vanguard Fixed Income, said, "From a macro perspective, the Fed will naturally begin purchasing Treasury bills next year as part of its reverse management operations. As the economy's demand for reserves increases, the Fed will inevitably meet that demand."

Hallam expects the Federal Reserve to launch a Treasury bill purchase program at the end of the first quarter or the beginning of the second quarter, with monthly purchases ranging from $15 billion to $20 billion.

In an interview, he stated, "This will be a routine reserve operation by the central bank and does not contain any monetary policy signal. It is simply a routine duty that the Federal Reserve should fulfill to ensure system liquidity. This move is intended to maintain the stability of funding rates."

(Article source: CLS)