According to a report by Chang'an Street Observer, the Financial Times of the UK cited a White House memo on Friday, stating that Washington accused Chinese tech giant Alibaba. Provide technical support to the Chinese military for operations targeting U.S. territory.

However, the report made no specific details about which capabilities or actions were involved, nor did it indicate whether the United States was seeking to respond in any way.

Following the release of the report, Alibaba's US-listed shares plummeted, falling from an intraday gain of 1.5% to a closing loss of 3.78%.

Alibaba responded strongly, stating, "The assertions and insinuations in the relevant content are completely untrue. We question the motives of the anonymous leaker, and the Financial Times has also admitted that they could not verify the leaked information. This is clearly a malicious public relations campaign, with the mastermind behind it intending to undermine the recent trade agreement reached between US President Trump and China." The Chinese Embassy in Washington also refuted the report, stating that China opposes and combats all forms of cyberattacks in accordance with the law.

There are two noteworthy background factors behind this move by the White House.

One is a Bloomberg report from Thursday. Bloomberg reported that Alibaba has secretly launched Project Qianwen, a personal AI assistant app based on Qwen's most powerful model, directly competing with ChatGPT. This is a key step in a broader effort to catch up with competitors and ultimately profit from individual users.

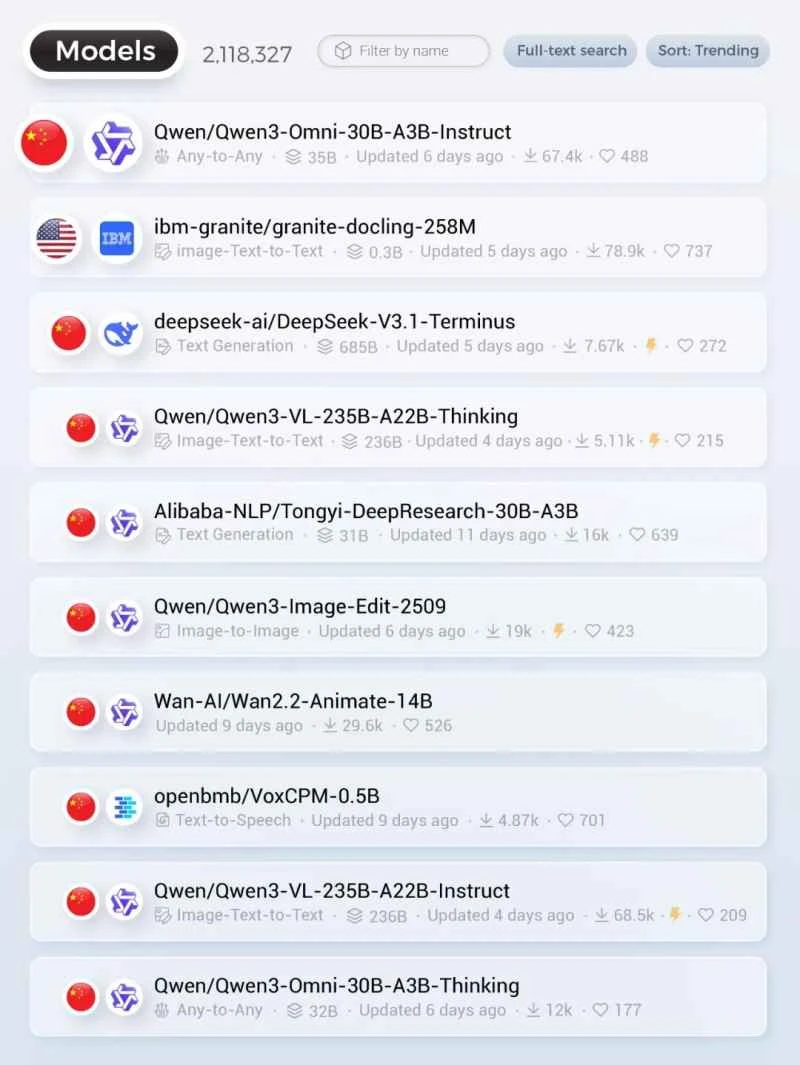

Qianwen occupies seven of the top ten spots on HuggingFace's global model ranking list.

One is a sentiment already spreading in Silicon Valley. Overseas social media has summarized it with the popular term "QwenPanic." The gist is: open-source models, represented by Alibaba's "QwenPanic" model, have cost advantages and will gain a larger customer base, while in the US, the closed-source path may be narrowing, and concerns about the debt burden of heavily investing in AI are emerging. This sentiment is consistent with the sentiment sparked by DeepSeek earlier this year. Its basis is that open-source models, represented by "QwenPanic," are capturing an increasingly larger market share.

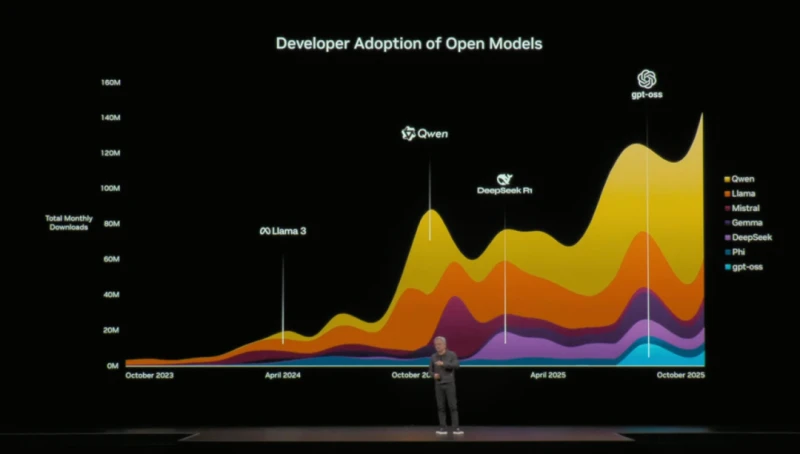

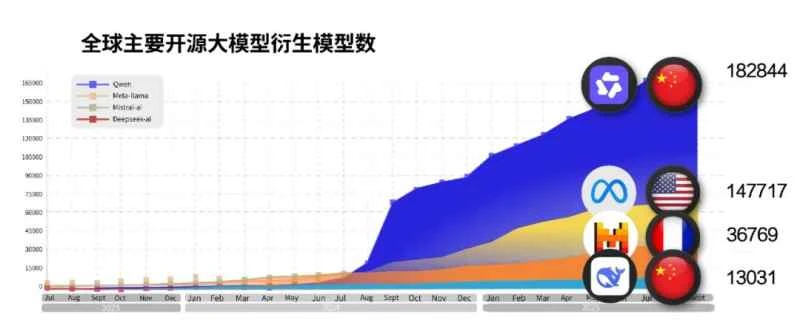

Since Alibaba open-sourced the Tongyi Qwen model in 2023, Qwen has been downloaded over 600 million times globally, with over 170,000 derived models, surpassing the Meta Llama series in both categories and ranking as the world's number one open-source model. Alibaba's Qwen has garnered significant praise in the global AI open-source community, with numerous prominent figures in the AI field, including Jensen Huang, Elon Musk, Fei-Fei Li, and the CEO of Airbnb, all giving it their approval. Apple... DeepSeek, Amazon Many well-known technology companies have adopted the Qwen model or conducted technological exploration based on Qwen.

In his keynote speech at the 2025 GTC conference in the early hours of October 29th, Beijing time, Jensen Huang stated that since 2025, Alibaba's Qwen from China has captured a large share of the open-source model market, and its leading advantage continues to expand.

On Tuesday, former Google CEO Eric Schmidt admitted in a podcast that there is a "strange paradox" in the current global AI landscape: the largest AI model in the United States is closed-source and paid, while the largest AI model in China is open-source and free. He predicted that under the dual pressures of cost and technological feasibility, most countries in the world may eventually turn to using Chinese AI technology.

The sustainability of the US debt burden has been consistently challenged in its vigorous development of AI. This year, the US artificial intelligence... The company's bond issuance has exceeded $200 billion. Goldman Sachs Previous estimates suggested that companies like Meta, Alphabet, and Oracle had already issued a massive $180 billion in bonds this year. Meta announced on Thursday that it will issue another $30 billion in corporate bonds. This amount means that AI- related bond issuance this year accounts for more than a quarter of the total net supply of US corporate debt.

In fact, US AI infrastructure stocks, including Coreweave and Nebius, have seen significant declines this week. The debate over AI strategies, coupled with market factors, is exacerbating the "QwenPanic" (a Chinese internet slang term for panic over a thousand questions).

(Source: Daily Economic News)