Following Japan's richest man, Masayoshi Son of SoftBank, another billionaire has made a move, selling off his entire stake in Nvidia , a core leader in the AI field. .

Documents disclosed over the weekend show that billionaire Peter Thiel has sold his entire stake in Nvidia .

Thiel is the co-founder of fintech giant PayPal and defense AI company Palantir. He has also achieved remarkable success in the investment field, not only founding well-known investment funds such as Founders Fund, but also accurately betting on many star companies, such as investing in Facebook in its early stages and reaping huge returns. He is known as the "Godfather of Silicon Valley Venture Capital" .

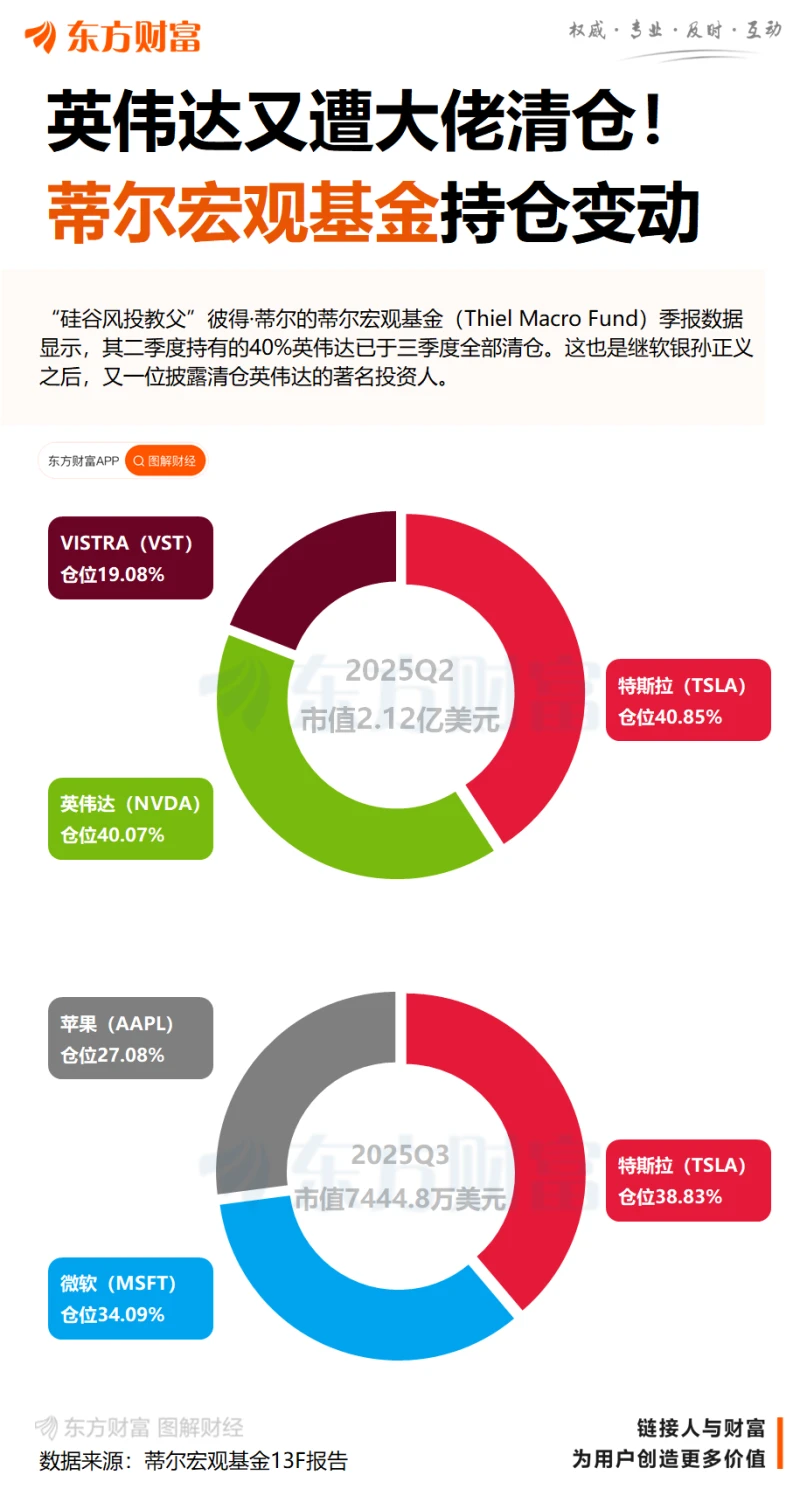

According to a 13F filing by Thiel's Thiel Macro Fund, Thiel sold approximately 537,742 Nvidia shares (representing nearly 40% of his portfolio) between July and September, and as of September 30, he no longer held any Nvidia shares .

According to relevant calculations, based on Nvidia's average stock price from July to September, the value of the shares sold is close to $100 million.

The documents also show that Thiel also invested in Tesla. The company reduced its holdings from 272,613 shares to 65,000 shares and purchased 79,181 shares of Apple. Stock and 49,000 shares of Microsoft stock.

Thiel also sold all of his shares in energy production company Vistra Energy Corp, totaling 208,747 shares.

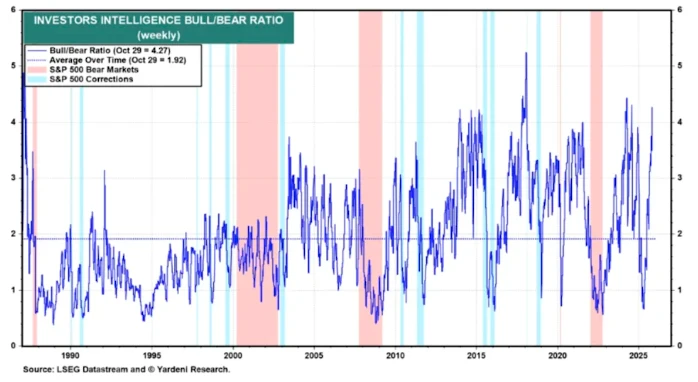

At the time Thiel made these moves, the market was reacting positively to artificial intelligence. Concerns are growing that the resulting tech valuation bubble is growing.

Investors are concerned about how AI giant OpenAI plans to deliver on its spending commitments of over $1 trillion, and what impact this will have on chipmakers like Nvidia, its main supplier. Nvidia's investment in OpenAI has also raised concerns about revolving financing.

Just a week before Thiel disclosed that he had sold all his Nvidia shares, SoftBank Group, a well-known Japanese technology investment company, announced that it had sold all its Nvidia shares, cashing out $5.8 billion.

Last Friday, Bridgewater Associates, one of the world's largest hedge funds, disclosed that it reduced its holdings of Nvidia shares by nearly 4.72 million in the third quarter. As of the end of the third quarter, Bridgewater held 2.51 million Nvidia shares, a 65.3% decrease from the 7.23 million shares held at the end of the second quarter.

Earlier this month, Michael Burry, an investor known for predicting the 2008 subprime mortgage crisis, also disclosed a large short position in Nvidia.

The reasons behind Thiel's divestment of his Nvidia shares are currently unclear.

Earlier this year, Thiel warned that Nvidia was overvalued, drawing parallels between the surge in tech stock valuations and the bursting of the dot-com bubble in 1999-2000. He also warned that the hype surrounding artificial intelligence far outpaced its actual economic benefits.

Despite a recent significant pullback in its stock price, Nvidia remains the world's most valuable company, with its market capitalization recently surpassing $5 trillion.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)