According to industry insiders, just as concerns began to rise about the debt-financed AI investment boom, Boaz Weinstein, one of Wall Street's most successful derivatives market traders, was "going against the grain"—targeting those seeking investment opportunities in Oracle . and Microsoft Financial institutions, including tech giants, sell related credit derivatives to hedge risks.

The aforementioned industry insider stated that some banks They are acting as counterparties to Saba Capital Management, the US hedge fund owned by this "King of Black Swans," by purchasing credit default swaps (CDS) of tech giants to mitigate potential losses.

These financial institutions can hedge their positions in bonds issued by related tech giants by buying CDS, while Saba Capital is actively increasing its risk leverage, betting that credit defaults are unlikely to occur.

Sources familiar with the matter revealed that Saba sold Oracle , Microsoft , Meta, and Amazon to several banks . And CDS contracts with Google's parent company Alphabet, as well as non-bank financial institutions such as some large asset management companies, including a private credit fund, are also actively purchasing these products.

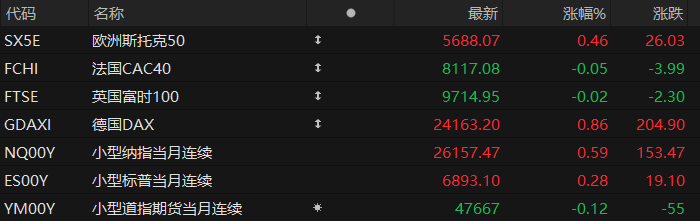

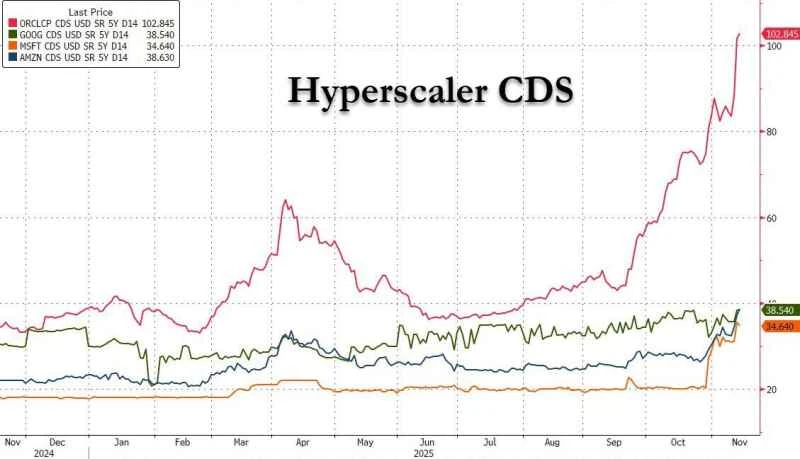

Although the value of CDS increases with rising corporate default risk, current prices suggest that the default risk of technology stocks remains low compared to other sectors.

Banks seek protection

Analysts point out that this move highlights the market's scramble to hedge against the risks of soaring AI company valuations and mounting debt burdens. It also reflects a growing concern that if the current AI boom proves to be a bubble, any bursting of the bubble could trigger a sharp stock market correction, subsequently impacting the economy.

As mentioned in yesterday's article by Cailian Press, banks and fund management institutions are racing to increase their holdings of related CDS, which will provide compensation when AI hyperscalers default on their debts.

Data shows that since September, the cost of related credit derivatives has more than doubled as demand for credit protection on Oracle corporate bonds has surged. In the six weeks ending November 7, Oracle-related CDS trading volume surged to approximately $4.2 billion, far exceeding the $200 million recorded in the same period last year.

Sources also indicate that many financial institutions are currently seeking to mitigate the growing debt risks on the balance sheets of tech companies—AI companies that are borrowing heavily to fund their multi-billion dollar artificial intelligence projects . The project is funded.

Goldman Sachs A client report released last Friday showed that demand for hedging protection in equity derivatives trading is also increasing.

Deutsche Bank Analyst Jim Reid also noted in a report on Monday that "part of the hedging demand stems from concerns about the supply of AI corporate bonds in the coming quarters—the supply of bonds in this sector has unexpectedly surged in recent weeks… These tools also appear to be used as a general hedge against various AI long positions."

The essence of CDS is to pay compensation when a company goes bankrupt. Of course, when a company's economic situation deteriorates, the price of these derivatives will also appreciate.

The funding needs of so-called hyperscalers—essentially large artificial intelligence technology companies—have surged in recent weeks. Meta issued an unprecedented $30 billion in bonds last month, Oracle raised $18 billion in September, and Google's parent company, Alphabet, announced funding plans on Monday. Bank of America data shows that in September and October alone, the issuance of investment-grade bonds in the sector more than doubled the industry's annual average.

S&P Global Data shows that driven by strong demand, credit default swap (CDS) prices for Oracle and Alphabet have reached their highest levels in two years, while CDS contracts for Meta and Microsoft have also seen significant increases in recent weeks. Data shows that Oracle's five-year CDS spread broke through 105 basis points last week, while Alphabet and Amazon traded at around 38 basis points, and Microsoft at around 34 basis points.

The "King of Black Swans" goes against the grain

It is worth noting that this is the first time Saba has sold hedging protection for a select group of companies, and also the first time a bank has made such a transaction request to the hedge fund.

At a time when the entire market is seeking CDS protection from tech giants, Weinstein's potential sale is undoubtedly attracting particular attention. It's worth noting that he rose to fame with the "London Whale" operation (an operation that led to the arrest of JPMorgan Chase, Wall Street's largest investment bank). Weinstein, who lost $6.2 billion, was one of the most successful traders in the derivatives market.

His CDS trading cases often thrived during periods of extreme market volatility—including the 2000-2001 California power crisis, the 2001 Enron scandal, and the 2002 WorldCom scandal.

In the aforementioned cases, Weinstein and SABA were primarily known as risk-takers in short-selling transactions, specifically going long on CDS (shorting bonds and consequently shorting stocks). Therefore, the fact that such a seasoned short seller has now turned bullish (shorting CDS) inevitably raises questions about whether recent market concerns about an AI bubble have been exaggerated.

Industry analysts believe that SABA may be engaging in a synthetic purchase of bonds issued by the seven major AI companies. Given that the most liquid CDS has a five-year maturity, its bet seems to be that even in a downside scenario, defaults will not occur before 2030. Whether this signifies confidence that the Trump administration will intervene to rescue the AI industry and guarantee the bonds remains to be seen.

Of course, Saba could also simply be arbitrageurizing the price movements between CDS and stocks—by selling CDS and shorting the stock, as has been repeatedly mentioned in the industry recently, the two have become severely decoupled in recent weeks...

Historically, Weinstein employed a similar strategy when AOL Time Warner's stock price fell in the early 2000s. He correctly bet that the company wouldn't default, buying corporate bonds while simultaneously hedging his risk by shorting the stock. This strategy, known as capital structure arbitrage, was one of Weinstein's main long-standing strategies, aiming to leverage different types of securities from the same company. Profits are made from price differences.

(Article source: CLS)