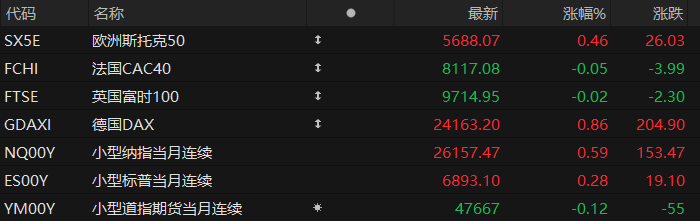

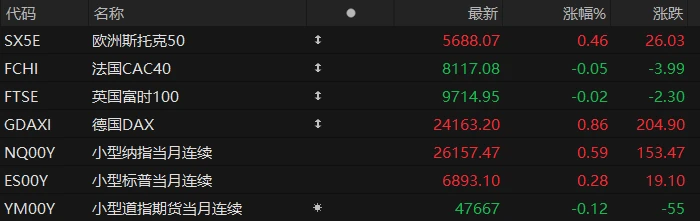

U.S. stock index futures were mixed in pre-market trading on Monday, while major European indices showed divergent trends. As of press time, the Nasdaq... S&P 500 futures rose 0.59%, S&P 500 futures rose 0.28%, and Dow Jones futures fell 0.12%.

In terms of individual stocks, major US tech stocks generally rose in pre-market trading, with Nvidia among them. Microsoft rose nearly 2%. Meta rose more than 0.7%, while Google and Amazon also rose. Tesla Slightly higher in pre-market trading.

Storage-related stocks rose collectively in pre-market trading, with SanDisk up over 5% and Micron Technology also gaining ground. Seagate Technology rose nearly 4%. Western Digital It rose by more than 1%.

Cryptocurrency concept stock IREN rose more than 22% in pre-market trading after the company signed a $9.7 billion deal with Microsoft .

Popular Chinese concept stocks were mixed in pre-market trading, with Zai Lab showing mixed results. XPeng Motors rose more than 3%. Bilibili Alibaba rose more than 1%; Baidu It fell by nearly 1%.

On November 5 local time, the U.S. Supreme Court will hold a hearing on the so-called "reciprocal tariffs" policy implemented by the Trump administration.

On November 2, US President Trump stated on social media, "In my view, this will be one of the most important and influential rulings in the history of the US Supreme Court." He further warned that if the Supreme Court forces him to abandon the relevant tariff policies, "our country could be reduced to 'Third World' level."

However, Trump changed his previous stance of planning to attend the hearing in person, instead stating, "I will not go to the Supreme Court in person on the 5th because I do not want to distract the public from the importance of this ruling."

Although the Supreme Court does not set a fixed timeframe for its judgment, this case falls under the category of expedited proceedings, and the outside world expects the court to make a decision in a relatively short period of time. However, the market is not generally optimistic about the prospects of the verdict in this case.

Hot News

A new "Super Week" is coming! Several leading AI companies are releasing their earnings reports at the end of the week, and the market faces the challenge of a "data shortage."

After one of the busiest trading weeks of the year, investors are about to face another packed week. This week, artificial intelligence... AI will remain a market focus, with Palantir (PLTR.US), AMD (AMD.US), and Supermicro all expected to benefit. AI concept stocks such as SMCI (SMCI.US) and Constellation Energy (CEG.US) will release their quarterly financial reports one after another.

On the economic data front, the ongoing government shutdown may delay the release of monthly non-farm payroll data for the second consecutive month, making Wednesday's ADP private sector employment data the most important indicator for the labor market this week.

Institute for Supply Management and S&P Global The manufacturing and services PMI data released this week are also key highlights, while the University of Michigan's preliminary November consumer confidence reading, to be released on Friday, will also be closely watched.

Latest poll: Over 60% of voters are dissatisfied with Trump's handling of the economy.

A recent NBC News poll shows that Americans are increasingly dissatisfied with Trump's handling of the economy in less than a year since he took office.

In a poll of 1,000 voters conducted from October 25 to 28, 63% of respondents said Trump's economic performance had fallen short of their expectations. Additionally, 65% believed Trump had failed to effectively protect the interests of the middle class, and 66% shared similar dissatisfaction with his handling of inflation and the cost of living.

Since March, Trump's overall approval rating in this poll has dropped by 4 percentage points to 43%, while 55% of people are dissatisfied with the president's job performance.

This poll also revealed a divide among voters regarding which party is better positioned to manage the economy. According to the poll, 38% of voters believe Republicans would do a better job, while 37% believe Democrats would be more efficient. The results indicate a growing negative outlook on the U.S. economy.

Has the gold price correction bottomed out? UBS: Strong fundamental demand expected to push prices back to $4,200 this year.

Last week, gold prices experienced a sharp correction after reaching a record high. Gold prices fell below $3,950 at one point in the middle of the week, but then rebounded and finally closed at $4,002 per ounce on Friday, down 0.94% from the previous trading day.

Despite the significant pullback in gold prices, most Wall Street banks remain confident about the outlook for gold prices. UBS recently stated that they believe the current price correction is temporary and maintain their target price of $4,200 per ounce by the end of the year.

They also stated that if geopolitical or market risks escalate, gold prices could even rise to $4,700 per ounce this year. UBS indicated that the current pullback in gold prices was expected, and that this correction has "temporarily stopped."

“Aside from technical factors, we have not found any substantial reason for this sell-off,” UBS noted. “The weakening price rally triggered a second round of declines in the number of open futures contracts.” UBS also emphasized that underlying demand for gold remains strong.

Is the global copper supply shortage expected to worsen? Glencore is reportedly closing its Canadian copper smelter.

US Stocks Focus

IREEN surges pre-market after signing $9.7 billion AI cloud deal with Microsoft .

Microsoft has signed a deal worth approximately $9.7 billion with Australian company IREN Ltd. to purchase artificial intelligence (AI) cloud computing power, becoming the Australian company's largest customer. Stimulated by this news, IREN's stock surged in pre-market trading, rising over 21% as of press time.

According to a statement released by IREN on Monday, the five-year agreement will provide Microsoft with an accelerator system based on Nvidia's GB300 architecture, located in Texas, to handle AI workloads. The agreement also includes a 20% upfront payment. Sydney-based IREN also announced that it has agreed to acquire a $5.8 billion contract from Dell Technologies. Procurement of the necessary GPUs and related equipment.

In an email, IREN CEO Daniel Roberts stated that once fully implemented, the agreement is expected to generate approximately $1.94 billion in annualized revenue, representing only 10% of IREN's total capacity. This leaves room for the infrastructure provider to sign more contracts and generate additional revenue.

He pointed out, "We have always regarded large and hyperscale cloud service providers as natural partners. As their computing power needs and our AI cloud capabilities grow in tandem, our negotiations with several leading companies have accelerated significantly."

Google is reportedly planning to issue at least €3 billion in bonds to support its AI expansion.

According to sources, Google's parent company, Alphabet, plans to issue at least €3 billion in bonds in Europe to support its record capital expenditures on artificial intelligence (AI) and cloud infrastructure. This would be the company's second return to the European bond market this year.

Sources familiar with the matter revealed that Alphabet will issue six tranches of euro-denominated benchmark bonds with maturities ranging from 3 to 39 years, with a total expected size of at least €3 billion (approximately US$3.5 billion).

The pricing of the 3-year bond was about 60 basis points higher than the medium-term swap rate, while the issuance price of the longest-term 39-year bond was about 190 basis points higher.

This will be Alphabet's second bond issuance in the euro market this year. Earlier this year, the company issued its first multi-tranche bond offering totaling €6.75 billion, which was met with enthusiastic investor demand, marking the US tech giant's expansion of its financing channels from the dollar market to Europe.

As the AI investment boom continues to heat up, many tech companies have recently increased their fundraising efforts. Last week, Meta issued $30 billion in corporate bonds in the dollar market, marking the largest dollar bond issuance this year.

apple Developed in-house and outsourced: Google's Gemini model reportedly to power Siri.

Apple 's "Deepsea Siren" may become a shell version of Google's "twin stars." According to renowned journalist Gurman, Apple is collaborating with Google to create a paid Apple-exclusive Gemini model to support Siri, which can run on Apple's private cloud servers.

Apple is expected to launch the revamped Siri next March. Gurman stated that Siri will not be integrated into Google services or the Gemini interface; instead, Gemini will become the core of Siri's processing, ensuring users will still experience the enhanced Siri within the familiar Apple ecosystem.

Furthermore, the new Siri will feature AI-driven web search capabilities and significantly improve its semantic understanding and conversational fluency. However, Gurman emphasized that Gemini support does not guarantee user satisfaction, but it is expected to salvage Siri's brand image, which has been steadily eroded over the years.

He also pointed out that Apple is expected to showcase new system versions such as iOS 27, macOS 27, and watchOS 27 at the WWDC technology conference next June, where Apple's artificial intelligence will be the focus.

(Article source: Hafu Securities) )