Technical analysts who study US stock charts are sounding the alarm: the latest decline in US stocks could develop into a full-blown correction of at least 10%, which could exacerbate market anxiety...

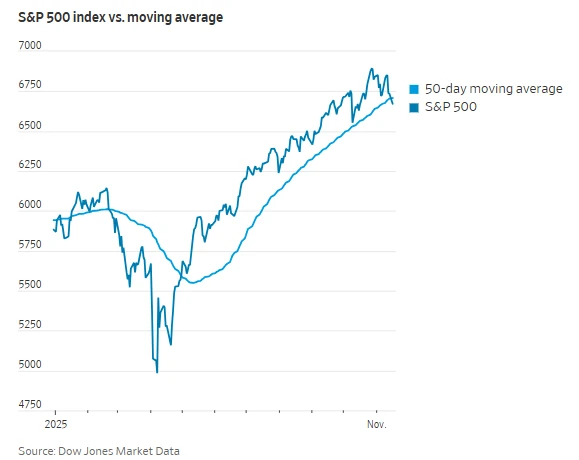

Market data shows that the S&P 500 experienced a sharp sell-off on Monday, with its decline since hitting a record high on October 28 now reaching 3.2%, the largest pullback from its peak since the major sell-off in U.S. stocks from February to April.

Meanwhile, the benchmark index closed below its 50-day moving average for the first time in 139 trading days on Monday, while also marking the second-longest period this century that it has remained above this key trend line.

Another key figure is 6725 points, more than 50 points lower than the S&P 500's closing price of 6672.41 on Monday – Goldman Sachs Derivatives strategist Brian Garrett just stated over the weekend that 6725 points is very important for the S&P 500, and a break below this level could trigger trend-following quantitative funds (such as CTAs) to switch from buying to selling. Investors should "put the S&P 500 at 6725 points on your launchpad."

With the breach of these key levels and support levels on Monday, several Wall Street strategists have issued warnings.

Dan Russo, co-chief investment officer and portfolio manager at Potomac Fund Management, said, “The market is suffering a severe shock beneath the surface. It would be even more worrying if the 50-day moving average were broken along with a continued contraction in market breadth—meaning more stocks would hit new lows—which would signal an impending sell-off.”

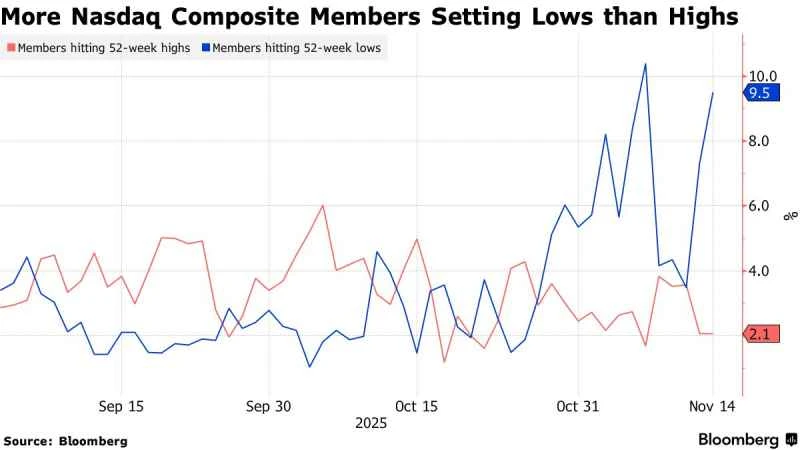

John Roque, head of technical analysis at 22V Research, also pointed out that Nasdaq The composite index also sent some ominous signals. He pointed out that among the index's approximately 3,300 constituent stocks, the number of stocks at 52-week lows now exceeds the number at 52-week highs, indicating weakness within the market and a low probability of further rebound.

Roque stated that if the market movement wasn't clear in the first week of November, it should be now: a correction is underway. He advised investors to adopt a defensive strategy. Roque predicts that the Nasdaq Composite Index has fallen more than 5% from its high last month, and the decline could extend to 8%, before testing support around 22,000 points.

For Janney Montgomery Scott, technical strategist and associate director of research Dan Wantrobski, the S&P 500 breaking its historic strong run above its 50-day moving average foreshadows potentially more volatility ahead.

“A market correction has already occurred, and I believe the S&P 500 will fall further from its current level,” Wantrobski noted.

Wantrobski added that the index could fall by 5% to 10% by the end of December. “Market breadth is extremely poor, and the stock market is in a fragile state. A mild correction now would be more beneficial for the S&P 500 than a more volatile start to next year.”

CTA may sell

In fact, as Goldman Sachs previously warned, U.S. stock market bulls may find it increasingly difficult to gain support from commodity trading advisors (CTAs) – these trend-following institutions typically buy when indices rise and sell when they fall.

UBS Group Equity derivatives strategist Maxwell Grinacoff predicts that this group will begin reducing its risk positions within the next two weeks, cutting its current 20% equity exposure.

He stated that if global indices fall by 5% or more, the scale of selling could easily triple. He also pointed out that if the S&P 500 falls below 6500 points, CTA selling will intensify further.

Many industry insiders say the root cause of the recent stock market weakness lies precisely in the previously overly strong performance of tech stocks—these stocks were what propelled the S&P 500 index up 38% from its April low to its October high. But now, with growing concerns about an AI bubble, the tech stock rally has stalled, forcing the market to rely on sectors more vulnerable to an economic slowdown and weak consumer confidence.

Market data shows that the "Big Seven" US stocks have fallen nearly 4.5% so far this month, with only Alphabet, Google's parent company, bucking the trend. These tech giants have contributed almost all of the stock market's gains this year. However, as investors scrutinize artificial intelligence... The massive financing required for construction has turned the sector from euphoria to skepticism. Just this Monday, Amazon... The company issued another $15 billion in bonds through the credit market.

Regarding the specific future trend, 22V analyst Roque believes that Meta may be a "bellwether for this round of correction" because its decline started earlier than its peers, and it may need to "bottom out and rebound" before the current market correction ends. Meta fell another 1.2% on Monday, and has fallen by about 24% from its August peak.

Of course, while Monday's Wall Street discussion focused primarily on the technical weakness, fundamental factors may regain dominance later this week – Walmart Home Depot and Target US retailers are expected to release their earnings reports and comment on the upcoming holiday shopping season; Nvidia This will be the last tech giant to release its latest financial report; and a series of government economic data that have been absent for seven weeks will also be released one after another.

Sam Stovall, chief investment strategist at CFRA, pointed out that the current rotation from large-cap tech stocks (Monday's healthcare and utilities) is underway. The sector's outperformance (outperforming the broader market) should help eliminate some of the bubble that has accumulated in growth stocks. While the market has been volatile due to the sharp drop in the index over the past two weeks, he stated that "the current decline is not yet sufficient to constitute a correction."

Ned Davis Research also described the recent sell-off as "sufficiently manageable"—the possibility of a rebound remains, but warned that "if the consolidation period lasts too long and fails to restart the upward trend, the risk of it turning into a top formation process will increase significantly."

(Article source: CLS)