1. SoftBank sells off its entire stake in Nvidia again. 1. Last time, they missed out on a $200 billion money-making opportunity; 2. Sony 1. Upward revision of fiscal year guidance confirms stronger-than-expected iPhone sales; 2. Will a second rear camera be added? The second generation of iPhone Air may be delayed; 3. Yang Likun is rumored to be leaving Meta to start his own business.

Following news of SoftBank's divestment of its Nvidia stake, coupled with emerging cloud service provider CoreWeave lowering its revenue guidance, most tech giants saw slight pre-market weakness. AI leader Nvidia and storage powerhouse SanDisk... The declines all exceeded 2%.

As of press time, Nasdaq S&P 500 futures (2512 contract) fell 0.5%, S&P 500 futures fell 0.18%, and Dow Jones futures rose 0.04%.

(Nasdaq daily chart, source: TradingView)

The Nasdaq surged over 2% yesterday, its biggest one-day gain since May, following a breakthrough in the US government shutdown resolution. The Senate has approved a temporary funding bill, and the House of Representatives is expected to vote on it as early as Wednesday, ending the shutdown.

What caused a stir in the market before today's trading session was SoftBank's latest earnings report, which revealed that it had sold off its entire stake in Nvidia, netting $5.83 billion. SoftBank also reduced its holdings in T-Mobile, netting $9.17 billion. SoftBank last sold off its entire Nvidia stake in 2019, investing $4 billion and netting $3 billion . However, if it hadn't sold those shares, it would have over $240 billion in unrealized gains by today.

SoftBank CFO Yoshimitsu Goto stated during the earnings call, " Due to the large scale of our investment in OpenAI, we are raising funds through (the sale of shares) and utilizing them. "

According to the previously signed financing agreement, SoftBank will invest an additional $22.5 billion in December as OpenAI completes its restructuring.

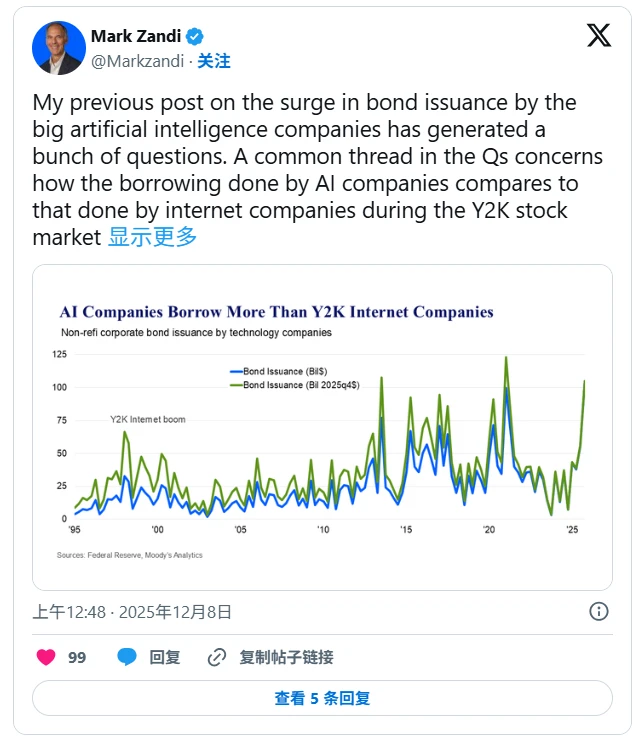

Between April and September this year, SoftBank recorded investment income of 3.92 trillion yen, of which 2.15 trillion yen (approximately 99.2 billion yuan) came from the increase in OpenAI's valuation. Yoshimitsu Goto also stated that it's impossible to answer whether AI investment is a "bubble" at this time; the important thing is to ensure financial stability while not missing investment opportunities.

When asked whether the decision to cash out Nvidia in October involved valuation considerations, Yoshimitsu Goto declined to comment, stating only that adjusting asset allocation is the destiny of investment companies.

Other market news

Sony raises fiscal year guidance, confirming stronger-than-expected iPhone sales.

Sony Group shares surged over 5% after releasing its earnings report on Tuesday, buoyed by a significant increase in shipments of high-end smartphone camera sensors, and the company raised its full-year guidance. The company stated in its earnings report that during the reporting quarter, shipments of smartphone image sensors... Sales were significantly higher than the same period last year, mainly because "major customers used larger image sensors in their new products, and shipments also exceeded the company's expectations."

[Is a second rear camera being added? The second-generation iPhone Air is reportedly delayed]

Tuesday's latest news indicates that Apple... (The sentence is incomplete and lacks context). Apple has notified its suppliers that it will remove the second-generation iPhone, originally scheduled for release next fall, from its launch schedule without providing a new date. Sources indicate that Apple is redesigning the ultra-thin model, which may be released in spring 2027 alongside the standard iPhone 18 and iPhone 18e. The most significant change is likely the addition of a second rear camera.

【 Intel Chief AI Officer Jumps Ship to OpenAI

Intel's chief technology and artificial intelligence Sachin Katti, an Intel executive, has announced his departure to join OpenAI, where he will work on building general-purpose AI computing infrastructure. He is the second major AI executive to leave Intel this year. Previously, he was responsible for Intel's data center... Justin Hotard, who led the company's artificial intelligence business, left Nokia this spring to join the company. CEO.

Yang Likun is rumored to be leaving Meta to start his own business.

Tuesday's latest news indicates that Turing Award winner Yann LeCun, considered one of the pioneers of modern artificial intelligence, has told his colleagues at Meta that he will be leaving the company in the coming months. Sources familiar with the matter say LeCun is in talks to raise funds for a new startup. This summer, Mark Zuckerberg brought in 28-year-old Wang Tao, founder of data labeling company Scale AI, to lead the newly formed superintelligence team, and asked LeCun to report to Wang.

AMD is expected to outline its AI business plans on Tuesday.

AMD will hold its Financial Analyst Day event on Tuesday, where business leaders are expected to present their business outlook and financial projections for the next few years. In addition to the upcoming MI400 series AI chips launching next year, AMD may also discuss its gaming... The company's chip and programmable chip businesses. AMD last held an Analyst Day event in 2022; this year's event will begin at 1 p.m. ET.

(Article source: CLS)