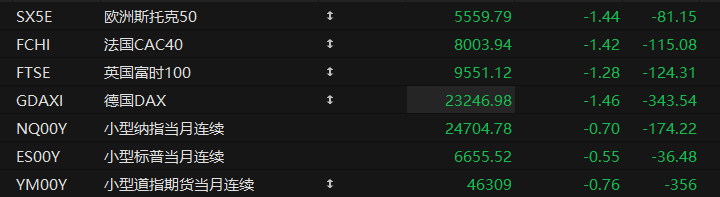

U.S. stock futures fell across the board in pre-market trading on Tuesday, while major European indices also declined. As of press time, the Nasdaq... S&P 500 futures fell 0.70%, S&P 500 futures fell 0.55%, and Dow Jones futures fell 0.76%.

In terms of individual stocks, tech stocks showed mixed performance in pre-market trading, with Google up nearly 1% and Apple... Broadcom Up about 0.3%; Amazon , Microsoft AMD and Nvidia fell nearly 2%. Tesla It fell by about 1%.

Pinduoduo The stock fell more than 3% in pre-market trading after rising nearly 4% earlier. Q3 revenue and adjusted net profit both exceeded expectations, but management issued another financial warning.

Baidu Alibaba shares fell more than 2% pre-market after reporting a 50% surge in Q3 AI revenue, exceeding expectations. Pre-market trading continued with a gain of approximately 0.5%, as its Quark app integrated with the Qianwen Dialogue Assistant; Ctrip The stock rose nearly 1% before the online storage service was launched, and Citigroup is optimistic about it after the earnings report.

Following the conclusion of the longest government shutdown in U.S. history, a backlog of economic data will be released this week, providing crucial information for markets and the Federal Reserve to assess the economic situation. More than 30 important economic reports were postponed or canceled during the shutdown, including core indicators such as employment, inflation, and GDP.

It is worth noting that the release of some key data remains uncertain. The U.S. Department of Labor stated that it is uncertain whether the October Consumer Price Index (CPI) will be released as scheduled, because about two-thirds of the price data needs to be collected on-site and cannot be supplemented by retrospective methods.

Hot News

The S&P 500 and Nasdaq both suffered a "Black Monday," signaling a potential technical collapse!

Analysts studying chart patterns in the U.S. stock market have sounded the alarm, fearing the recent decline could turn into a full-blown correction. The S&P 500 closed below its 50-day moving average for the first time in 139 trading days, breaking the second-longest streak above that trendline this century.

The index has also fallen more than 50 points from the 6725 mark, according to Goldman Sachs. Veteran trader Lee Coppersmith points out that this level could cause trend-following quantitative funds (CTAs) to shift from buying to selling.

Like the S&P 500, the Nasdaq also fell below its 50-day moving average, ending its longest streak of consecutive days above the 50-day moving average since October 2, 1995, a streak that lasted 187 trading days. John Roque, head of technical analysis at 22V Research, said the Nasdaq was also sending some “bad” signals.

He stated that among the approximately 3,300 constituent stocks in the index, the number of stocks hitting 52-week lows exceeded the number hitting highs, a sign of market weakness that suggests a very low probability of further rebound. On Tuesday, Bitcoin briefly fell below $90,000, further fueling risk aversion in the market.

A Bank of America investigation warns: Investor frenzy triggers "sell signals"!

A Bank of America monthly fund manager survey released Tuesday showed that global investors increased their allocations to equities and commodities in November, but cash holdings fell to just 3.7%, triggering a "sell signal" from Bank of America. This has raised concerns that bullish positions could become a headwind for risk assets.

A November survey warned that if the Federal Reserve does not cut interest rates in December, overvalued markets could face further downside, particularly emerging markets and banks. It is considered the sector most vulnerable to risk aversion volatility in the fourth quarter of 2025.

Among respondents, 45% of investors considered the “AI bubble” to be the biggest tail risk. A record percentage of investors said companies were “over-investing,” suggesting that spending by mega-corporations may need to slow. Tech sector positions remain very crowded, with 54% of respondents listing “long the Big Seven” as the most crowded trade.

Bank of America The bank warned that its rally may still be weakening. It noted that current market breadth is deteriorating, and historical patterns suggest that if key support levels fail to hold, the index could experience a 10% pullback.

Defying the trend, "Sister Wood" invests $10 million to increase her stake in cryptocurrency concept stock Bullish.

Cathie Wood, a well-known Wall Street fund manager, continued to expand the company's investment in the cryptocurrency sector on Monday (November 17) by purchasing a total of $10.2 million worth of shares in cryptocurrency exchange Bullish through three of its exchange-traded funds.

According to a trading report released by the company on Monday, its flagship fund, ARK Innovation ETF (ARKK), purchased 191,195 shares of Bullish stock, while ARK Next Generation Internet ETF (ARKW) purchased 56,660 shares; ARK Fintech Innovation ETF (ARKF) increased its holdings of Bullish stock by 29,208 shares.

This year, Ark Investments has been actively adjusting its cryptocurrency portfolio. Last Thursday (November 13), the company also purchased $7.28 million worth of Bullish, $15.56 million worth of Circle, and $8.86 million worth of BitMine.

Ark's latest increase in holdings comes at a time of significant volatility in the crypto market, with Bullish's stock trading on the New York Stock Exchange. The stock has seen three consecutive days of decline, closing down 4.5% on Monday at $36.75 per share, and has fallen 37.46% over the past month.

US Stocks Focus

Baidu's Q3 revenue reached 31.17 billion yuan, with AI business revenue growth exceeding 50%.

On November 18th, Baidu released its Q3 2025 financial report, showing total revenue of 31.2 billion yuan, a year-on-year decrease of 7%. This quarter, Baidu disclosed its AI business revenue for the first time, with overall year-on-year growth exceeding 50%, becoming the biggest highlight of the performance. Breaking it down: AI cloud revenue increased by 33% year-on-year; AI application revenue reached 2.6 billion yuan; and AI-native marketing services performed particularly well, with a significant year-on-year increase of 262%, reaching 2.8 billion yuan.

In the field of autonomous driving, Carrot Express's global ride-hailing service reached 3.1 million trips in the third quarter, a year-on-year increase of 212%, with the growth rate accelerating further from 148% in the second quarter. As of November, its cumulative global ride-hailing service trips have exceeded 17 million, ranking first in the world.

In addition, at the recent "Baidu World 2025" conference, Baidu launched several new products, including the Wenxin Big Model 5.0, Kunlun Core M100 and M300, to continuously improve its AI technology ecosystem layout.

Pinduoduo's Q3 revenue growth slowed to 9%, while net profit increased by 17% year-on-year.

Pinduoduo's revenue in the third quarter was RMB 108.28 billion (approximately US$15.209 billion), a year-on-year increase of 9%. This growth rate slowed significantly compared to previous quarters, marking the first time in recent years that the company's revenue growth rate has fallen to single digits. Net profit attributable to shareholders was RMB 29.33 billion, a year-on-year increase of 17%, and non-GAAP net profit was RMB 31.38 billion, a year-on-year increase of 14%.

Vice President of Finance Liu Jun warned that "revenue growth continues to slow, reflecting the evolution of the competitive landscape and external uncertainties," and stated that "financial results may continue to fluctuate quarter by quarter as we increase support for merchants and investment in the ecosystem."

Faced with slowing growth, Pinduoduo's management team collectively signaled a focus on long-term value, greater social responsibility, and a proactive approach to competition. Chairman and Co-CEO Chen Lei stated on the company's tenth anniversary:

"Looking ahead, as we grow in scale, we are prepared to take on greater social responsibility and continue to serve the broader public interest and the long-term prospects of the entire e-commerce ecosystem."

Arm and Nvidia join forces to advance NVLink, aiming at AI chips. Internet industry standards

On Monday (November 17) local time, chip design giant Arm announced on its official website that it has deepened its partnership with NVIDIA and will promote its computing platform Neoverse through NVIDIA's NVLink Fusion architecture.

Arm stated that it will extend the Neoverse platform through NVIDIA's NVLink Fusion, "potentially replicating the performance, bandwidth, and efficiency of NVIDIA's Grace Hopper and Grace Blackwell platforms across the entire ecosystem."

According to Arm, Neoverse is a computing platform designed for high efficiency, energy saving, and high-performance scaling. It is currently deployed across more than 1 billion performance cores and is expected to dominate the world's top hyperscale data centers by 2025. 50% market share.

In a press release, Arm CEO Rene Haas wrote, "Arm and NVIDIA are working together to set a new standard for AI infrastructure, bringing Grace Blackwell-level performance to all Arm-based partners. "

Analysts believe that closer collaboration between the two companies will help solidify NVLink's position as an industry standard. For Arm, it will be able to offer customers more complete chip designs, helping it find more sources of revenue growth.

iPhone sales in China saw a strong surge! October sales increased by 37% year-on-year, with a market share reaching 25%.

Apple 's iPhone 17 series smartphones achieved impressive sales figures. According to data released Tuesday by research firm Counterpoint, iPhones accounted for a quarter of smartphone sales in China in October, with sales increasing by 37% year-on-year.

Data shows that overall smartphone sales in China increased by 8% year-on-year in October, mainly driven by Apple and Chinese brand phones. Counterpoint stated that all three iPhone 17 models achieved double-digit mid-to-high-end sales growth, with the base model showing the most significant increase.

This marks the first time Apple has achieved such a high market share in China since 2022. Prior to 2022, Apple had consistently led other smartphone brands due to relatively weak competition in the high-end smartphone market.

Counterpoint senior analyst Ivan Lam told the media that the new iPhone accounts for more than 80% of Apple's total sales. With the increase in average selling price, Apple's revenue is expected to grow further.

(Article source: Hafu Securities )