In the current artificial intelligence Amid the AI craze, one trend is becoming increasingly conspicuous: led by large tech companies, many corporate borrowers are flocking to the bond market seeking funding to realize their AI ambitions. This trend has caught the attention of Wall Street observers.

While commentators have been closely watching the massive capital expenditures on artificial intelligence throughout the year, the question isn't just how much companies have spent, but also how much they've borrowed. Some strategists have recently stated that the mountain of debt financing held by large tech companies is increasingly causing concern among investors.

He borrowed heavily for AI.

This year, with global interest rates falling and the economic cycle remaining favorable for businesses, the lending environment has improved, and this wave of bond market financing has coincided with the AI boom. According to data compiled by the media, global bond issuance this year has reached approximately $6 trillion, a record high, exceeding the total issuance for the entire year of 2024 (which also set an annual record). Moreover, most of these bond issuances are concentrated in a few companies.

Bank of America A recent analysis report shows that Google's parent company Alphabet and Amazon... Meta, Microsoft and oracle bone script So far this year, these companies have issued approximately $100 billion in bonds, more than double the amount they raised in the bond market last year.

Moreover, this trend shows no signs of stopping in the short term, especially as hyperscale enterprises invest increasingly more in artificial intelligence . Here are some of the latest moves by tech giants in the bond market:

Amazon is reportedly preparing to raise $15 billion through an oversubscribed bond offering. The company originally planned to raise $12 billion, but increased the offering size after receiving $80 billion in orders from investors. The proceeds will be used for various purposes, ranging from capital expenditures to stock buybacks.

Reports in October indicated that Oracle planned to issue $38 billion in bonds to fund the construction of its artificial intelligence infrastructure.

Meta also issued $30 billion in bonds at the end of October, the largest corporate bond issuance this year.

Wall Street is increasingly worried

In a recent report, strategists at HSBC Global Research wrote that Wall Street is not averse to the idea of free cash flow driving AI spending, but debt-driven capital expenditures are increasingly worrying.

The bank linked its concerns about the lending boom to signs of a credit crisis, such as subprime auto lender Tricolour and auto parts... The bankruptcy of supplier First Brands, and the regional bank last month The report shows significant losses from non-performing loans.

"Following concerns about Tricolor, First Brands, Zions Bancorp, and commercial development companies, bond issuances by technology companies (especially Oracle ) have now become the new 'canary in the coal mine'," said an HSBC strategist.

Neil Shearing, chief economist at Capital Economics, said that the amount of debt raised by large technology companies could pose a risk to the overall economy if the stock market corrects.

In his latest report, he wrote: "If most of the funding comes from free cash flow, then the impact of any adjustments will be mitigated. However, the increasing reliance on debt and special purpose vehicles to support AI projects is a risk worth noting."

“Excessive leverage often turns industry bubbles into systemic problems and has spillover effects on the real economy,” he added. “However, borrowing in the sector remains low, and the risks appear to be manageable at present.”

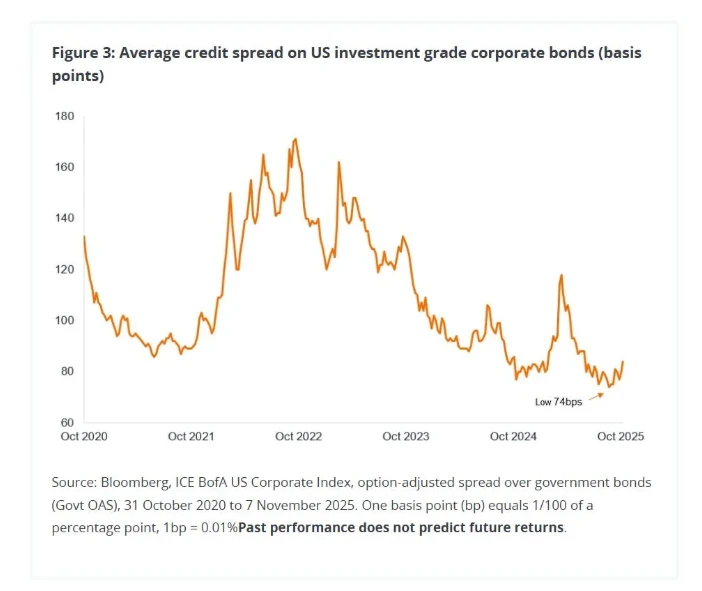

On the other hand, Janus Henderson researchers wrote in a recent report that the average credit spread of U.S. investment-grade corporate bonds has begun to widen.

Credit spreads widen when investors begin demanding a premium slightly above the risk-free rate for holding corporate bonds. The company added that in this scenario, it could be driven by the increasing supply of bonds issued by large technology companies.

"The recent surge in supply—especially from tech companies—may have changed the game." "Rules. Credit investors may also demand additional compensation until the 'winner' of this supercycle is clearly identified," the company added.

(Article source: CLS)