Holdings worth hundreds of billions exposed!

Recently, H&H International Investment, managed by Duan Yongping, filed a 13F document (a document required by the U.S. Securities and Exchange Commission to institutional investors to periodically disclose their holdings). As of the end of the third quarter of 2025, the portfolio's total holdings were valued at approximately $14.7 billion (approximately RMB 104.4 billion), an increase of nearly 28% from $11.5 billion at the end of June.

In the third quarter, Duan Yongping increased his holdings in Berkshire Hathaway and ASML , a newly emerging lithography machine giant. Reduce holdings of Apple Alibaba Google, etc.

Duan Yongping's holdings revealed

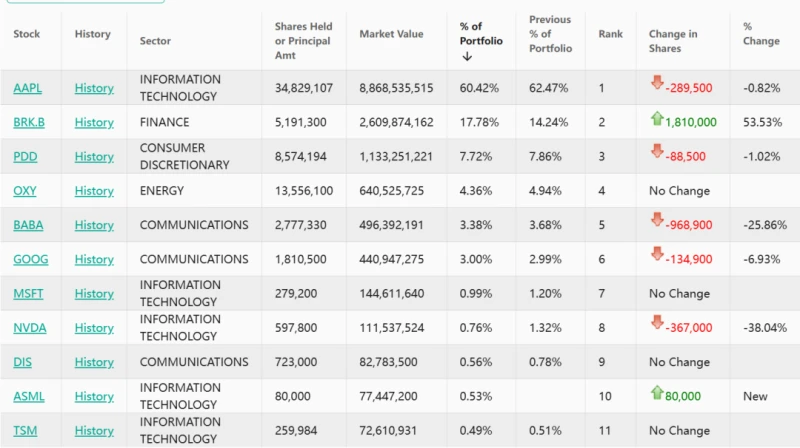

According to its 13F filings, H&H International Investment holds shares in 11 companies, including Apple , Berkshire Hathaway, and Pinduoduo . Western oil , Microsoft Disney TSMC Nvidia wait.

Image source: Whalewisdom, H&H International Investment 13F filing

Looking at the top holdings, as of the end of the third quarter of this year, Apple remained the largest holding, accounting for 60.42% with a market value of $8.869 billion; Berkshire Hathaway's holdings accounted for 17.78%, with a market value of $2.61 billion.

In terms of increased holdings, Duan Yongping significantly increased his stake in Berkshire Hathaway in the third quarter, by over 53%. On August 5th, Duan posted, "I sold a lot of Berkshire Hathaway put options today. The price seems reasonable; I hope to buy more and hold them. It should be more profitable than the S&P 500 index." At that time, Berkshire Hathaway's stock price had fallen to around $464 per share after three months of decline. However, it subsequently rose steadily, reaching approximately $502 per share by the end of September.

Judging from the reduction in holdings, Duan Yongping significantly reduced his positions in Alibaba and Nvidia , with reductions exceeding 25%. In addition, he also slightly reduced his holdings in Apple, Pinduoduo , and Google. In the third quarter, Duan Yongping bought shares in lithography machine giant ASML .

Duan Yongping: AI still doesn't quite understand.

It wouldn't be appropriate to miss out completely.

Regarding the AI sector, which is currently attracting considerable market attention, Duan Yongping recently stated in an interview, "I still don't fully understand AI. But I've watched many of Huang Renxun's videos and admire him greatly. What he said more than ten years ago is the same as what he's saying today. He saw it long ago and has been working in that direction ever since. So you have to think that what he's saying now is still his belief in the future, so I think it's worth investing a little and seeing. I think it's best to at least get involved in AI and not miss out. It seems a bit inappropriate to completely miss out."

Regarding Apple's investment value, Duan Yongping stated, "If you put money in a bank... " Earning just over one percent interest is really less worthwhile than buying an Apple product. However, if you can earn over ten percent a year, then there might not be any need to buy an Apple product. I don't know if Apple will ultimately succeed. It's possible for Apple's value to double, triple, or even triple in the future, but I don't know. It's not that it's doomed, but it's not cheap.

Regarding Buffett, Duan Yongping once publicly stated: "Buying stocks is buying companies. You can read Buffett's letters to shareholders; there are many examples of how he views companies. I haven't read any books on investing."

Public records show that Duan Yongping was born in Taihe County, Jiangxi Province in 1961. His parents were teachers at Jiangxi Water Resources and Hydropower College. Duan Yongping is a well-known figure in the investment world, often referred to as "China's Buffett" by netizens. He previously made his fortune through investments in NetEase. He rose to fame with his first investment, subsequently investing heavily in Apple, Moutai, and Tencent. In 2006, he became the first Chinese person to win a lunch with Warren Buffett, paying $620,000. Furthermore, Duan Yongping is a well-known entrepreneur, having founded "Subor" and " BBK Electronics. " "Two well-known brands, and later served as chairman of BBK Group."

(Source: China Fund News)