After being "48 days late," the U.S. Bureau of Labor Statistics will finally release the September non-farm payroll data on Thursday, marking the partial filling of the gap in official employment data caused by the U.S. government shutdown. However, it is clear that this report can only provide a rather outdated "rearview mirror view."

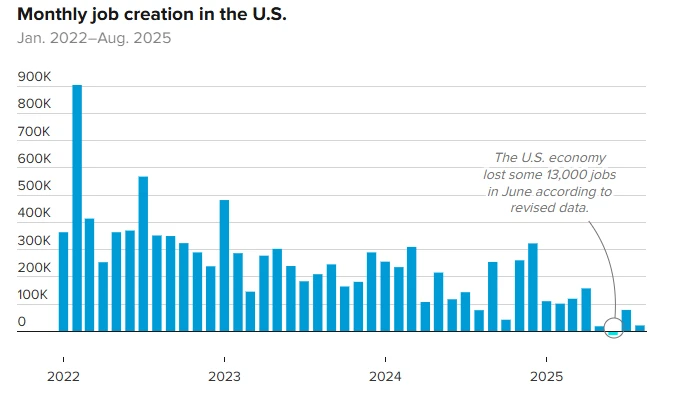

According to the schedule, the September non-farm payroll report, which was originally supposed to be released on October 3, is now scheduled to be released at 9:30 PM Beijing time tonight. Industry experts generally expect September's non-farm payrolls to increase by 54,000, higher than the previous figure of 22,000 —but this figure will still indicate that the US labor market is weak.

While the report is lagging, it at least provides investors, economists, and Federal Reserve officials with some information—during the record-breaking government shutdown in Washington, people have had to rely on a wealth of private alternative data to understand the direction of the U.S. economy. This is also the first monthly employment report released by the Bureau of Labor Statistics since the August non-farm payroll data was released on September 5.

RSM Chief Economist Joseph Brusuelas said: "My feeling is that the September report, as well as the revised data for July and August, will show a slightly better outlook than generally expected, but there's nothing to brag about."

Regarding specific sub-indicators, current media surveys indicate that the data, released a week after the government deadlock ended, is expected to show that the unemployment rate remained at 4.3% in September, with average hourly wages increasing by 0.3% month-on-month and 3.7% year-on-year, all three figures remaining unchanged from August.

“I don’t expect the (September nonfarm payroll) report to be much different from previous reports,” said Allison Shrivastava, an economist at Indeed Recruiting Lab. “I really expect this weak labor market to continue.”

Based on currently disclosed information, Goldman Sachs September's non-farm payrolls are expected to increase by 80,000 , higher than the current mainstream market forecast, but October's non-farm payrolls are expected to decrease by 50,000, mainly due to the expiration of the federal government's delayed departure program in response to layoffs at the Department of Government Efficiency.

In addition to the September data, tonight's non-farm payroll report will also include revised figures for July and August. Both Brusuelas and Goldman Sachs economists expect the revised figures to be higher than the previous estimates.

It may be difficult to reverse the expectation that the December decision will keep rates unchanged.

Industry insiders generally believe that because the data reflects the situation in September, this report will offer limited help to policymakers trying to cope with the current complex situation, and the market may not take it seriously—especially given the rapid changes in the U.S. economy and the increasing difficulty many Americans and businesses are facing in making a living.

At the press conference following last month's interest rate decision, Federal Reserve Chairman Jerome Powell likened the current situation to "driving in thick fog" and warned investors not to assume further rate cuts are inevitable when seeking policy direction.

Meanwhile, the U.S. Bureau of Labor Statistics updated the release dates for several data points for October and November on Wednesday.

The U.S. Bureau of Labor Statistics announced that it will not release its October monthly employment report (commonly known as the non-farm payrolls report) due to insufficient data collection during the government shutdown. The current census is unable to collect household survey data for the October 2025 reference period. The Bureau also announced that the November employment report, originally scheduled for release on December 5th, will be postponed to December 16th, at which time it will include business survey data collected by the agency for October. This means that the U.S. October unemployment rate data will be permanently blank for the first time ever…

After the Federal Reserve announced it would not release the October non-farm payrolls report and rescheduled the November report for release after December 16 (later than the Fed’s December decision), traders in the interest rate market almost completely abandoned their bets on a December rate cut on Wednesday.

Data shows that the swap market, which is linked to the Federal Reserve's policy rate, currently only prices in a 6-basis-point easing expectation for the December policy meeting—equivalent to a probability of about 24% for a 25-basis-point rate cut. The cumulative easing expectation by January is only 19 basis points. Prior to Wednesday, the swap market had priced in an 11-basis-point easing expectation for December, meaning the probability of a Fed rate cut three weeks later was roughly 50/50.

Brusuelas stated, "The economy is currently navigating a period of widespread uncertainty. Given the length of the government shutdown, I don't think we'll have a clear reading on the state of the U.S. labor market until early February next year."

In a report, Goldman Sachs economists Ronnie Walker and Jessica Rindels noted, "While the Bureau of Labor Statistics is not expected to release October unemployment data, we speculate that the figure may rise, reflecting upward pressure from mandatory furloughs caused by the government shutdown and rising indicators of broader labor market slack."

From a market news perspective, given Nvidia's performance after the US stock market closed on Wednesday... The latest earnings report was quite "explosive," triggering a surge in the after-hours share price of AI leader Nvidia . The market's performance after the US stock market opens tonight is more likely to follow the movements of tech stocks rather than this somewhat outdated employment data, unless the data deviates significantly from market expectations.

However, Dan Carter, portfolio manager at Fort Washington Investment Advisors, predicts that " if the non-farm payroll data is weak, the market reaction could be larger than if the data meets or slightly exceeds expectations , because market expectations for a pause in rate cuts at the December meeting are already high. The Fed doesn't have many major economic data releases ahead of the meeting."

(Article source: CLS)