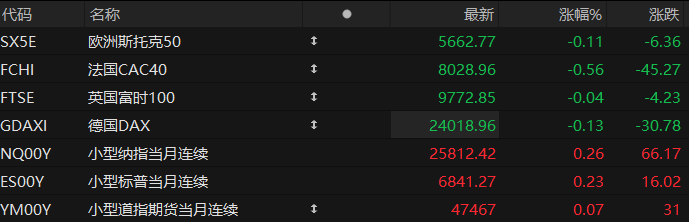

U.S. stock index futures rose across the board in pre-market trading on Friday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 0.33%, S&P 500 futures rose 0.19%, and Dow Jones futures rose 0.09%.

In terms of individual stocks, prominent tech stocks showed mixed performance in pre-market trading, with Netflix... Oracle fell more than 3%. Broadcom Google and Amazon rose more than 1%; Meta rose about 0.5%, while Google and Amazon also rose. Nvidia Tesla rose 0.4%. Slightly higher in pre-market trading.

Popular Chinese concept stocks generally rose in pre-market trading, with NIO among them. XPeng Motors rose more than 3%. Weibo rose more than 2%. Alibaba Baidu rose more than 1%; Kunlun Core shares surged about 5% pre-market after reports surfaced that it plans a Hong Kong IPO with a valuation of nearly $3 billion.

Tonight at 11 PM, the September PCE (Personal Consumption Expenditures Price Index) will be released, seen by the market as a "belated but crucial verdict." Analysts believe that if the PCE meets expectations, expectations for interest rate cuts will strengthen, and the year-end Christmas rally may continue.

Wall Street expects the Federal Reserve's preferred core personal consumption expenditures (PCE) price index to rise 2.8% year-on-year in September, up from 2.7% in August, which would be the highest level since April 2024. If the data meets expectations, core PCE inflation will have been above the Fed's 2% target for 55 consecutive months.

In addition, the PCE price index is expected to rise 0.3% month-on-month in September, with the core index rising 0.2%. In terms of annualized data, the overall PCE increase is expected to remain unchanged at 2.9%.

Hot News

Deutsche Bank: S&P 500 to reach 8000 points next year, valuations could rise further.

After several weeks of volatility, US stocks have gradually begun to stabilize. (Deutsche Bank) Bankim Chadha, chief U.S. equity strategist, recently stated that the ongoing upward trend in U.S. stocks is likely entering its fourth year, with an even stronger rally expected in 2026.

Chadha is optimistic that the S&P 500 will continue its upward trend in 2026, driven by further strong corporate earnings growth.

Despite the persistent concerns of market participants regarding artificial intelligence There are concerns about a potential bursting of the bubble, but Chadha predicts that the S&P 500 will rise to 8,000 points by the end of 2026, which means there is still 18% upside potential from current levels.

Chadha has long held a bullish view on the stock market and the U.S. economy, even during periods of short-term market corrections or increased recession fears. He recently stated that investors should expect a surge in profits next year, with growth spreading from the fastest-growing tech stocks to the rest of the market.

He pointed out, "The key logic is that market breadth will continue to expand starting from the third quarter. For the stock market to achieve a soft landing, it needs broad market support."

Where exactly is the AI bubble? Goldman Sachs Chief Strategist: The issue isn't with US stocks like Nvidia , but with…

Goldman Sachs ' chief U.S. equity strategist, David Kostin, said that while he agrees there is a bubble in the artificial intelligence industry, it is not in the leading tech giants like Nvidia . Instead, it exists in the frenzy of the private equity market, which is far removed from Wall Street.

Kostin cites the theory of legendary investor and "Bond King" George Soros, which states that rising prices tend to attract more capital, a situation that is now happening in the private equity market: private equity valuations of artificial intelligence are often based on growth expectations rather than fundamentals.

"As these companies raise funds, their growth rates also increase. As growth rates increase, valuations also rise."

Kostin also pointed out another risk from “revolving financing” or “supplier financing”, in which the growth of the invested company often depends on external financing, which may not be sustainable.

Masayoshi Son consults with the White House on a major plan: to use funds pledged under the US-Japan agreement to build a high-tech park in the US.

It is reported that SoftBank Group founder and billionaire investor Masayoshi Son is working closely with the Trump administration. After months of discussions with White House and Commerce Department officials, SoftBank is finalizing a plan called "Trump Industrial Parks," which aims to build Trump-branded industrial parks across the United States.

According to sources familiar with the discussions, these parks will be primarily built on U.S. federal land and will mainly produce components for artificial intelligence infrastructure.

The project is funded by funds pledged by the Japanese government during the US-Japan trade negotiations, with disbursements expected to begin as early as the beginning of 2026. Once completed, the facilities will belong to the US federal government.

According to the trade agreement reached between the US and Japan in July this year, the US agreed to reduce tariffs on Japanese automobiles from 25% to 15%. In exchange, Japan pledged to invest $550 billion in US strategic industries (energy, semiconductors, and shipbuilding).

The U.S. government has the right to decide where this huge investment goes, and the U.S. retains 90% of the profits after the Japanese side recovers its costs.

US Stocks Focus

Baidu's Kunlun Chip is reportedly planning a Hong Kong IPO with a valuation of nearly $3 billion.

Accelerating the global computing power race, semiconductors Amidst escalating competition within the industry chain, Baidu 's AI chip subsidiary, Kunlun Chip, is accelerating its path to the capital market.

On Friday, media outlets, citing multiple sources familiar with the matter, reported that Kunlun Chip has begun preparations for a Hong Kong listing and plans to submit its listing application to the Hong Kong Stock Exchange as early as the first quarter of 2026, aiming to complete the IPO in early 2027. The company's latest round of financing valued it at approximately 21 billion yuan (approximately US$2.97 billion). Following the news, Baidu's US-listed shares rose more than 5% in pre-market trading.

JPMorgan Chase JPMorgan believes that Baidu's investment narrative is undergoing a fundamental shift: the company is transforming from a traditional search advertising company into an AI infrastructure provider, and revenue growth is expected to be significantly driven by Kunlun chip sales and GPU computing demand. JPMorgan predicts that Baidu's Kunlun chip revenue will surge from approximately RMB 1.3 billion in 2025 to RMB 8.3 billion in 2026, a six-fold increase.

Interview with Jensen Huang: There is no "finish line" in the AI race; technological iteration is the key.

Nvidia founder and CEO Jensen Huang recently gave a two-hour in-depth interview on a podcast, elaborating on his views on the AI race, company management, and personal growth. The head of one of the world's most valuable technology companies revealed a surprising fact with rare candor: despite Nvidia becoming a core enterprise in the AI era, he still wakes up every day feeling that the company is "30 days away from bankruptcy."

When discussing the current global AI race, Jensen Huang offered a perspective quite different from the mainstream view. He believes that this race does not have a clear "finish line" as many imagine, nor will it see any one side suddenly gain an overwhelming advantage. Instead, technological progress will be gradual, with all participants evolving together on the shoulders of AI. He argues that true competitiveness lies in the ability to continuously iterate, rather than in achieving a one-time breakthrough.

Is a Hollywood "nuclear bombshell" merger imminent? Warner Bros. reportedly exploring... Entering exclusive negotiations with Netflix

According to sources familiar with the matter, Warner Bros. Exploration has entered into exclusive talks to sell its film and television studios and HBO Max streaming service to Netflix . The sources added that Netflix would have to pay a $5 billion termination fee if regulators do not approve the deal.

If negotiations do not break down, the two companies could announce a deal as early as the next few days. This news indicates that Netflix is ahead of other bidders seeking to acquire all or part of Warner Bros. Explore's assets, such as Paramount Skydance (PSKY.US) and Comcast. (CMCSA.US).

Server delivery delays amid AI boom, Hewlett Packard Despite lackluster tech performance, the narrative surrounding AI computing power remains hot.

Data shows that Hewlett Packard Enterprise's total revenue in the fourth fiscal quarter increased by 14% year-on-year to $9.7 billion, falling short of market expectations of approximately $9.9 billion; adjusted earnings per share were $0.62, exceeding the average analyst expectation and significantly higher than $0.04 in the same period last year.

GAAP gross margin was 33.5%, up 270 basis points year-over-year; non-GAAP gross margin was 36.4%, up 550 basis points year-over-year. The company expects revenue of $9 billion to $9.4 billion for the first fiscal quarter ending in January, below market expectations of $9.88 billion; adjusted earnings per share are expected to be $0.57 to $0.61, better than market expectations of $0.53.

The company's first-quarter revenue guidance fell short of expectations, largely indicating that it failed to meet high expectations for AI server sales, primarily due to the postponement of some large AI server deals to calendar year 2026. However, overall AI computing infrastructure orders remain full, and future collaborations with AMD and Broadcom are expected to bring strong incremental growth. As of press time, Hewlett- Packard's shares were down more than 9% in pre-market trading on Friday.

(Article source: Hafu Securities) )