On November 19th, US local time, tech giant Nvidia... Nvidia released its earnings report. Third-quarter revenue reached $57 billion, a 62% year-over-year increase; net profit reached $31.9 billion, a 65% year-over-year increase, again exceeding Wall Street's already high expectations. Nvidia also provided revenue guidance of $65 billion for the next fiscal quarter, suggesting that AI demand has not yet peaked.

Since November, the technology sector has been leading the decline in US stocks. Previously released Q3 holdings reports showed that several well-known institutions began significantly reducing their holdings in Nvidia . Market concerns about a technology valuation bubble fueled by AI are intensifying. After the earnings report was released, Nvidia's stock price surged more than 5% in after-hours trading, seemingly alleviating market anxieties about an "AI bubble" to some extent.

From an industry fundamentals perspective, JPMorgan Chase Goldman Sachs Some institutions believe that AI demand is still growing exponentially, and the bottleneck in the supply of key hardware is unlikely to be alleviated in the short term, indicating that the industry's boom cycle has not yet reached a point of reversal. The "AI bubble theory" may remain to be seen, but Wall Street's shift from concentrated betting to rebalancing shows that the logic of AI investment is entering a new phase of differentiation.

The AI boom cycle has not reversed.

In May 2023, Nvidia's better-than-expected earnings report ignited the current wave of AI technology stocks. After nearly three years of gains, market skepticism regarding AI deals reached its highest point since the release of this key earnings report in 2023.

“There are concerns about a bubble in the AI sector, and these concerns may persist, given that the AI rally has lasted for nearly three years. However, the key issue is the continued sluggish response from the supply side,” Gokul Hariharan, co-head of Asia TMT research at JPMorgan Chase, told Shanghai Securities News . The reporter explained that the typical pattern of a reversal in the technology industry cycle is as follows: new demand triggers a large-scale response on the supply side, but because hardware capacity construction takes time, demand often changes by the time supply arrives, leading to a supply-demand mismatch and triggering a downward cycle. However, the market has not observed this phenomenon at present.

Gokul Hariharan believes that artificial intelligence Applications continue to expand rapidly, with major applications seeing a 5-10 fold increase in token processing volume compared to last year. This trend is evident in tech giants like Google and Meta, as well as emerging companies and AI labs.

Demand growth remains stable, while supply-side response has lagged. In the hardware sector, key resources such as chips and electricity continue to face supply bottlenecks. "This main characteristic that has characterized the investment cycle over the past two years will not fundamentally change next year," said Gokul Hariharan, referring to semiconductors . Whether it's memory chips or power infrastructure, the capital expenditures of core companies in their supply chains have not increased significantly, with capacity expansion generally remaining at 50% to 60%. This prudent expansion strategy will prolong the current industry cycle, and it is expected that most key components will remain in a tight supply situation until 2026 or even early 2027.

In a report, Sunil Tirumalai, Chief Global Emerging Markets Equity Strategist at UBS, analyzed that the current market is still in the early stages of the technology and AI cycle, with the overall environment approaching the 1.5 to 2 years before the AI cycle peaks. "In fact, the market micro-situation is healthy, AI investment funds come from cash flow, and companies making huge investments have low leverage ratios."

Goldman Sachs also believes that valuations in the US technology sector are rising, but have not yet reached levels seen during historical bubble periods. The firm wrote in its research report that, so far, the technology sector's rise has been driven by fundamental growth rather than irrational speculation about future growth, and the top-performing leading companies have robust balance sheets.

Several institutions reduced their holdings in Nvidia in the third quarter.

In mid-November, US institutional investors began releasing their third-quarter holdings reports (13F filings), further highlighting investors' concerns about an AI bubble.

For example, Peter Thiel's fund sold off all of its Nvidia shares in the third quarter, totaling approximately 537,700 shares, representing nearly 40% of its portfolio.

Peter Thiel, co-founder of payment giant PayPal and AI data analytics company Palantir, is also highly influential in the investment world. He was Facebook's (Meta) first outside investor and is known as the "godfather of Silicon Valley venture capital." Thiel's recent portfolio adjustment was not entirely unexpected. He had previously stated publicly that the hype cycle in the AI field has far outpaced its actual economic benefits, comparing the current market frenzy to the dot-com bubble of 1999.

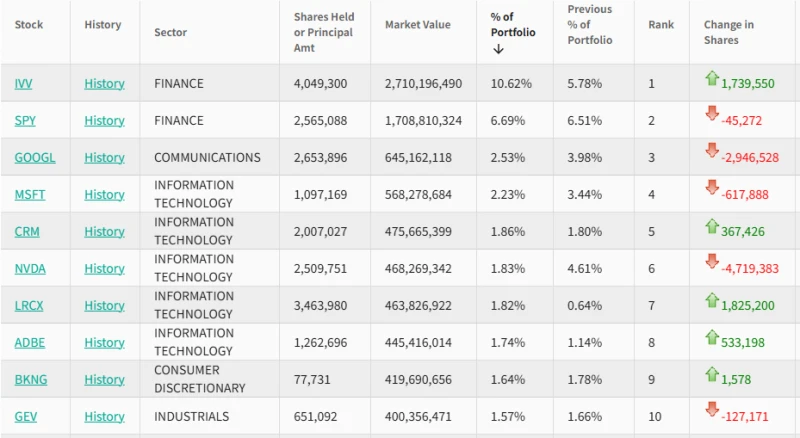

SoftBank Group, a well-known Japanese technology investment firm, also sold off its entire stake in Nvidia, cashing out approximately $5.8 billion. Bridgewater Associates, a prominent Wall Street hedge fund, reduced its Nvidia holdings from 7.23 million shares to 2.51 million shares, a 65.28% decrease compared to the end of the second quarter.

Even more aggressive is Michael Burry, the investor known for predicting the 2008 subprime mortgage crisis, who disclosed earlier this month a large short position in Nvidia. According to his 13F filing, he bought 1 million shares (notional value of approximately $186 million) of Nvidia put options and 5 million shares (notional value of approximately $912 million) of Palantir put options in the third quarter, accounting for nearly 80% of his fund's holdings.

Cautious sentiment towards AI investment has also spread to other major US tech stocks. The Gates Foundation sold 17 million shares of Microsoft in the third quarter of 2025. The number of shares held decreased by nearly 65% compared to the second quarter. Based on Microsoft's average share price in the third quarter, this reduction netted approximately $8.7 billion. This is one of the largest single-quarter reductions in the firm's history. Following the transaction, Microsoft 's weighting in the firm's portfolio decreased from 27.27% to 13.01%.

Institutions are moving from consensus on AI to divergence.

On one hand, institutional investors are actively adjusting their portfolios; on the other hand, the industry's fundamentals remain in a state of rapid growth. Ultimately, the root of the disagreement lies in whether AI is too expensive. In particular, the significant differences in market expectations among different technology companies have led to a divergence in institutional assessments of AI, moving from consensus to divergence.

Matt Simpson, a senior analyst at Gain Capital, said investors are concerned that the growth potential of AI hardware is already fully reflected in stock prices, and that tech giants may pause their expansion after a period of massive capital expenditure. Microsoft and Nvidia have invested heavily in AI infrastructure, but the rapid emergence of cheaper, open-source AI alternatives has raised concerns about the high valuations of tech stocks.

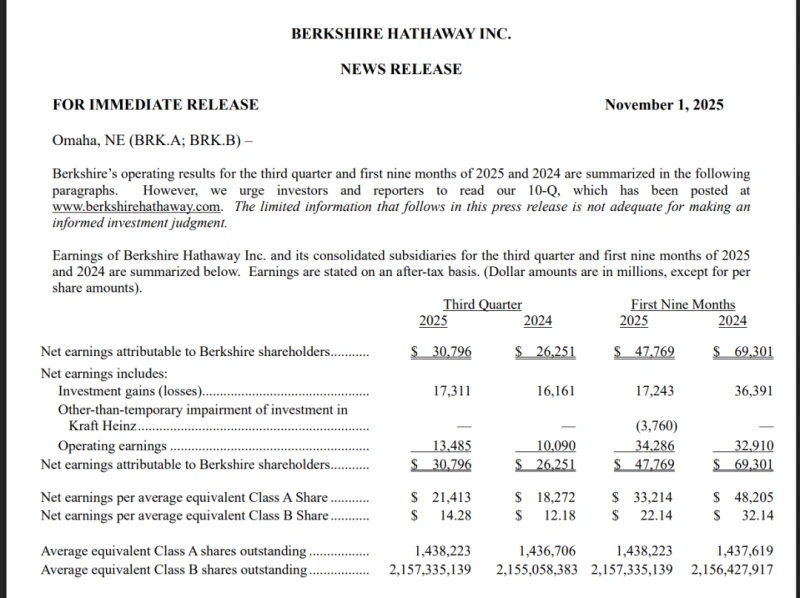

However, the third-quarter 13F filing revealed that Warren Buffett's Berkshire Hathaway established its first position in Alphabet, Google's parent company, with a holding of $4.3 billion, making it Berkshire's tenth largest holding. Given Buffett's traditional value investing philosophy and his long-standing cautious stance on high-growth technology stocks, Berkshire's move to establish a position in Alphabet surprised the market.

"The current AI market is hardly a bubble, but the highly concentrated market and increasingly fierce competition in the AI field mean that investors should continue to focus on diversified investments," wrote Peter Opinheimer, Goldman Sachs' global chief strategist, in a report. This likely represents the view of a considerable number of institutions: maintain a balanced portfolio and avoid betting on a single trend.

The trends revealed in 13F filings indicate that some institutions believe the AI revolution will be a "slow burner." Compared to hardware companies with high valuations, application-side companies may be more likely to provide sustained growth value in the future. For example, while liquidating his Nvidia holdings, Peter Thiel also rebalanced his portfolio, with his firm establishing new investments in Microsoft and Apple in the third quarter. The company held positions of 49,000 shares of Microsoft and 79,200 shares of Apple stock.

(Source: Shanghai Securities News)