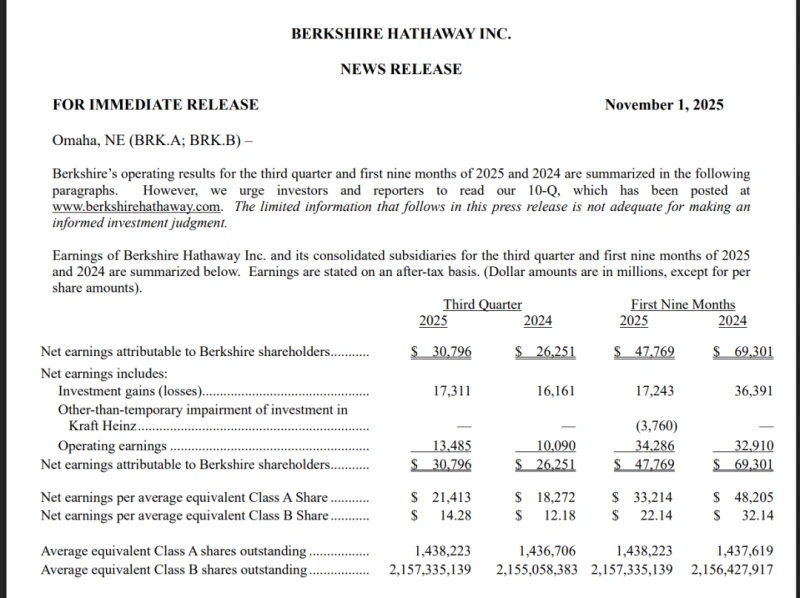

[Summary] Buffett releases the company's third-quarter financial report.

Let's take a look at the latest financial report released by Berkshire Hathaway, the company owned by Warren Buffett.

The following are the key points of the financial report.

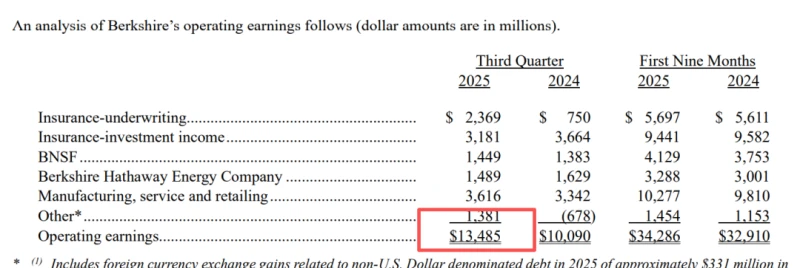

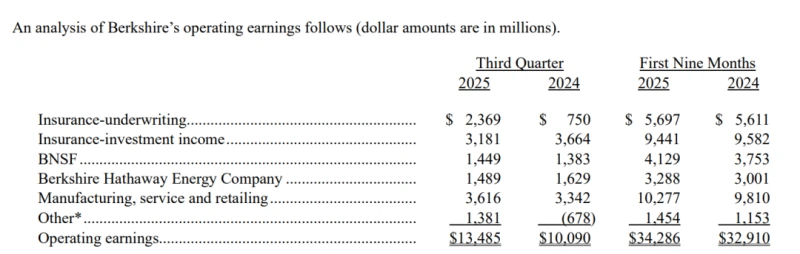

1. Operating profit rebounded strongly

Berkshire Hathaway derives from its wholly owned businesses (including insurance) Operating profit (excluding certain investment results) for companies including railways jumped 34% year-on-year to $13.485 billion in the third quarter. The growth was primarily driven by insurance underwriting revenue surging over 200% to $2.37 billion .

Buffett stated that operating profit is a better reflection of a company's performance. Accounting standards require Berkshire Hathaway to include unrealized gains and losses from its vast investment portfolio in its net income, meaning that short-term stock market fluctuations can cause significant swings in the company's quarterly net income.

2. No company stock was repurchased.

Despite a significant pullback in the stock price, Buffett again refrained from buying back company shares. The company stated that no buybacks were conducted in the first nine months of 2025. To date, Berkshire Hathaway's Class A and Class B shares have both risen 5% this year, while the S&P 500 has risen 16.3% .

3. Record cash reserves

Without any share buybacks, Berkshire Hathaway's cash reserves rose to a record $381.6 billion , surpassing the $347.7 billion high set in the first quarter of this year.

4. Net selling of stocks

Berkshire Hathaway also found no other stocks attractive and sold a net amount of stocks in the third quarter , realizing a taxable gain of $10.4 billion .

5. The Buffett premium has diminished.

Warren Buffett, 95 , announced in May that he would step down as CEO at the end of the year , ending his legendary 60-year tenure. Greg Abel, vice chairman of Berkshire Hathaway responsible for non- insurance businesses , will succeed him as CEO, while Buffett will continue as chairman of the board. Abel will also begin writing the annual shareholder letter starting in 2026 .

Following the announcement, the company's stock price fell by more than 10% from its all-time high. This decline partly reflects the fading of the so-called " Buffett premium "—the extra price investors were willing to pay for his unparalleled track record and superior capital allocation skills.

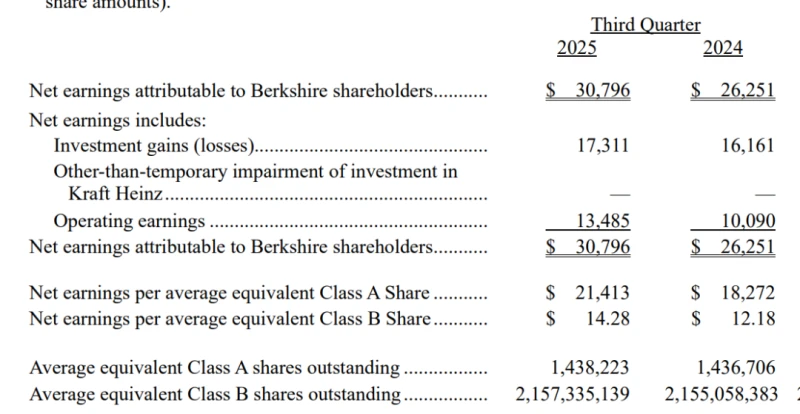

6. Net Profit

Berkshire Hathaway reported a net income of $30.796 billion in the third quarter, or $21,413 per Class A share , compared with $26.251 billion , or $18,272 per share, in the same period last year.

7. Performance of major business segments

The insurance business generated $2.369 billion in underwriting profit and $3.18 billion in insurance investment income. The manufacturing, service, and retail businesses contributed $3.616 billion in operating profit, making it the largest single business segment.

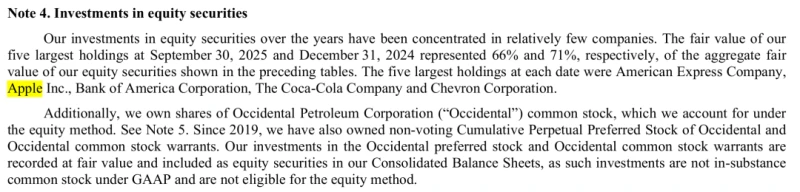

8. Investment holdings

Berkshire Hathaway stated that for many years, its equity investments have been concentrated in a few companies. As of September 30, 2025, and December 31, 2024, the fair value of its top five holdings accounted for 66% and 71% of the total fair value of its equity investments, respectively. These five holdings are: American Express... , apple Bank of America , Coca Cola And Chevron In addition, we also hold Occidental Petroleum . Common stock.

(Source: China Fund News)