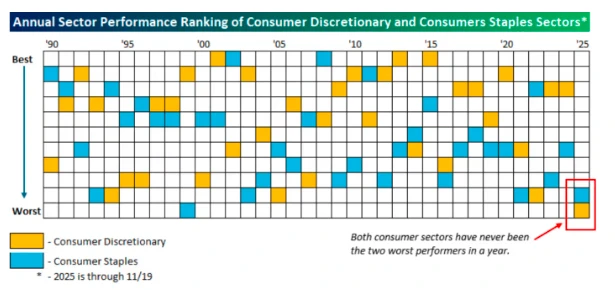

In a client report on Thursday, analysts at research firm Bespoke noted that if the US stock market closes for the year on Thursday, it would be the first time since 1990 that the consumer discretionary sector has been the worst-performing of the 11 sectors in the S&P 500, and the only time that two major consumer-related sectors (consumer discretionary and consumer staples) have simultaneously become the two weakest performing sectors in the market…

According to Bespoke's statistics, neither of these two consumer sectors has led the market since 2025, and both have continued to decline sharply since the start of the longest government shutdown in US history in early October!

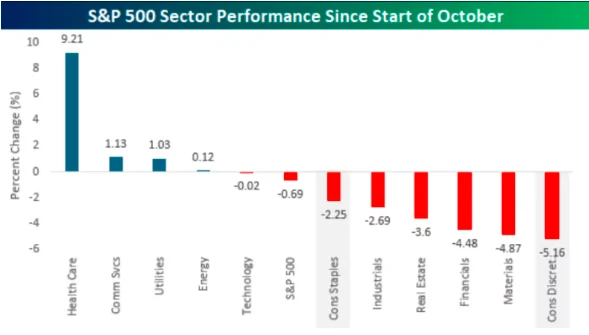

The Bespoke team points out that "since October, only four sectors in the S&P 500 have recorded positive returns. The consumer staples sector has fallen three times the size of the broader S&P 500, while the consumer discretionary sector, with a 5.2% decline, has been the worst-performing sector in the US stock market during this period." (See chart below)

"Consumer spending accounts for about 70% of the total US economy, so although the market is currently focused on Nvidia..." Artificial intelligence While business and financial performance are important, from an economic perspective, consumer activity is the more critical variable,” the Bespoke team emphasized.

Bespoke analysts acknowledge that the stock market and the economy are not necessarily perfectly synchronized, and that the weakness in the consumer sector may simply be a valuation reset. However, they also added, "Policymakers should not ignore this signal—especially when you agree with the market's forward-looking perspective."

In fact, the latest preliminary reading of the University of Michigan Consumer Sentiment Index also shows that the U.S. consumer confidence index fell to 50.3 in November from 53.6 in October, not only below expectations but also hitting a three-year low. This reflects that the U.S. economy is currently facing multiple challenges, including continuously rising prices, increased pressure on business cost transmission, and a disconnect between government policies and the public's actual experience.

This can also be seen in the financial reports of US retailers. This week, Target... Home Depot 's stock price has plummeted nearly 7% after the major retailer reported a decline in quarterly sales and lowered its full-year profit forecast on Wednesday, reflecting cautious consumer sentiment. The company's stock price also fell by more than 8% this week. The home furnishing retail giant not only missed the third-quarter earnings forecast but also gave a pessimistic performance outlook.

Of course, not all retailers are struggling. Walmart The company presented a more optimistic picture of consumer demand this week – the discount retail giant saw its stock price surge 6.5% on Thursday alone after reporting strong third-quarter results and raising its full-year forecast.

According to FactSet data, Target and Walmart both belong to the consumer staples sector of the S&P 500, while Home Depot belongs to the consumer discretionary sector.

It is worth noting that historically, the stock performance of the consumer staples sector has often contrasted with that of non-essential consumer goods and services companies. Consumer staples stocks cover necessities that consumers will buy and use regardless of economic conditions, and are therefore usually regarded as defensive stocks that help hedge portfolio risk. Non-essential consumer goods stocks, on the other hand, have cyclical characteristics because consumers tend to reduce spending during economic slowdowns or recessions.

Therefore, these two sectors rarely fluctuate in sync in the past, but this year they have unusually moved in sync...

(Article source: CLS)