Nvidia Nvidia CEO Jensen Huang has completed his stock sale plan for the year, cashing out over $1 billion since late June. Despite this, Nvidia's stock price has still risen significantly this year, surpassing a market capitalization of $5 trillion.

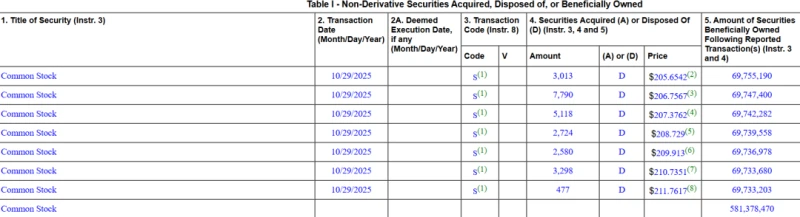

25,000 shares were sold in a single day.

According to documents filed by Nvidia with the SEC, Jensen Huang sold 25,000 shares on October 29, and still holds 69.73 million Nvidia shares after the sale.

This share reduction plan began in March of this year. At that time, Huang Renxun cited reasons such as diversifying his personal wealth, mitigating risks, or meeting tax requirements as reasons for reducing his holdings of company stock through the 10b5-1 plan. This rule allows insiders to formulate and publicly disclose a detailed stock trading plan in advance without possessing any material non-public information. Once the plan is finalized, the transaction will be automatically executed according to the preset time, price, or quantity, thereby effectively avoiding suspicion of insider trading and conveying the transparency and legality of the transaction to the market.

Jensen Huang officially began reducing his holdings in June. By the time this reduction plan was completed, a maximum of 6 million shares had been sold, totaling over $1 billion.

In addition, in 2024, Jensen Huang also reduced his holdings of Nvidia stock by approximately $700 million through the 10b5-1 plan.

The more Nvidia CEO Jensen Huang sells, the higher the stock price rises.

When a company's top executive reduces their holdings of company stock, it usually puts downward pressure on the stock price. However, Jensen Huang's continued reduction of his holdings has not prevented Nvidia's stock from repeatedly hitting new highs.

On October 29, Nvidia's market capitalization soared past the $5.05 trillion mark, jumping from $4 trillion to $5 trillion in just 113 days. Its stock price has surged 54% this year and rebounded more than 135% from its year-to-date low. Forbes' real-time billionaires list shows that Jensen Huang's personal wealth has exceeded $180 billion, ranking eighth globally.

The strong stock price is supported by Nvidia's solid fundamentals. Financial reports show that Nvidia achieved revenue of $46.743 billion in the second fiscal quarter, a year-on-year increase of 56%, slightly exceeding analysts' expectations of $46.23 billion. Among them, data center revenue in the second fiscal quarter... Revenue was $41.1 billion, slightly below analysts’ expectations of $41.29 billion.

Meanwhile, at a press conference in Washington, Jensen Huang expressed great confidence in the future performance of Nvidia's next-generation Blackwell and Rubin chips, predicting that these chips would bring the company up to $500 billion in revenue in the coming quarters, far exceeding the general expectations of Wall Street analysts.

Currently, while institutional opinions on Nvidia differ, the overall sentiment leans towards optimism, with the prevailing view being "long-term positive outlook, but short-term caution against volatility." Of the 80 analysts covering Nvidia, 73 have given it a "buy" rating, 6 hold a "hold" view, and only one has given it a "sell" rating.

The most optimistic analyst in the market is HSBC. Frank Lee recently upgraded Nvidia's rating to "buy" with a target price of $320 per share, citing that market demand for AI accelerators will surpass that of the current largest customers.

Jim Awad, senior managing director at Clearstead Advisors, stated: "AI is a multi-year generational cycle, and we're still in the early stages, not even mid-stage. Nvidia is a major player in this, driving the economy and the stock market. The firm holds Nvidia stock."

Moon Surana, portfolio manager at Harding Loevner LP, expressed a similar view, believing that we are still in the early stages of investment and there are no signs of overcapacity or idle GPUs.

The only bearish firm, Seaport Global Securities analyst Jay Goldberg, stated, "I'm skeptical of all the hype surrounding AI; this isn't the first time I've seen a bubble." He likened the current situation to the dot-com bubble of around 2000 and warned that the market landscape could quickly reverse once the massive spending supporting these high valuations slows. He set a price target of $100 per share for Nvidia.

(Source: Securities Times) (Times)