① US stocks opened higher but closed lower on Thursday, a rare occurrence, with the Nasdaq... The index fell to its lowest level since September 11, and market volatility soared; ② Yardeni research analysts believe there are five forces behind the sudden market downturn: artificial intelligence. Concerns about a bubble, the freefall of Bitcoin, worries about the Federal Reserve cutting interest rates, doubts about economic growth, and the prolonged unemployment of Americans.

On Thursday, Eastern Time, US stocks experienced a rare opening higher but closing lower – following Nvidia's performance. Driven by strong earnings reports, the S&P 500 opened nearly 2% higher, but then plunged after the release of the non-farm payrolls report, ultimately closing down 1.6%.

This reversal sent the Nasdaq down to its lowest closing level since September 11 and the S&P 500 down to its lowest level since September 10. Meanwhile, market volatility surged, with the VIX index hitting its highest closing level since the end of April.

Nvidia shares rose as much as 5% in early trading, but closed down 3.2%, a decline for US semiconductor stocks. The stock index fell 4.8%. Both the Nasdaq and Dow Jones Industrial Average fluctuated by more than 1,000 points intraday, marking one of the largest intraday swings in months.

Earlier this month, investment research firm Yardeni Research had already anticipated a correction in US stocks. Analysts at Yardeni Research released a report on Thursday stating that this correction has clearly intensified and may be entering the early stages of a broader market correction, particularly for the Nasdaq.

In the report, Yardeni Research analysts outlined five key forces behind the sudden market downturn.

I. Concerns about an artificial intelligence bubble

Concerns about an artificial intelligence bubble have gradually spread on Wall Street in recent days. Although Nvidia CEO Jensen Huang directly refuted the "AI bubble" claims during Thursday's earnings call, emphasizing the company's booming demand for its products and the fact that downstream customers have already benefited from AI, this clearly did not completely convince the market.

Analysts say that spending on AI infrastructure is impacting AI data centers. The widespread uncertainty surrounding the company's earnings has severely impacted market sentiment. Despite Nvidia's strong report and Jensen Huang's repeated optimistic pronouncements, there has been little clarification regarding market concerns about excessive spending on AI infrastructure .

Also unsettling for investors are recent reports that SoftBank and Thiel Macro, the hedge fund of "Silicon Valley venture capital godfather" Peter Thiel, have both sold all of their Nvidia shares. Meanwhile, "big short" Michael Burry continued to question the accounting audits of major artificial intelligence companies on Thursday, further fueling market anxieties.

II. Bitcoin's Free Fall

In addition to the AI bubble itself, analysts also attributed the weakness in US stocks in part to the sharp drop in Bitcoin.

Yardeni analysts highlighted the strong correlation between Bitcoin and the leveraged ETF TQQQ that tracks the Nasdaq, suggesting that the collapse of the cryptocurrency market may also have forced some investors to unwind their stock positions.

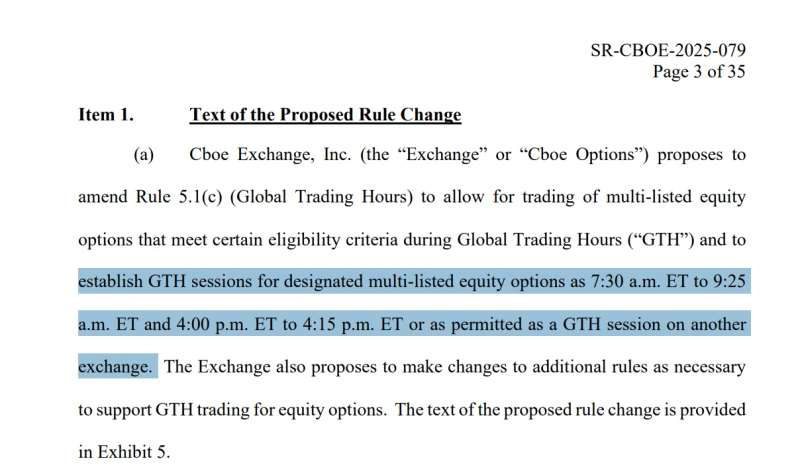

III. Concerns about the labor market and the Federal Reserve

The U.S. non-farm payrolls report released before the market opened on Thursday showed that the U.S. added 119,000 jobs in September, more than double the expected number, while the unemployment rate rose slightly to 4.4%.

Analysts say these complex signals leave investors uncertain about what action the Federal Reserve will take at its December meeting.

“Stronger-than-expected employment figures have reduced the likelihood of the Federal Reserve cutting interest rates at the December 10 FOMC meeting,” analysts wrote, though rising unemployment could increase that possibility.

"Overall, the cautious tone of the Fed officials' remarks today exacerbated the stock market's downward trend," the report added.

IV. Doubts about the US economic growth rate

Analysts point out that while the U.S. government's reported real GDP growth is close to 4%, total U.S. labor force hours have remained flat in recent months. This disconnect has unsettled some investors, even though the company believes upcoming productivity data "should boost the stock price."

V. Extended period of unemployment

While initial jobless claims remain low, continuing jobless claims have risen, meaning people are unemployed for longer periods. Analysts believe this combination is also "making investors uneasy."

In conclusion, despite the aforementioned concerns, Yardeni analysts remain confident in the resilience of the U.S. economy.

The company stated that tensions related to artificial intelligence may dampen market sentiment for some time, but could also create buying opportunities for the broader market.

Analysts also stated that if this correction truly spreads into a full-blown correction, the S&P 500 may struggle to reach its target of 7,000 points by the end of the year, and the decline could extend into early 2026. However, analysts believe that the rapid shift in market sentiment suggests that the slump in US stocks should end soon.

(Article source: CLS)