Citigroup Wealth manager Andy Sieg said he believes the U.S. stock market bull run still has "room to rise further" because Citigroup has attracted a large influx of funds from high-net-worth clients this year.

Andy Seeger has held this position since 2023, responsible for the strategy and operations of Citigroup 's global wealth management business.

"Currently, there are no signs of excessive market prosperity, nor is there the kind of frenzied investment in stocks that typically occurs at the end of a bull market," he said in an interview.

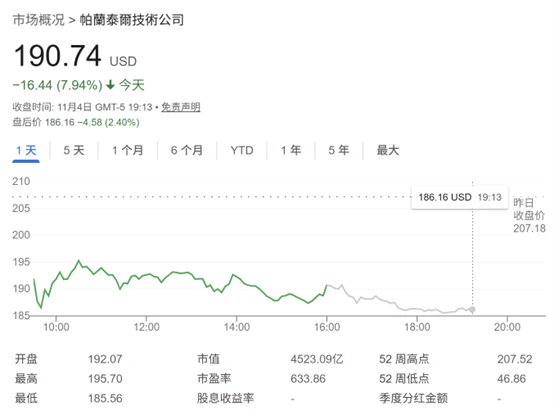

In November of this year, US stocks experienced significant volatility: the S&P 500 fell by about 2%, heading toward its worst month since March, while volatility increased sharply.

In fact, the sharp fluctuations in US stocks are not only reflected in the decline of the index, but more importantly, the US tech giants, led by the "Big Seven", have experienced a large sell-off.

With the market's focus on " artificial intelligence" Fears of a "bubble" are growing, even among AI leaders like Nvidia. The strong earnings report and optimistic forecast released after the close of trading last Wednesday in the Eastern Time region only briefly restored market optimism, and market confidence quickly cooled down again shortly after the market opened on Thursday.

Nevertheless, Siegfried stated that Citigroup still believes the market has not yet reached a "turning point" because US corporate earnings expectations remain strong. High-net-worth clients continue to hold idle funds and seek downside protection in the market through products such as structured notes.

Data released by Citigroup shows that client investment assets grew by approximately 14% year-over-year in the third quarter of this year . Meanwhile, new capital inflows reached $37.1 billion in the first nine months of the year, with the third quarter seeing a record inflow.

The Asian market performed particularly well, with record inflows in the third quarter.

“Our net customer inflow in Asia is the highest we’ve ever seen anywhere,” Sieg revealed.

Following his recent visits to Beijing and Shanghai, Siegfried noted that China has demonstrated unprecedented dynamism in its economic development. He stated that the bank... He is "very satisfied" with his business in China.

(Article source: CLS)