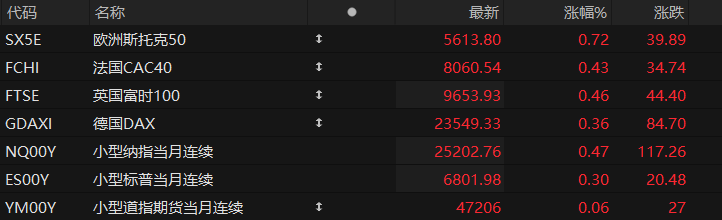

U.S. stock index futures rose across the board in pre-market trading on Wednesday, while major European indices also generally gained. As of press time, the Nasdaq... S&P 500 futures rose 0.47%, S&P 500 futures rose 0.30%, and Dow Jones futures rose 0.06%.

In terms of individual stocks, prominent tech stocks showed mixed performance in pre-market trading, with Oracle among them... Google-A shares rose more than 2%. Tesla Advanced Micro Devices (AMD) rose more than 1%, while AMD fell nearly 1%.

Popular Chinese concept stocks were mixed in pre-market trading, with Pony.ai showing mixed performance. Li Auto Pinduoduo fell by more than 2%. JD.com NIO Alibaba rose more than 1%. TSMC It rose by nearly 1%.

Weaker-than-expected US consumer data and the prospect of a dovish Federal Reserve chairman fueled market expectations of interest rate cuts, driving global stock markets higher and the dollar weaker. Meanwhile, uncertainty surrounding the Russia-Ukraine ceasefire agreement reignited safe-haven demand, supporting a rise in gold prices.

Recently, as economic data accumulated during the US government shutdown has been released one after another, coupled with a series of dovish signals from several Federal Reserve officials, market expectations for interest rate cuts have increased significantly. Traders expect the probability of the Federal Reserve cutting interest rates at its next meeting to be over 80%.

The market is closely watching the Federal Reserve Chair nomination, with White House chief economic advisor Kevin Hassett being a major contender. His previous public calls for interest rate cuts have further strengthened market expectations for easing.

Hot News

Market expectations reverse: The probability of a Fed rate cut in December surges to 80%, and bond market bulls make record bets.

Investors are betting heavily on another rate cut by Federal Reserve policymakers at their meeting next month, as market doubts about a rate cut have gradually dissipated in the previous week, laying the foundation for a rise in U.S. Treasury bonds.

Over the past three trading days, traders have seen a surge in new positions in futures contracts linked to the Federal Reserve's benchmark interest rate, with the January contract setting new daily volume records last week.

Current market pricing indicates an approximately 80% probability of a 25 basis point rate cut at the Federal Reserve's December meeting, compared to just 30% a few days ago. This shift in interest rate expectations began last week with the delayed release of the September non-farm payroll data—which presented a mixed picture. This was followed on Friday by New York Fed President John Williams... The statement indicated that, given the weak labor market, there is room for interest rate cuts "in the near term," further fueling this trend.

AI stocks still have room to rise; HSBC predicts the S&P 500 will reach 7500 points by the end of next year.

Despite for artificial intelligence Questions about the sustainability of the AI boom had previously weighed on the market, but Wall Street still expects the AI rally to continue driving market gains next year.

HSBC A new forecast predicts that the S&P 500 will reach 7,500 points by December 2026. The S&P 500 closed at 6,765.88 on Tuesday, meaning this target price implies nearly 11% upside potential and another year of double-digit gains.

"AI capital spending will continue to dominate in 2026 as the AI arms race intensifies," HSBC analysts Nicole Inui, Alastair Pinder, and Matt Borchetta wrote in a report.

This forecast no longer discusses the question of whether AI is a bubble (other analysts at the bank have previously argued that the market is not in a bubble), but instead points out that upward trends can often last for a long time.

Is an "AI bubble" exacerbating volatility in US stocks? Are Wall Street's "smart money" taking advantage of the dips?

Last week, US stocks experienced significant volatility as concerns about an "AI bubble" intensified. However, Bank of America... The latest customer traffic data shows that Wall Street hedge funds and institutional investors, known as "smart money," are taking advantage of this opportunity to buy heavily, indicating that "smart money" remains optimistic about the overall prospects of the US stock market.

However, the funds from "smart money" mainly flowed into sectors such as consumer discretionary and healthcare, while the highly valued technology sector still faces the predicament of capital outflow.

ETF activity also revealed a similar divergence—mixed and value funds attracted significant inflows, while growth ETFs experienced sell-offs. Technology ETFs saw the largest outflows across all sectors, while healthcare and financial ETFs saw the strongest inflows.

Meanwhile, corporate buybacks rose for the third consecutive week, reaching an eight-week high. However, since March of this year, the ratio of buybacks to market capitalization has been declining over the past 52 weeks, and is currently at its lowest level since early 2024.

US Stocks Focus

Regarding Tesla Robotaxi! Musk predicts: Austin fleet size will double next month.

On Tuesday local time, Tesla CEO Elon Musk said that following the launch of its Autopilot service in Austin, Texas in June, Tesla 's operations in the city will... The number of Robotaxi buses is expected to double in December .

Tesla 's self-driving taxi service currently operates in Austin and the San Francisco Bay Area, and vehicles still require a safety supervisor. The automaker also received a permit last week to operate a ride-hailing service in Arizona.

In October of this year, Musk stated during Tesla's third-quarter earnings call that he expected Tesla Robotaxis in most parts of Austin to no longer be equipped with safety drivers by the end of the year.

He also stated that if Tesla can successfully obtain regulatory approvals in various regions, it will expand its Robotaxi service to 8 to 10 metropolitan areas by the end of this year.

As Musk aggressively pushes forward with the self-driving car business, Tesla's core vehicle sales operations continue to face increasing difficulties. The automaker is experiencing sales pressure in all three of the world's largest automotive markets—Europe, China, and the United States.

Li Auto (LI.US) reported a net loss of 624.4 million yuan in the third quarter.

Li Auto released its results for the three months ended September 30, 2025. Total vehicle deliveries were 93,211 units, a decrease of 39.0% year-on-year. Vehicle sales revenue was RMB 25.9 billion, a decrease of 37.4% year-on-year and a decrease of 10.4% quarter-on-quarter.

Total revenue was RMB 27.4 billion, a decrease of 36.2% year-on-year and 9.5% quarter-on-quarter. Gross profit was RMB 4.5 billion, a decrease of 51.6% year-on-year and 26.3% quarter-on-quarter. Net loss was RMB 624.4 million, compared with net profits of RMB 2.8 billion in the third quarter of 2024 and RMB 1.1 billion in the second quarter of 2025.

As of September 30, 2025, the company had 542 retail centers in 157 cities across China, operated 546 after-sales service centers and authorized Li Auto body repair centers in 225 cities, and had put into operation 3,420 Li Auto Supercharging Stations equipped with 18,897 charging piles . .

Strong demand for AI servers drives Dell Technologies (DELL.US) Q3 revenue hits record high, raises full-year guidance.

Dell Technologies reported a record 11% year-over-year increase in revenue to $27.005 billion in the third quarter, but fell short of analysts’ consensus estimate of $27.2 billion.

Under non-GAAP accounting standards, operating profit was $2.503 billion, up 11% year-over-year; net income was $1.762 billion, up 11% year-over-year. Adjusted earnings per share were $2.59, exceeding analysts' consensus estimate of $2.48.

Dell Technologies expects full-year revenue for fiscal year 2026 to be between $111.2 billion and $112.2 billion, with the midpoint of the forecast range at $111.7 billion (representing a 17% year-over-year increase), better than the previous forecast of $107 billion; adjusted earnings per share for the full year are expected to be $9.92 (representing a 22% year-over-year increase), better than the previous forecast of $9.55.

(Article source: Hafu Securities) )