Despite for artificial intelligence Questions about the sustainability of the AI boom had previously weighed on the market, but Wall Street still expects the AI rally to continue driving market gains next year.

HSBC A new forecast predicts that the S&P 500 will reach 7,500 points by December 2026. The S&P 500 closed at 6,765.88 on Tuesday, meaning this target price implies nearly 11% upside potential and another year of double-digit gains.

"AI capital spending will continue to dominate in 2026 as the AI arms race intensifies," HSBC analysts Nicole Inui, Alastair Pinder, and Matt Borchetta wrote in a report.

This forecast no longer discusses the question of whether AI is a bubble (other analysts at the bank have previously argued that the market is not in a bubble), but instead points out that upward trends can often last for a long time.

“We believe there is still room for growth and recommend that investors broaden their AI trading portfolios,” the analyst wrote.

It's not just tech optimism that's driving the market. HSBC predicts that the US will continue to be influenced by factors such as tightening consumer spending and the need to maintain a K-shaped economic trajectory in 2026.

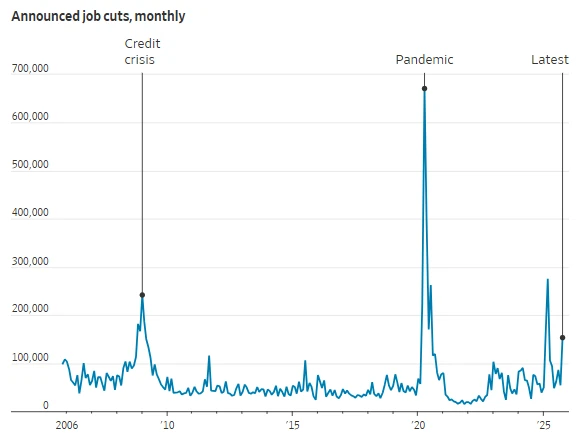

Analysts said, "While the AI investment boom will support the economy, we are seeing more volatile consumer behavior. Inflation remains stubborn, the labor market is weakening, and policy changes are more favorable to high-income spending."

HSBC predicts that the US economy will exhibit a so-called "two-speed economy" in 2026, meaning that the gap between key economic indicators will continue to widen.

High-income earners and those with higher credit scores showed strong spending and greater confidence in the economy; while low-income earners and those with lower credit scores showed weaker spending and more cautious views.

HSBC analysts wrote, "With policies favoring high-income consumers and the Federal Reserve holding rates steady, we believe this K-shaped consumption trend will expand further in 2026."

The bank's view aligns with that of other bullish institutions, which generally emphasize that the AI investment cycle still has room for growth.

Earlier this week, Deutsche Bank The forecast sets a target of 8,000 points for the S&P 500 by the end of 2026, emphasizing that the enthusiasm for AI is the main reason. This is currently the most optimistic forecast among major global institutions.

Although the AI boom is currently dominated by a few tech giants—especially large cloud service providers—HSBC analysts predict a broader diffusion effect in 2026, with downstream AI beneficiaries of these cloud giants gradually emerging.

HSBC stated, "As the AI arms race unfolds, we are optimistic that AI deals will spread from hyperscale cloud companies to AI adopters and AI promoters."

(Article source: CLS)