Over the past two years, "AI" has become the most core keyword in the global stock market. Almost all corporate executives have discussed the impact of AI on them to some extent, and investors are eager to flock to companies that are more likely to benefit from the AI boom.

However, Goldman Sachs Greg Calnon, co-head of secondary market investments at an asset management firm, said they believe that while the U.S. stock market rally will continue to expand next year, with a few sectors likely to perform well, AI trading is not among them.

Karenno said he believes the overall market outlook for risk assets looks relatively optimistic next year, given favorable factors such as the Federal Reserve continuing to cut interest rates.

However, he is more optimistic about sectors outside of AI—sectors that, while largely ignored for most of the year, now appear to be seeing their stock prices begin to rise. He specifically pointed to three areas that could present good investment opportunities: small-cap stocks, healthcare stocks, and overseas stocks.

Small-cap stocks

Karenno stated that while most of the market's attention is currently focused on mega-corporations represented by the "Big Seven," smaller companies are at the forefront of artificial intelligence. The “front line” of the trend. This is because many small businesses are able to enter “niche markets,” allowing them to avoid direct competition with the “giants” in the AI industry.

He also pointed out that the valuations of these smaller companies are quite attractive compared to large-cap stocks.

The Russell 2000 index, which represents small-cap U.S. stocks, has risen 11.3% so far this year.

"I think there are a lot of opportunities here," Carrenno said. He added that he believes small businesses are driving "a lot of innovation."

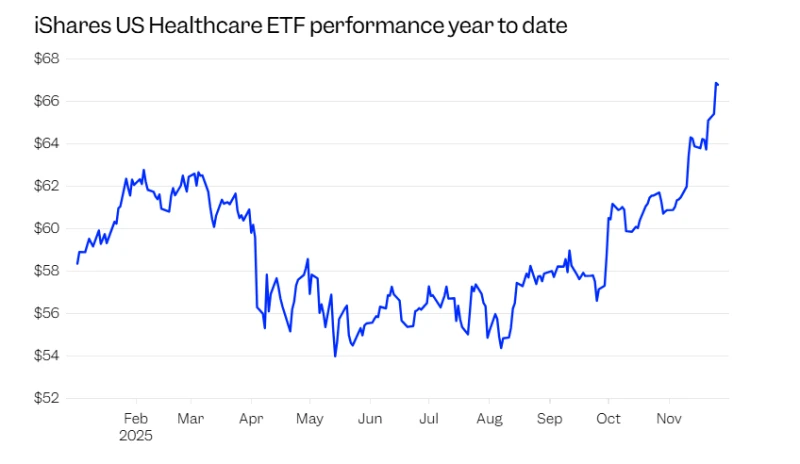

Healthcare stocks

Karenno stated that the healthcare market segment appears to have benefited to some extent from the artificial intelligence boom, and the sector's upward trend is now beginning to spread to the entire industry; for example, the iShares U.S. Healthcare ETF has risen 14.5% year-to-date.

“We can see this in the AI healthcare sector,” Carreno said, referring to investment opportunities in specific sectors of the U.S. stock market. “Healthcare is undoubtedly a leader in this field.”

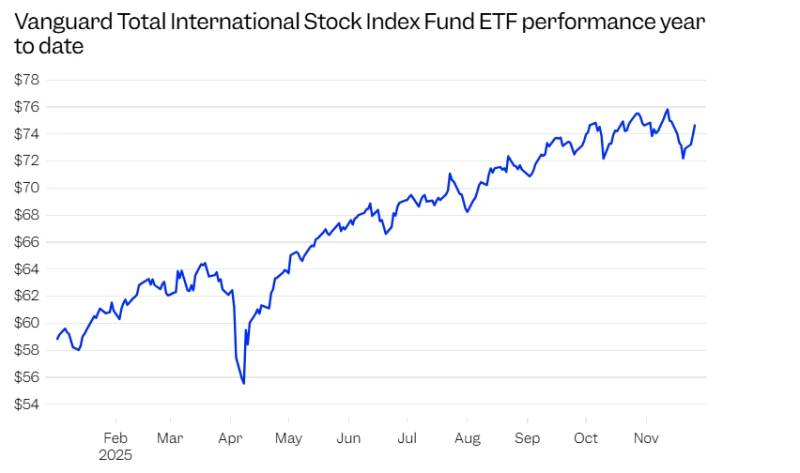

International market stocks

Karenno pointed out that this year's stock market rally has extended to international stocks outside of the US market, and these international stocks have even outperformed the US stock market.

The Vanguard International Equity Composite Index ETF has risen 26.8% year-to-date.

In a previous report to clients, Goldman Sachs stated that it believed international stocks would generally outperform US stocks over the next 10 years.

According to the bank's calculations, the S&P 500 will have an annualized return of only 6.5% over the next decade, while emerging markets and most Asian stocks will have an annualized return of 10%.

“This doesn’t necessarily have to come at the expense of the US market. But I think we’ve been overemphasizing the ‘either invest in the US or don’t invest at all’ approach, while ignoring the fact that other markets can also participate,” he said.

(Article source: CLS)