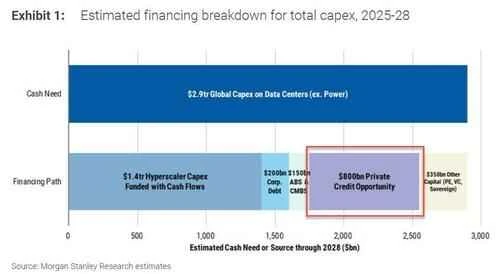

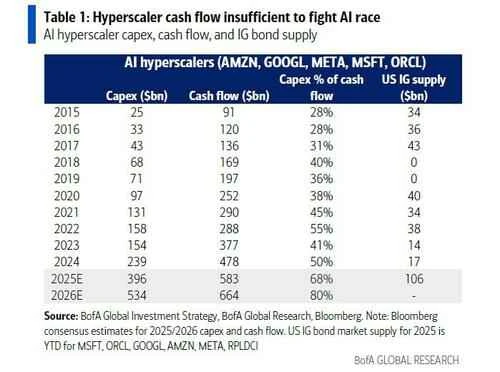

As early as the end of September, Cailian Press reported on the "debt cliff" behind the AI wave. This reflects an industry view that has existed since this summer: hyperscale cloud service providers will soon run out of free cash flow to support their massive capital expenditure expansion plans, at which point they will have to rely on more than one trillion US dollars of new debt issuance (including $800 billion in private credit).

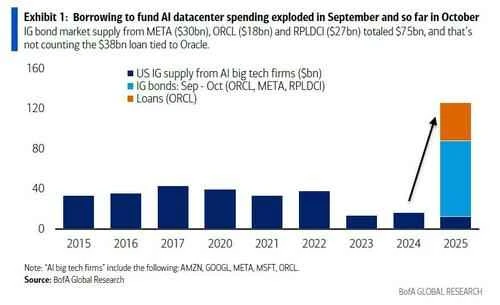

Despite the stock market's largely ignoring of the most fundamental questions in finance—the source and use of funds—this all came to an abrupt halt in the first week of November. Meta, Oracle The wave of new bond issuances by companies like [Company Name] has sparked market interest in artificial intelligence. Profound questions about the credibility of the bubble: How long can this bubble last when trillions of dollars of "revolving financing" mechanisms are about to deplete corporate cash flow?

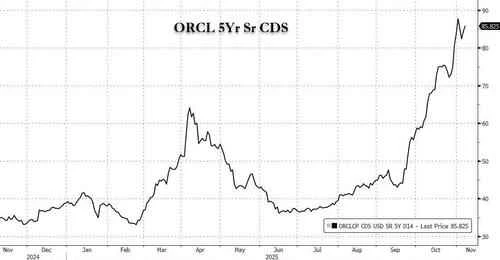

Ultimately, what may trigger market panic is not only affecting stocks, but also pointing directly to the core of the market: the default risk of bonds and seemingly "unbreakable" corporate entities —such as Oracle , whose credit default swap (CDS) contracts have recently surged.

Executives at OpenAI, the core of the US AI "chain of funding," recently discussed the possibility of the government acting as a guarantor to facilitate financing—perhaps the most sensitive statement to date. This comes despite subsequent denials from CEO Altman that the company would seek federal guarantees to mitigate the risks of massive AI infrastructure spending.

Given that even the most sluggish funds (stock market funds) finally sensed the crisis last week, one can't help but wonder what will happen next?

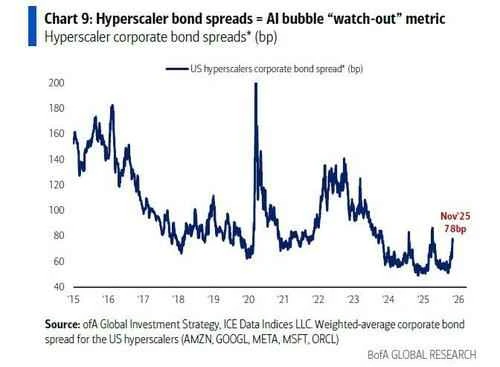

The answer may still lie with Michael Hartnett, Bank of America's chief strategist, often referred to as Wall Street's "most accurate analyst" —back in August, he accurately predicted the need to closely monitor credit spreads to determine when the AI bubble would burst. In his latest fund flow report, titled "Hypertension," released last weekend, the Bank of America chief investment strategist pointed out that three months after his warning, credit spreads on bonds issued by mega-AI companies have begun to widen, drawing attention…

In focusing on the recent increasingly volatile market conditions of tech giants, Hartnett noted that prosperity and bubbles ultimately end with signals of "warning" and "withdrawal." Indeed, there are currently several warning signs, such as:

Market capitalization concentration (the top seven AI stocks account for over 40%)

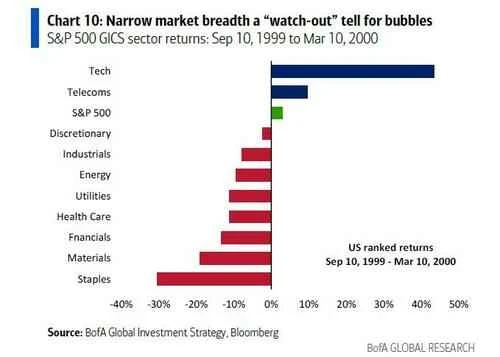

Market breadth (refer to the last 6 months of the 1999 bubble)

Valuation levels (AI giants have P/E ratios of 45x)

Global buying (Advanced Testing in Japan and SK Hynix in South Korea saw their share prices double in just eight weeks)

Retail investor buying (record-breaking inflows into tech stocks over the past two months)

However, Hartnett also points out that the market's ultimate "exit signal" is always interest rates—and currently the Fed has not raised rates, nor have yields surged. This is why the "big short" must wait for the right opportunity (maybe Michael Burry has entered the market too early again?).

While waiting for the right opportunity to short stocks, Hartnett revealed that he is shorting bonds of hyperscale cloud service providers, as their cash flow is no longer sufficient to cope with the AI capital expenditure arms race.

Over the past seven weeks, bond issuance has reached a staggering $120 billion, and even giants in the artificial intelligence sector have hinted that government intervention is needed to lower funding costs. Sure enough, credit spreads on hyperscale cloud service provider bonds have risen from 50 basis points in September to around 80 basis points…

This may mean that the low point in interest rate spreads is now a thing of the past!

Hartnett also cautioned that before the peak of the tech bubble in March 2000, the price of U.S. technology company bonds (CITE) had fallen by 8%. In other words, if history were to repeat itself, the situation would be drastically different.

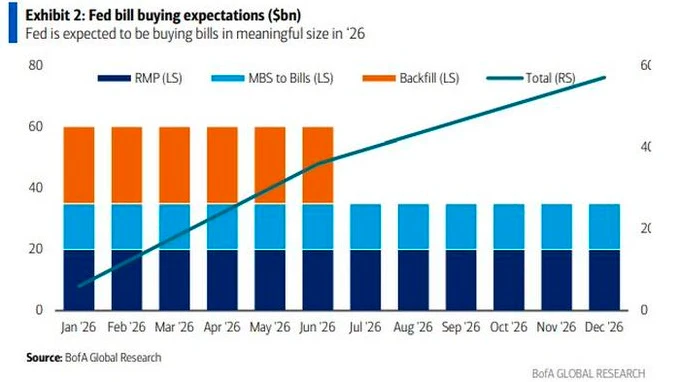

When the credit crunch spreads to AI companies, a prediction mentioned at the beginning of Hartnett's latest report may come true: "The next time the Fed implements quantitative easing (QE), you will see them buying bonds of AI mega-corporations."

(Article source: CLS)