Michael Burry, the "Big Short" investor and one of the real-life inspirations for the movie "The Big Short," recently met with Nvidia... They've hit a snag, launching one attack after another against this artificial intelligence company. (AI) giants launch a counterattack.

Burry was credited with accurately shorting mortgage-backed securities before the 2008 financial crisis. His reputation soared, with both Michael Lewis's book "The Big Short" and the Oscar-winning film of the same name documenting this trade. In late October of this year, after a two-year hiatus, he returned to the social media platform X, warning that AI stocks were in a bubble.

Burry recently announced that his hedge fund, Scion Asset Management, has deregistered with the U.S. Securities and Exchange Commission (SEC), will no longer accept external funding, and has moved to the Substack platform to launch paid newsletters, thus opening a new model for the output of personal market views.

In a post published on Substack on Tuesday, Burry further intensified his criticism of Nvidia and other AI giants, emphasizing that he is shorting Nvidia and Palantir . He stated that a recent memo from Nvidia to Wall Street analysts was "disappointing," claiming it was a response to allegations he had never made .

In the aforementioned memo, Nvidia refuted allegations of fraud, accounting scandals, and revolving financing.

Burry in an article titled " Unicorns" The article "Unicorns and Cockroaches: Blessed Fraud" states that it is hard to believe that Nvidia's response (the aforementioned memo) comes from the world's most valuable publicly traded company .

He stated that the document was riddled with "one scarecrow fallacy after another," and the entire memo "reads almost like a hoax."

The Straw Man Fallacy is a common fallacy in logical debates that involves distorting the opponent's argument before refuting it. The core of the fallacy is to replace the opponent's true argument with a more easily attacked "false version" (like putting up a fragile "scarecrow"), and then focus firepower on refuting this false argument. It may seem like you have won the debate, but in reality, you have not touched the opponent's true claim at all.

Burry stated that he never implied that Nvidia intentionally extended the depreciation period of its property, plant and equipment (PP&E) – after all, Nvidia is primarily a chip design company with minimal capital expenditures, not a manufacturing enterprise.

“Nobody cares about Nvidia’s own depreciation problem,” he wrote. “The first scarecrow has been burned.”

Burry also refuted Nvidia's claim that its older generation of chips is still in use, saying that his real concern is that the new generation of chips may face functional obsolescence (meaning that technological iterations cause older products to lose their usability) between 2026 and 2028.

“I’m looking to the future because I see what’s really important to investors right now,” he wrote. “The second scarecrow has also been burned.”

Burry added that Nvidia's response to him was "obviously hypocritical and disappointing."

In his latest article, he also emphasized that he has placed bets on shorting Nvidia and another AI darling: " I still hold put options on Palantir and Nvidia , and the details will be discussed at a later time."

Core Controversy: Depreciation Issue

One of Burry's main concerns is how AI companies handle depreciation accounting—that is, how quickly an enterprise expects its asset value to decline and the residual value of the asset at the end of its useful life.

In his latest article, he wrote that companies can boost profits and increase book asset value in the short term by spreading relevant costs over five or six years instead of three. However, this practice could lead to huge asset write-downs in the future.

He also cited Microsoft In a recent interview, CEO Satya Nadella mentioned that he had slowed down Microsoft 's data center expansion earlier this year. The reason for this construction is the concern that if data centers are built on a large scale to accommodate a certain generation of chips, the existing facilities may be incompatible with a new generation of chips with completely different power consumption and cooling requirements, ultimately resulting in wasted resources and investment losses.

"For depreciation accounting reasons, hyperscale cloud service providers have been deliberately extending the lifespan of chips and servers. At the same time, they are investing hundreds of billions of dollars in purchasing graphics chips, and the planned obsolescence rate of these chips is accelerating."

He implied that his comments on depreciation elicited a far greater response than he had anticipated, both in Nvidia's memo and in the market's broader reaction: "I've been drawn into an event that has far greater implications than my personal life."

Continuous sniping

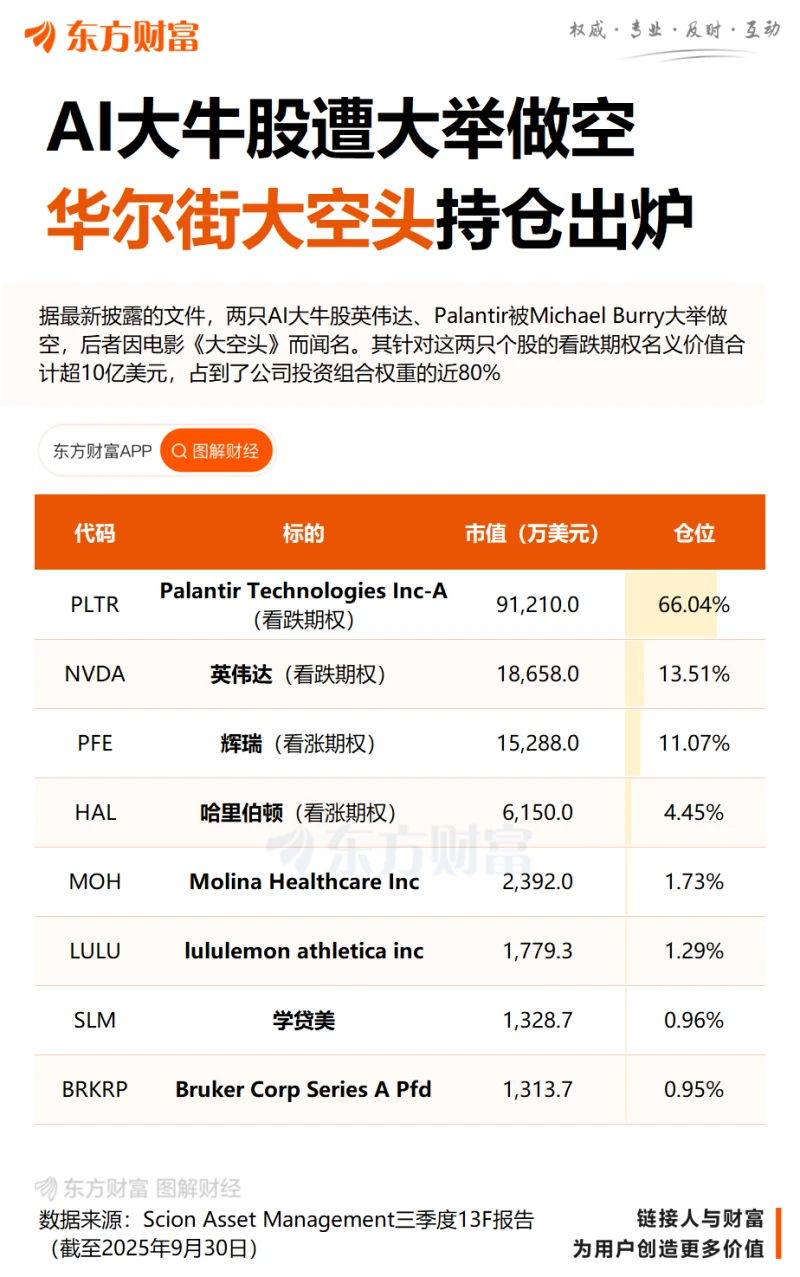

According to documents disclosed earlier this month, Burry's Scion Asset Management held put options on Nvidia and Palantir as of the end of September. These previously disclosed short positions had a notional total value of $1.1 billion, but Burry wrote in its latest Substack article that each option cost only about $10 million.

Burry has been relentlessly attacking Nvidia recently. On Monday, he published an article on Substack titled "Key Signs of a Bubble: Supply-Side Greed," calling the current AI craze "a magnificent folly" and comparing Nvidia to Cisco during the dot-com bubble. This is a harbinger of the bursting of the AI bubble, and it also mentions the catastrophic oversupply and undersupply in the AI field.

Last Wednesday, just hours after Nvidia released its bombshell earnings report, Burry warned that the ultimate real demand for artificial intelligence is far lower than currently perceived, and he also accused major tech giants of misrepresenting their revenue.

Nvidia's stock price has fallen about 14% from its November 3 high, fueled by growing investor concerns about overspending and overvaluation of AI companies.

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)