Data released Monday by the Institute for Supply Management (ISM) showed that the overall manufacturing sentiment in the United States declined further, falling below the 50-point mark for the ninth consecutive month. Faced with the tariff impact of the Trump administration's trade war, businesses are not only experiencing declining orders and pressure on job creation, but also rising production costs.

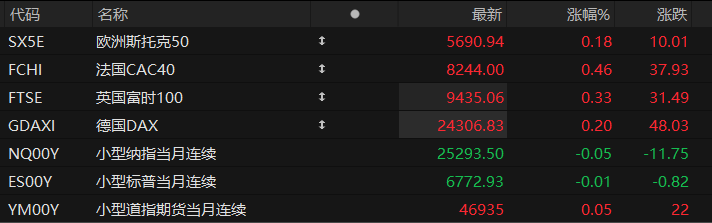

With the Federal Reserve's year-end meeting approaching, the balance of monetary policy is tipping toward another rate cut, and the performance of several key indicators remaining this week will also be closely watched.

Manufacturing faces continued pressure

The ISM survey released that day showed that the manufacturing Purchasing Managers' Index (PMI) fell to 48.2 in November from 48.7 in October. Among the sub-indices, the new orders sub-index further declined to 47.4. Tariffs pushed up the prices of some goods, thereby suppressing demand. Manufacturers' input costs continued to rise, with the price index rising to 58.5 in November from 58.0 in October.

Of particular note is that manufacturing employment has contracted for 10 consecutive months. Susan Spence, chair of the ISM Manufacturing Business Survey, said, "67% of survey participants said that headcount management remains the norm for companies, rather than hiring new employees."

Manufacturing accounts for 10.1% of the US economy. Of the industries covered in the survey, only four—computers and electronics, machinery and equipment, etc.—experienced growth. Meanwhile, wood products, transportation equipment, and textiles contracted. Although some manufacturers cited the recent end of the US government shutdown as a possible slight improvement in industry conditions, factory activity is likely to remain sluggish.

Some manufacturers in the transportation equipment industry have linked layoffs to the broad tariff policies implemented by US President Trump, saying they are beginning to implement more permanent adjustments due to the current tariff environment. "These adjustments include layoffs, issuing new guidance to shareholders, and adding overseas production facilities—operations that were originally planned for US exports."

Some chemical manufacturers stated that "tariffs and economic uncertainty continue to suppress demand for adhesives and sealants—products primarily used in construction." "The business environment remains weak due to rising costs caused by tariffs, government shutdowns, and increased global uncertainty."

Manufacturers of electrical equipment, home appliances, and components have expressed considerable discontent with the “trade chaos,” while some companies have stated that “suppliers are encountering more and more problems when trying to export to the United States.”

While Trump defends his tariff policies, arguing they are crucial for protecting domestic manufacturing, Wall Street economists believe that structural problems such as labor shortages prevent the manufacturing sector from returning to its former glory. Stephen Stanley, chief U.S. economist at Santander US Capital Markets, stated, "Manufacturing remains constrained by an uncertain tariff environment."

As previously reported by CBN, a U.S. Supreme Court justice questioned the legality of Trump's tariff policies last month, sparking speculation that the tariff policies might be repealed, leading to further chaos—as it is widely expected that if the ruling is unfavorable to Trump, he will turn to other trade strategies.

How the Federal Reserve weighs its options

With the Federal Reserve entering its blackout period, the market will only be able to gauge future policy prospects from economic data. Next, key data to watch this week includes last month's ISM Services Index and the ADP Private Sector Employment Report. As two of the Federal Open Market Committee's (FOMC) responsibilities, the latest performance of employment and price-related indicators will receive significant attention.

Latest data shows that the number of Americans continuing to claim unemployment benefits rose to 1.96 million last week, the highest level since the pandemic, reflecting a significant increase in the difficulty of finding work. The Federal Reserve has expressed concern and has cut interest rates twice since September, with the possibility of another cut in the coming weeks. A report from Oxford Economics states that while rate cuts may provide some relief, a significant improvement in the job market is unlikely before trade tensions ease and the US economy accelerates—and this could take a considerable amount of time.

In the past two weeks, voting expectations at the year's final meeting have undergone a major reversal, with the third-ranking official at the Federal Reserve, New York Fed President Williams... After officials such as John Williams signaled further easing, the interest rate market indicated that a rate cut next week was nearly fully priced in.

Bank of America Global Research said on Monday that, given the weak labor market and recent comments from policymakers suggesting a possible earlier rate cut, the bank now expects the Federal Reserve to cut rates by 25 basis points at its December meeting. Then, in June and July 2026, the Fed will cut rates by another 25 basis points each (i.e., two quarterly rate cuts), at which point the final interest rate (the ultimate interest rate level) will fall to the 3.00%-3.25% range.

According to reports, White House economic advisor Kevin Hassett has become a leading candidate for the next Federal Reserve chairman. A Bank of America analyst noted in a report, "Our forecast for additional rate cuts next year stems from potential changes in Fed leadership, rather than our assessment of the current economic situation."

A survey by CBN reporters found that, as of press time, most major global brokerage firms expect the Federal Reserve to cut interest rates by 25 basis points next week, while Morgan Stanley... and Standard Chartered Bank A few institutions, however, believe that the Federal Reserve will keep interest rates unchanged.

(Article source: CBN)