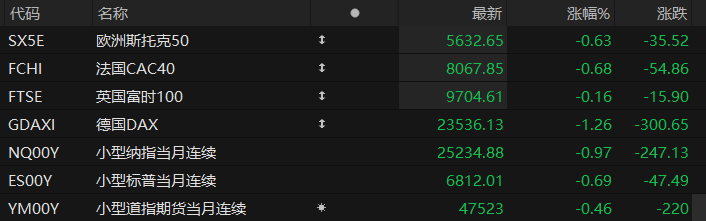

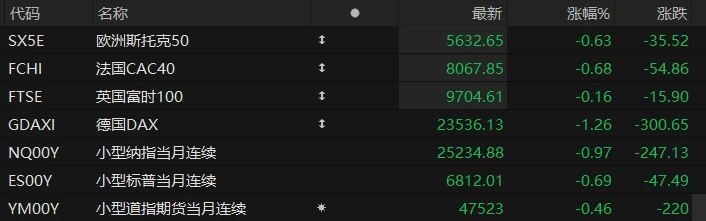

U.S. stock index futures fell across the board in pre-market trading on Monday, while major European indices also generally declined. As of press time, the Nasdaq... S&P 500 futures fell 0.97%, S&P 500 futures fell 0.69%, and Dow Jones futures fell 0.46%.

In terms of individual stocks, leading tech stocks collectively declined in pre-market trading, with Advanced Micro Devices (AMD) and Micron Technology among the losers. Nvidia shares fell more than 2%. It fell by nearly 2%.

Popular Chinese concept stocks were mixed in pre-market trading, with NIO among them. XPeng Motors fell more than 3%. Li Auto fell more than 2% Alibaba fell more than 1%. It rose by more than 1%.

US cryptocurrency stocks fell in pre-market trading, with CleanSpark down nearly 10%, Cipher Mining down more than 8%, and Bitmine Immersion Technologies down more than 7%.

As trading begins in December, seasonal factors shift in favor of Wall Street. According to the Stock Traders' Almanac, since 1950, the S&P 500 has averaged a gain of over 1% in December, making it the third-best performing month of the year.

"Given that last week's strong rebound improved the breadth following the market weakness in early November, I am more optimistic about the prospects for positive returns in December," Fundstrat technical strategist Mark Newton wrote last week. "With the increasing likelihood of a December rate cut, the stock market seems to be gradually regaining confidence."

This week, investors will be closely watching data including the November Purchasing Managers' Index (PMI) and the ADP employment report. According to the CME Group's FedWatch Tool, traders generally believe the Federal Reserve will cut interest rates for the third consecutive time to support the labor market.

US President Donald Trump said on Sunday that he has decided who to nominate to succeed Federal Reserve Chairman Jerome Powell, but did not reveal the specific candidate. Bettors in the prediction market generally believe that Kevin Hassett, director of the White House National Economic Council, is the most likely candidate.

Hot News

US stocks are entering the final month, but will there be no "Santa Claus rally" this year?

As the US stock market enters December, Wall Street traders are once again looking forward to the annual "Santa Claus rally."

The so-called "Santa Claus rally" refers to the seasonal rise in US stocks every December. After Thanksgiving, US stocks tend to rise steadily with decreasing volatility, making December typically one of the best-performing months of the year for US stocks.

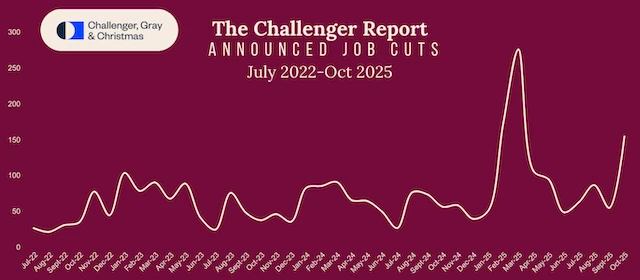

However, some strategists say that Santa Claus may not be making an appearance this year. Since the beginning of the year, various signs have indicated that this year has not been a normal market cycle : for example, in February, the emergence of the DeepSeek open-source AI model caused a sharp drop in US tech stocks; in April, US President Trump unexpectedly announced a broad range of so-called "reciprocal tariffs," triggering another widespread stock market crash; and in the past few months, the market's concerns about artificial intelligence... Concerns about high valuations have led to a rollercoaster ride for tech stock investors.

Artificial intelligence technology has not only brought about innovation in social life and production, but also brought unprecedented disruption and uncertainty to the US stock market. Wall Street strategists say that this year's market trends are almost completely different from those of the past decade.

Bitcoin plunged to below $86,000! Just as the market stabilized, selling pressure erupted again.

On Monday (December 1) during the Asian session, cryptocurrency prices generally plummeted, and investors' risk aversion sentiment began to rise again, with the seemingly stabilizing sell-off in the crypto market starting to stir again.

Bitcoin prices fell more than 7% intraday, briefly dipping below $85,000; Ethereum prices also fell more than 7%, dropping to around $2,800; most other tokens showed similar trends, such as Solana, which fell 7.8%.

Bitcoin depreciated by 16.7% in November, but easing selling pressure last week allowed its price to rebound, rising above $90,000. Just when people thought the sell-off was over, the market experienced an even larger drop at the beginning of this week.

Sean McNulty, Head of Derivatives Trading for Asia Pacific at FalconX, noted, “Since the beginning of December, the market has experienced some volatility. The biggest concern is the extremely low inflows into Bitcoin ETFs (exchange-traded funds) and the lack of bargain hunters. We expect this structural headwind to continue this month. We consider $80,000 to be the next key support level for Bitcoin.”

Musk makes a startling prediction: AI will end the US "debt crisis" within three years!

Just this past weekend, Elon Musk, the world's richest man, published a groundbreaking new view: Artificial intelligence (AI) will end the escalating "debt crisis" in the United States within three years.

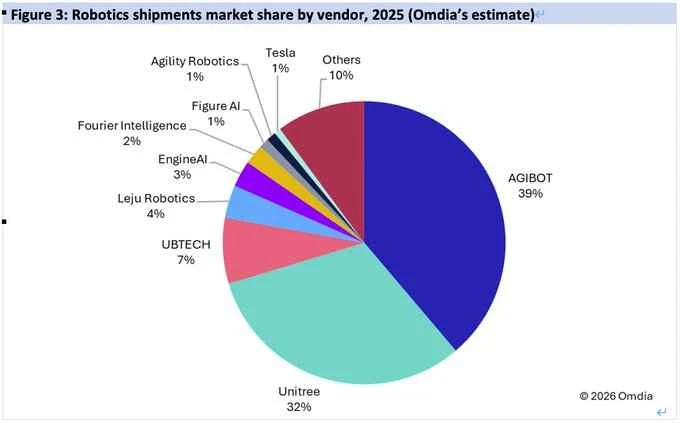

In a podcast that aired last Sunday, Musk stated that there is only one way out of the US debt problem: artificial intelligence. "The only way to get rid of America's deepening fiscal hole is through artificial intelligence and robots. " "Driven productivity (increases). This is almost the only way to solve the U.S. debt crisis, but it could lead to severe deflation," he added.

According to data from the U.S. Treasury Department, as of November 26, the U.S. national debt reached $38.34 trillion, more than double what it was a decade ago.

Musk further pointed out that artificial intelligence has not yet increased productivity to a level sufficient to drive economic output growth outpacing inflation, but this is about to change. "I estimate that within three years or less, output of goods and services will outpace inflation," he added.

US Stocks Focus

Establishing high-speed cloud connections! Amazon Partnering with Google to launch multi-cloud networking services

On Sunday (November 30), Amazon and Google launched a jointly developed multi-cloud networking service. In a statement, the two companies said the move aims to meet customers' growing demand for reliable network connectivity and avoid major service outages. The statement also noted that the initiative will allow customers to establish private, high-speed connections between the two companies' computing platforms in minutes, rather than weeks.

It's worth noting that just one month before the launch of this new service, on October 20th, Amazon Web Services (AWS) experienced a major outage, crippling thousands of websites worldwide and rendering some of the internet's most popular applications inoperable. According to analytics firm Parametrix, this outage is estimated to cost U.S. businesses between $500 million and $650 million.

Robert Kennedy, Vice President of AWS Networking Services, stated, "This collaboration between Amazon Web Services and Google Cloud marks a significant shift in the multi-cloud interconnection model." Rob Enns, Vice President and General Manager of Google Cloud's Cloud Networking Group, added that the joint network aims to make it easier for customers to transfer data and applications between different cloud platforms.

Tesla While sales continued to decline in some European markets, Norway bucked the trend and set a new annual record.

November's new car registration data for Europe has been released, and Tesla suffered a major setback in its core markets. Only Norway bucked the trend and broke its annual record a month ahead of schedule, becoming a rare bright spot for the company in Europe.

The latest official statistics show that this leading American electric vehicle manufacturer saw its registrations in France, Sweden, and Denmark plummet by 58%, 59%, and 49% year-on-year in November, respectively. New car registrations typically reflect sales performance.

In contrast, Norway's November registrations nearly tripled to 6,215 vehicles, breaking the country's annual sales record a month ahead of schedule.

Tesla 's struggles in Europe began late last year when CEO Elon Musk publicly praised right-wing politicians, sparking protests in several parts of the continent. This month, a Tesla store in southern France... The showroom was set on fire again, and police have launched a criminal investigation, further damaging the brand's reputation. Although Musk subsequently toned down his political rhetoric, sales did not stop falling, highlighting the structural difficulties its European business is facing.

Wei Xiaoli releases November delivery data

In November, NIO (NIO.US) delivered 36,275 new vehicles, a year-on-year increase of 76.3%. Of these, 18,393 were under the NIO brand; 11,794 were under the Ledo brand; and 6,088 were under the Firefly brand. XPeng Motors (XPEV.US) delivered 36,728 smart electric vehicles, a year-on-year increase of 19%. Li Auto (LI.US) delivered 33,181 new vehicles. As of November 30, 2025, Li Auto's cumulative deliveries will reach 1,495,969 vehicles.

Micron Technology invests a whopping $9.6 billion to build a factory in Japan, diversifying its production capacity and competing in the HBM market.

According to sources familiar with the matter, Micron Technology plans to invest 1.5 trillion yen (approximately US$9.6 billion) to build a new factory in Hiroshima, western Japan, to produce advanced high-bandwidth memory. Chips. The US chipmaker reportedly aims to begin construction at its existing site next May and plans to start shipping around 2028. Japan's Ministry of Economy, Trade and Industry will provide subsidies of up to 500 billion yen for the project. Demand for high-bandwidth memory chips is being fueled by the development of artificial intelligence and data centers. Driven by investment. It is understood that expanding the factory in Hiroshima will help Micron diversify its production layout in Taiwan and compete with market leader SK Hynix.

(Article source: Hafu Securities) )