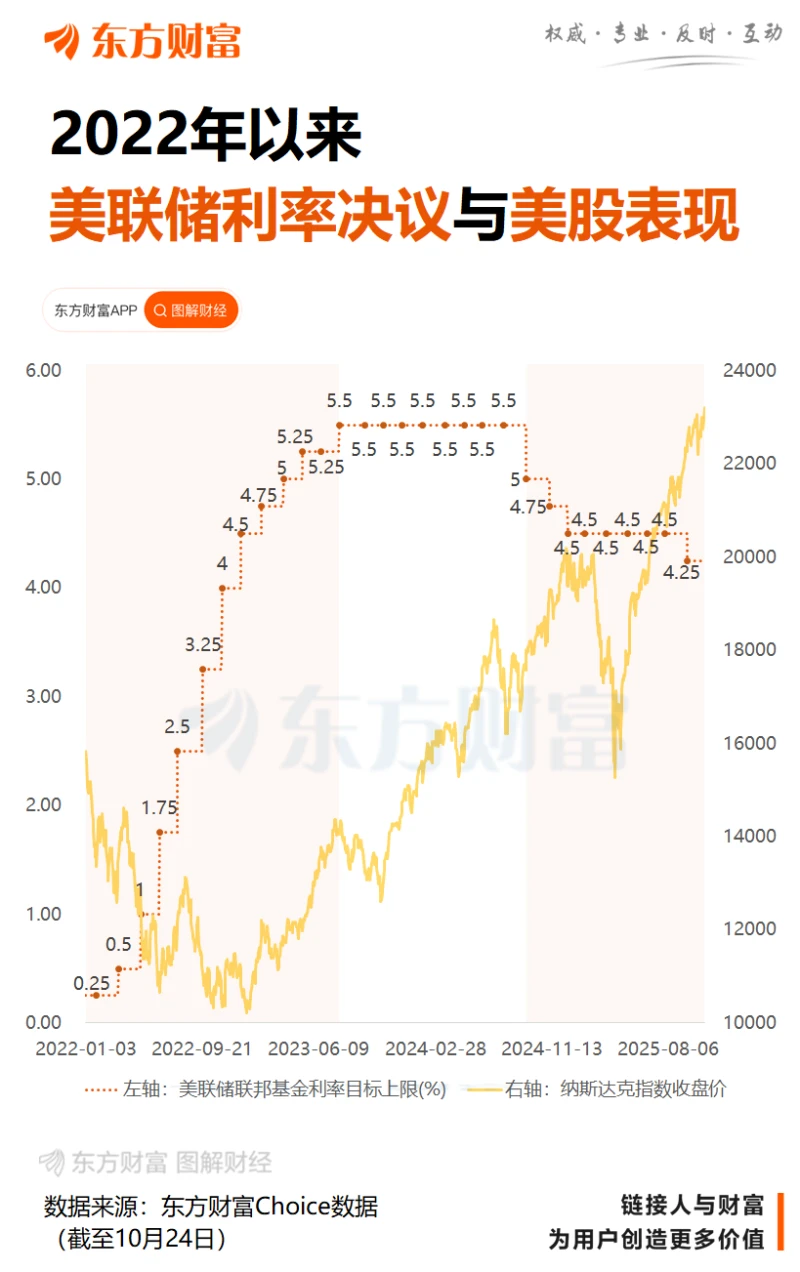

The Federal Reserve is expected to cut interest rates for the second consecutive time this week to bolster its faltering job market. However, any attempt to extend the easing cycle beyond October could face renewed opposition from some officials who remain concerned about inflation.

Many industry insiders say that although the doves within the Federal Reserve are still winning the debate and are expected to push for another rate cut this month, the hawks among policymakers may still be worried about the rate cut being too aggressive.

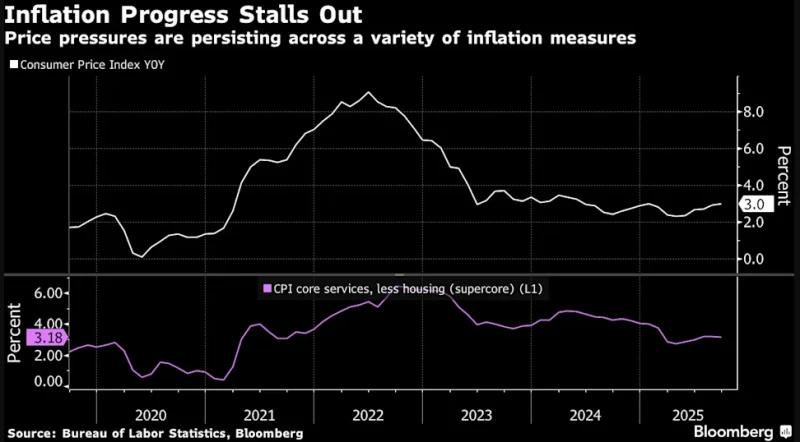

The latest CPI data released last Friday showed that core inflation in the US hit a three-month low in September. While this reinforced the Federal Reserve's plan to cut interest rates this week, the overall stalled pace of price cooling is not enough to justify further rate cuts by the Fed in the future.

Wells Fargo Economist Nicole Cervi stated, "This data will allow the Fed to maintain an accommodative stance in October, but the fundamentals of inflation haven't really changed."

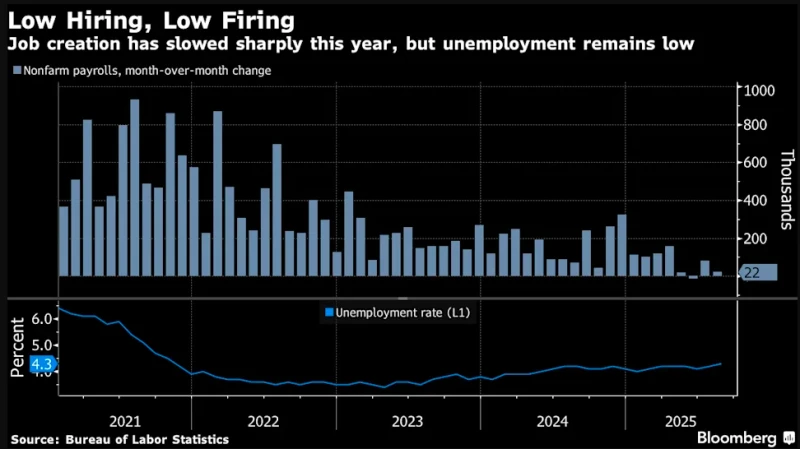

For the first eight months of this year, Federal Reserve policymakers remained on hold, awaiting an assessment of the impact of tariffs and other policy adjustments on the economy. After a sharp slowdown in hiring this summer, officials decided in September to cut the benchmark interest rate by 25 basis points. In the dot plot released that month, they projected two more rate cuts before the end of the year.

Since the September meeting, the latest U.S. labor market data—partly filled in by private data agencies to fill the data gaps caused by the government shutdown—has not brought many positive signals. Federal Reserve Chairman Powell stated earlier this month that the labor market has "actually softened significantly" and pointed to "considerable downside risks."

As a result, the interest rate futures market has almost completely priced in the Fed's expectations of a 25 basis point rate cut this week, another rate cut in December, and even a further rate cut in March next year.

Investors in the $29 trillion U.S. Treasury market have also reaped extraordinary returns this year, riding on market expectations of further interest rate cuts by the Federal Reserve—on track for their best annual performance since 2020. The Treasury market extended these gains this month, rising 1.1% on expectations of further rate cuts.

"It will be very difficult to get the market to abandon pricing in a total of 50 basis points in rate cuts over the next two meetings," Morgan Stanley said . "It's difficult to justify a deviation from market expectations," said Vishal Khanduja, head of the fixed income team at an investment management firm.

Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets, also said: "Financial markets have adopted a very aggressive betting strategy, and the Federal Reserve leadership has not explicitly opposed it."

Could internal divisions escalate further?

However, even though the financial markets seem to have already "drawn out" a roadmap for the Fed's continued interest rate cuts, and Powell seems to be "letting things go," this does not mean that there are no dissenting voices within the Fed.

Industry insiders say a number of regional Fed presidents, including St. Louis Fed President Musaleem, Kansas City Fed President Schmid, and Cleveland Fed President Hammark, may raise objections. Interest rate projections released in September showed that nine of the Fed's 19 policymakers support a maximum of one more rate cut this year, with seven favoring no further cuts.

Several officials in this group did acknowledge the slowdown in hiring and supported the September interest rate cut. However, they also pointed out that labor supply and demand have shrunk simultaneously due to a sharp decline in immigration. This means fewer new jobs are needed to maintain a stable unemployment rate. Some experts estimate that the current break-even point for maintaining a stable unemployment rate is already close to the current job growth rate—an average of 29,000 new jobs per month over the past three months.

At the same time, these officials are once again “raising their guard” against inflation.

While the tariffs have not triggered the level of price increases many had anticipated, the continued announcements of new tariffs by Trump have raised concerns that their effects may be more persistent. Furthermore, recent evidence suggests that price pressures are building in categories outside of those directly affected by the tariffs.

Cleveland Fed President Mark Hammark, who will gain a voting right on the FOMC next year, publicly expressed his concerns this month about soaring service sector prices. Data shows that while inflation in non-housing core services had somewhat subsided in early 2025, it has now risen by more than 3% year-over-year for four consecutive months.

Several officials pointed out that the inflation rate has exceeded the Federal Reserve's 2% target for four consecutive years and is not expected to return to the target range until 2028. Such a prolonged period of "exceeding the target" could significantly increase the risk of rising long-term inflation expectations—a development that should be truly alarming for policymakers.

In her first policy speech this month, Philadelphia Fed President Anna Paulson emphasized that "the stability of long-term inflation expectations is a key test of the credibility of monetary policy. It is crucial to accomplish the task of reducing inflation—bringing the inflation rate back to 2%."

Even Waller, the dovish Federal Reserve governor who was among the first to warn of a slowdown in hiring this summer, has recently called for cautious interest rate cuts due to the contradiction between strong growth and a weak labor market.

In a speech earlier this month, Waller said, "One of the two must change—either economic growth slows to match a weak labor market, or the labor market recovers to match stronger economic growth."

Regardless, the lack of official data during the government shutdown may further obscure the policy decisions of Federal Reserve officials. This context suggests that the Fed will likely maintain its September course this month, but the likelihood of it releasing any clearly dovish signals is undoubtedly low. ( Citigroup) Economist Veronica Clark points out that this could mean they will continue the policy path outlined in their September interest rate forecast—two more rate cuts this year and only one in 2026.

“There are still significant differences, but there is not enough evidence to truly sway the direction of decision-making,” Clark pointed out. “This could be one of the main signals that the current lack of clarity makes it difficult for policymakers to accurately predict future trends.”

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)