① Following JPMorgan Chase After that, Goldman Sachs President John Wardlong also stated on Wednesday that the current correction in US stocks may continue as technical indicators break down; Wardlong also emphasized that this correction is healthy after more than half a year of gains.

As the US stock market continued its correction into November, executives at top Wall Street institutions seemed to have reached a tacit agreement, unanimously suggesting that the current bull market in US stocks should take a break.

A recent example is Goldman Sachs President John Waldron, who said during an event in Singapore on Wednesday: " In my view, the market may pull back further from here. I do think the technicals are leaning towards more protection and further declines. "

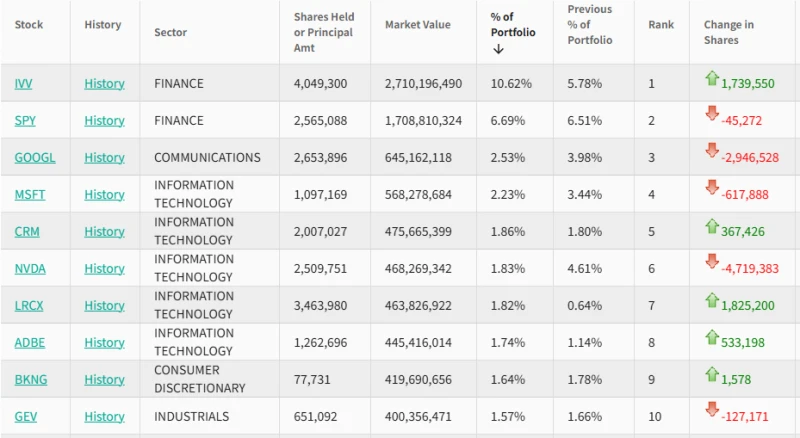

Against this backdrop, the S&P 500 fell more than 3% this month, potentially ending its six-month winning streak. More crucial than the magnitude of the decline is the technical breakdown.

According to statistics from CLS yesterday, the S&P 500 index fell below its 50-day moving average on Monday, the first time in nearly 139 trading days. The tech giants that led the stock market rally are now facing scrutiny regarding whether their AI investments are excessive.

(S&P 500 daily chart, source: TradingView)

Wardron said, “You can see that the market is currently correcting, which I think is healthy—after all, there have been significant gains this year . The market is currently highly focused on AI-related investment dynamics: can we achieve the capital returns the market expects? Have these expectations already been reflected in the stock price? That’s the biggest debate right now.”

Wardron also mentioned that Nvidia's stock price fell after the market closed on Wednesday (early tomorrow morning Beijing time). The earnings call will be "a very important moment for the current market." Additionally, early Thursday morning Beijing time, Nvidia CEO Jensen Huang will share the stage with Elon Musk at a dialogue event during the US-Saudi Investment Forum.

Regarding JPMorgan Chase CEO Jamie Dimon's widely circulated "cockroach" theory about American credit, Wardlong shifted the topic to the subprime lending sector.

He stated that the most vulnerable segment of the economy is low-end consumers, and that a significant amount of lending has flowed into the subprime sector in recent years. However, even though loan approval (underwriting) standards have begun to decline, this does not necessarily mean a credit crisis will erupt. As long as the overall economy can hold up, the credit market will remain stable .

Similar to Wardrow, JPMorgan Chase 's Vice Chairman and President Daniel Pinto also stated on Tuesday that artificial intelligence... The industry's valuation needs to be reassessed, and any decline will have a ripple effect on the entire stock market.

Pinto stated, " For these valuations to hold water, you have to assume that productivity will increase to a very high level—and that will indeed happen, but it may not arrive as quickly as the market is currently pricing in. "

Compared to Wall Street executives' assessment that the US stock market would "correct but not crash," their European counterparts have a different opinion.

Davide Serra, founder and CEO of European investment fund Algebris, advised investors in Singapore on Wednesday to reduce their allocation to tech giants, anticipating "a major adjustment is very likely to follow."

Serra also emphasized that the United States' share of the global market is approaching its "mathematical limit."

“Never before in history has an economy that accounts for only one-third of the global economy taken 70% of the global market capitalization,” Serra said. “The conclusion is that we are at a peak.”

(Article source: CLS)