The rising expectations of a Federal Reserve rate cut not only saved US stocks but also brought new opportunities to Bitcoin. After experiencing a drop of more than 30%, Bitcoin has bottomed out and rebounded. Although it is still too early to say that Bitcoin has reversed course, this rebound is hard-won for crypto-related assets that have undergone a longer and deeper correction than cryptocurrencies themselves.

So, after a deep correction, have cryptocurrency-related stocks, especially stablecoin stocks, fallen to a level that presents a good investment opportunity? This requires a case-by-case analysis.

In this issue, we will introduce the top 50 US stocks – Circle Internet Group (CRCL).

On June 5, 2025, Circle Internet Group officially listed on the New York Stock Exchange with an offering price of $31. This fintech company, known for issuing the USD stablecoin USDC, entered the market riding the wave of the crypto bull market: in less than three weeks after its IPO, its stock price soared to a high of $298.99 on June 23, a nearly tenfold increase, making it one of the most eye-catching new stocks in the US stock market at the time.

This extreme surge was largely driven by the prevailing macroeconomic and sentiment factors—Bitcoin consolidated around $100,000 before surging to a record high of $126,000. Market expectations for a "leading stablecoin company + compliant license + high-interest-rate environment" were pushed to their limits. Many investors viewed CRCL not just as a new stock, but as the first genuine equity ticket to the "digital dollar."

However, the story took a sharp turn after CRCL failed to break through $300. As Bitcoin fell from its all-time high to around $91,000, CRCL's stock price also experienced two rounds of sharp declines: first, it fell from nearly $300 to around $110, and then continued to decline under the pressure of the overall correction in crypto assets and repeated expectations of interest rate paths, recently falling to around $72, a pullback of more than 70% from its high.

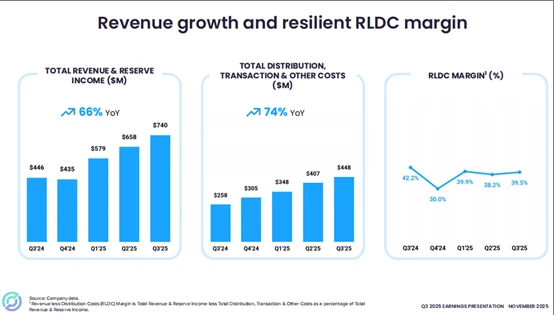

Even more dramatically, despite the fact that Q3 revenue and profit both significantly exceeded expectations, with revenue increasing by 66% year-on-year, the stock price still recorded a 10% single-day drop on the day of the earnings report, and then continued to decline to its current position.

On the surface, CRCL appears to be a "crypto concept stock" that has been driven up and then crashed by sentiment: its price fluctuations closely follow Bitcoin's, and its valuation has cycled from "sky-high" to "back to square one" within a few months. However, if we temporarily set aside the stock price curve and return to the business and data itself, we see a different picture—USDC's circulating supply has doubled in a year, on-chain transaction volume continues to expand, and the institutional cooperation network is constantly growing. The company's "network effect" in the real world is precisely in an accelerating phase.

So now, CRCL is no longer a bargaining chip driven by emotions, but has begun to return to the level that it should really be discussed—whether it can occupy an irreplaceable position in the future financial architecture.

[Company Introduction]

Circle Internet Group, Inc. is a global fintech company founded in 2013 and headquartered in New York, USA. It is dedicated to building platforms for stablecoins and blockchain technology. The application's infrastructure, network, and market platform. It is not simply a cryptocurrency issuer, but rather an attempt to transform stablecoins into the underlying channel of the internet finance system.

The core of the company's operations is a complete set of networked products and services built around the Circle stablecoin system, including:

USD Coin (USDC) and EURC—fiat currency-denominated stablecoins pegged to the US dollar and the euro respectively—serve as the value carriers and network gateways of the Circle ecosystem.

Developer Services – Provides plug-and-play enterprise-grade APIs and infrastructure that enable developers and institutions to directly integrate stablecoins into wallets, payments, clearing, custody, or other blockchain applications.

System Integration Services – responsible for connecting different blockchain networks with traditional financial institutions, enabling stablecoins such as USDC to circulate across chains and integrate into existing payment, settlement, and fund management systems;

Tokenized Funds – Regulated and yield-generating asset tokenization products, primarily used for capital market collateral, liquidity management, and compliance scenarios;

Liquidity & Payments Services – Provides institutional clients with the ability to mint, store, redeem, exchange, and clear funds across borders for Circle stablecoins, enabling them to transfer value globally in “networked dollars” or “networked euros.”

Circle has evolved from a stablecoin issuer into a financial infrastructure provider that integrates issuance, circulation, payment, compliant assetization, and network governance. This allows institutions to directly embed stablecoins into their business processes without bearing the complexity of cryptographic systems, enabling them to truly participate in the value exchange network of the internet finance era.

Financial Analysis

On November 12, 2025, CRCL released its second financial report since its listing. Its financial performance completely defied the stereotype of a "crypto sentiment stock." Its revenue is not dependent on coin price fluctuations, but is built on three sustainable curves: reserve returns, network expansion, and platform fees.

1) Revenue and profit both exceeded expectations.

In Q3 2025, Circle delivered a highly compelling data report:

This is not just about "impressive numbers," but rather a signal that both the scale of the network per unit and the efficiency of revenue per unit are improving simultaneously.

2) Revenue Structure Breakdown: It's not about cryptocurrency trading, but rather interest rate spreads plus network fees.

Circle's current revenue is mainly divided into two parts:

① Reserve Income – The Cornerstone of Cash Flow

For every $1 USDC issued, $1 of reserve assets (primarily short-term US Treasury bonds) are allocated. During periods of high interest rates, US Treasury yields provide Circle with a stable source of interest rate spreads.

This means that it doesn't make money from volatility, but from scale.

② Other Revenue is growing rapidly – a platform-based business model is emerging.

Other revenue increased 52.1 times year-on-year, driven by: developer service payments and bank connections. Revenue from integration with payment systems, and network transaction and clearing fees.

In other words, Circle is shifting from an "interest rate-sensitive asset side" to a "network-based fee-charging platform side." The former is triggered by the macroeconomic environment, while the latter is driven solely by network scale.

When revenue shifts from asset-driven to platform-driven, the company's valuation logic will be rewritten.

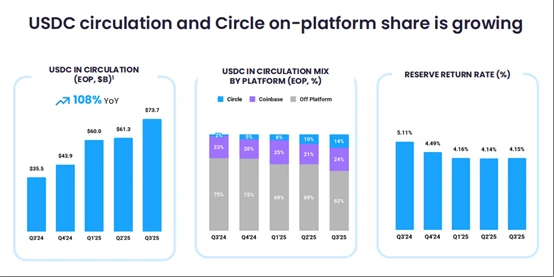

3) The network effect of USDC has entered a stage of exponential growth.

Circle's real growth engine is not revenue, but the scale of the USDC network: USDC on-chain transaction volume has exceeded $41T, which is a key foundation supporting the quality of revenue and the expansion of use cases.

USDC's market share rose to 29%, making it a core pricing layer in the stablecoin industry. Meaningful Wallets grew by 77%, indicating that active users are increasingly binding to the platform.

This means that Circle has moved from "minting business" to "network infrastructure business": minting is just the entry point, while settlement and liquidity are the real business models.

[Strong Reasons]

Circle's growth strategy is not "to make a better stablecoin", but rather to become an infrastructure provider for a global value transfer network.

1. From Cryptocurrency to the Internet: USDC is Becoming the "Internet Dollar"

Circle's biggest asset is not USDC itself, but USDC's network status.

USDC's circulating supply reached $73.7 billion, a year-on-year increase of 108%.

The cumulative transaction volume on the USDC blockchain has exceeded $41 trillion.

USDC's market share in the stablecoin industry has increased to 29%, making it the only networked asset that leads in all aspects of regulatory transparency, reserve auditing, and cross-chain compatibility. This means that USDC has transformed from a "settlement tool on a certain chain" into a "value protocol that enables interoperability across multiple chains."

Just as TCP/IP made data a native internet resource, Circle is making the dollar a native network asset. It occupies a position at the syntax layer, not the application layer. Companies that occupy the syntax layer will not easily change their status as long as the standards don't change.

2. CPN is becoming an "encrypted version of SWIFT".

Circle Payments Network (CPN) is the most underestimated growth engine in the market.

at present:

29 financial institutions have officially connected;

55 institutions are currently reviewing the case;

500 institutions are connected to the pipeline;

The volume of payment and settlement transactions increased 101 times.

User access brings scale, scale brings liquidity, liquidity brings stickiness, and stickiness creates a monopolistic moat.

Visa built its competitive advantage on transaction fees; Circle may build its competitive advantage on network fees in the future. When USDC becomes a cross-border payment... When it comes to the underlying language of liquidation, Circle does not collect one-time revenue, but rather continuous, network-based revenue.

3. Arc Layer-1: The real variables for the valuation ceiling have not yet been priced in.

Arc is not "just another public chain"; it solves a problem that no chain has solved in the past: how can real-world assets exist natively in the network?

Arc has attracted over 100 financial and technology institutions to pilot its services, including: Visa (payment gateway), BlackRock (asset side), HSBC, Kraken, AWS, etc.

If Arc enters the commercialization phase, CRCL's business model will shift from: issuing US dollars to earn interest → accumulating network value by supporting economic activities. This represents a leap from financial company valuation to platform value valuation.

Once Arc issues its native token, Circle's profit structure will possess protocol capture attributes, meaning that CRCL's valuation will no longer be based on profits, but on the network's value itself. This is a growth curve that is more like a breakout point than USDC.

4. Regulatory tailwinds are not risks, but rather a passport to success.

The market often mistakenly interprets regulation as a negative factor, but in the stablecoin industry, clear regulation equals higher barriers to entry.

Circle took the lead in adhering to reserve disclosure and auditing standards, compliantly accessing the US capital market and gaining cooperation intentions from traditional financial institutions and payment giants.

Regulation is not a gatekeeper standing in the way, but a moat that keeps most competitors out.

This means that for USDC and Circle, the further along the road, the harder it will be for competitors to emerge, and the easier it will be for Circle to enjoy the industry's compounding effect.

Valuation Analysis

From the perspective of traditional static metrics, CRCL's valuation seems high, but the data reveals a different reality: the market is using the old framework to evaluate a company that is entering a new paradigm.

1. Superficial "expensiveness" is a static perspective; growth rate determines its inherent high price.

CRCL's current valuation multiple is indeed higher than the median for the fintech industry:

P/S ≈ 8.6x vs. industry average 3.6x

EV/S ≈ 8.2x vs. industry average 3.5x

But comparing growth rates:

Q3 revenue grew by 66% year-on-year, more than six times the industry average growth rate (8%–10%). When the growth rate far exceeds the industry average, the valuation itself cannot be measured on par with traditional financial targets.

2. Cash flow and asset quality support the valuation basis.

CRCL is not a platform company that "focuses on structure but not on profits": the company holds $1.35 billion in cash and has only $222 million in debt, making its balance sheet extremely healthy.

The continued improvement in adjusted EBITDA and cash flow indicates that the business model has proven successful, rather than relying on financing to stay afloat. This means that CRCL has the ability to exchange growth for profits rather than burning money for scale, and its valuation has limited room for pressure.

3. Future valuation anchors will not be profits, but market size.

According to Citigroup's forecast, the stablecoin industry will expand from $282 billion to $1.9 trillion by 2030, representing a compound annual growth rate of 46%.

As long as USDC maintains its current market share, Circle is essentially reaping the systemic benefits of the internetization of the US dollar, rather than competing with it, by following the migration of the monetary system.

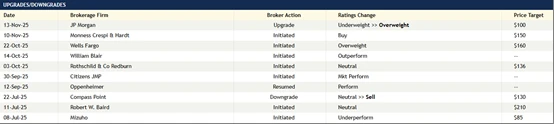

[Institutional Rating]

Judging from the trend of institutional ratings, although CRCL has experienced significant volatility since its listing, Wall Street's attitude towards its long-term potential is shifting. On November 13, JP Morgan broke its previous cautious stance, upgrading CRCL from Underweight to Overweight with a target price of $100. Following closely behind, Baird also upgraded its rating from Neutral to Outperform on November 14, setting a target price of $110, demonstrating institutional recognition of the company's fundamental resilience and network expansion prospects.

Brant, Chief Analyst at Chinese Investment Network, shares his views.

Although US stocks showed signs of rebounding again at the end of November, we believe this is not the end of the correction, but rather a mid-term rebound. After all, the high valuation problem plaguing US stocks has not been resolved, and the rebound is merely a technical bounce driven by rising expectations of interest rate cuts. Therefore, for investors, it is still advisable to adopt a wait-and-see approach, focusing on the market trend and waiting for further clarity.

However, after a deep correction, Bitcoin's price is now close to its mining cost, indicating a strong need for stabilization. Stablecoins, as a bridge between traditional currencies and the broader digital asset world, still hold immense potential for future growth. CRCL experienced significant volatility after its listing, and its growth and valuation have now reached a relatively balanced state. While it's still difficult to determine whether it has bottomed out, from a long-term perspective, accumulating long positions at the current level is very attractive.

(Article source: CLS)