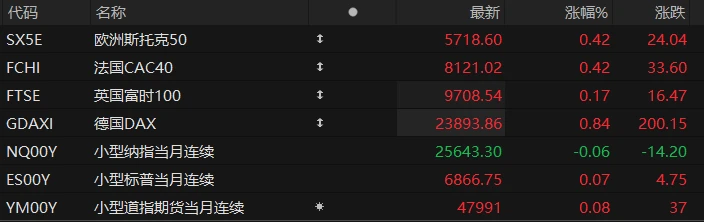

U.S. stock index futures were mixed in pre-market trading on Thursday, while major European indices generally rose. As of press time, the Nasdaq... S&P 500 futures fell 0.06%, S&P 500 futures rose 0.07%, and Dow Jones futures rose 0.08%.

In terms of individual stocks, most large-cap tech stocks rose in pre-market trading, with Meta up nearly 1% and Tesla... Nvidia Google rose about 0.5%, Amazon rose 0.5%. , apple Slightly higher in pre-market trading.

SAIF The stock rose more than 2% in pre-market trading after releasing its Q3 earnings report, which showed a 35% surge in ESP, far exceeding expectations, and the company also raised its full-year guidance.

Popular Chinese concept stocks generally rose in pre-market trading, with NIO among them. XPeng Motors rose nearly 4%. Bilibili Baidu rose more than 3%. Li Auto It rose by more than 1%.

Hesai The stock surged about 5% in pre-market trading after the company recently released its self-developed RISC-V lidar. The main control chip is Fermi C500.

Before the market opened on Thursday, the U.S. Challenger job cuts for November were released, totaling 71,321, compared to 153,074 in the previous month. The Challenger job cuts in November increased by 23.5% year-over-year, compared to a 175.30% increase in the previous month; however, they decreased by 53.4% month-over-month, compared to a 183% increase in the previous month.

According to data released by the U.S. Department of Labor on Thursday, initial jobless claims in the U.S. last week were 191,000, compared to expectations of 220,000 and a previous reading of 216,000. Following the data release, the U.S. dollar index rose briefly by about 10 points, currently trading at 98.94.

Bank of America stated that after three consecutive years of double-digit returns and valuations pushed to high levels, the upside potential for US stocks in 2026 is very limited. The bank predicts that the S&P 500 will close around 7100 points by the end of December next year.

Savita Subramanian, head of equity and quantitative strategy at the bank, said she expects U.S. companies to achieve double-digit earnings growth next year, but the stock market will see "moderate stock price returns."

Hot News

Four tailwinds support the 2026 stock market! JPMorgan suggests focusing on AI, cyclical stocks, and the Chinese market.

As the year draws to a close, investor sentiment towards artificial intelligence... (AI) trading is causing concern, and the overall US stock market is weak due to uncertainty surrounding the Fed's rate-cutting path. However, at JPMorgan Chase... According to JPMorgan strategists, now is the time for investors to strategically increase their stock holdings.

Andrew Tyler and Federico Manicardi, two key strategists at JPMorgan's market intelligence division, said there are several key catalysts that should drive the stock market higher into early next year.

The following factors are driving the US stock market: a strong US economic outlook, corporate earnings, fading tariff concerns, and a strong international market outlook. Tyler stated, "We are tactically bullish, and we expect the stock market to continue its upward trend into early 2026."

JPMorgan Chase also offered three key investment recommendations: 1. Artificial intelligence stocks, 2. Cyclical stocks, and 3. Key sectors in global equity markets. Manicardi highlighted potential opportunities in regions such as China, Europe, Japan, and India.

The following are the bank's key international areas of focus: Banking Stocks, Energy and Utilities Stocks related to "electrification," healthcare, mining, luxury goods, and renewable energy.

The World Gold Council's latest assessment predicts that gold prices may rise by another 30% in 2026.

A report released by the World Gold Council (WGC) on Thursday showed that gold performed exceptionally well in 2025, constantly breaking historical records, and at current prices, gold prices are expected to rise by another 15% to 30% in 2026.

Driven by U.S. tariff policies and geopolitical tensions, investors have flocked to gold, a traditional safe-haven asset, and its price has risen by about 60% so far this year. Central bank gold purchases and changes in interest rate policies have also profoundly influenced gold price trends this year.

Looking ahead to 2026, the gold market outlook remains heavily influenced by ongoing geoeconomic uncertainties. If the current environment persists, gold prices are likely to fluctuate within a range, as their movements largely reflect consensus expectations regarding the macroeconomy. However, given this year's performance, 2026 is likely to continue to bring surprises.

Gold prices may rise moderately if economic growth slows and interest rates decline further. However, in a scenario of rising global risks and a more severe economic downturn, gold could perform even stronger.

Goldman Sachs The current record surge in copper prices may be unsustainable, as supply can still meet global demand.

Goldman Sachs' latest views on the future trend of copper prices have injected a sense of caution into the market.

The bank noted that the current high copper prices are unlikely to be sustainable, as there is still ample copper supply to meet global demand. The bank expects copper prices to fluctuate between $10,000 and $11,000 in 2026.

"The recent rise in copper prices is primarily based on expectations of future market supply tightness, rather than current fundamentals," wrote analysts Aurelia Waltham et al. in a report. "We do not expect the current rally above $11,000 per tonne to be sustained."

As of press time, LME copper prices rose to $11,495 per tonne, a 31% increase year-to-date. Along with the surge in copper prices, mining stocks in the Asia-Pacific region also rose on Thursday (December 4).

The bank also pointed out that copper supply will exceed demand by about 500,000 tons this year, mainly due to weak demand in some Asian countries in the fourth quarter. The surplus will narrow to 160,000 tons in 2026, after which the market will gradually reach balance. A real copper shortage is not expected to occur until 2029.

PGIM warns: Even if Hassett leads the Federal Reserve, she will not be able to "rapidly cut interest rates" as Trump desires.

In a recent media interview, Gregory Peters, co-chief investment officer of PGIM Fixed Income, warned that even if current White House National Economic Council Director Hassett is ultimately appointed as the next Federal Reserve Chairman, he may not be able to achieve the rapid interest rate cuts that Trump desires, because the Fed's interest rate decisions are ultimately made collectively by the committee.

This warning comes as markets are buzzing about whether Hassett, if appointed head of the Federal Reserve, might adopt aggressive monetary easing policies to appease Trump. Trump stated this week that the race for Fed chair has "narrowed down to one person," and called Hassett a "potential Fed chair candidate," making her the frontrunner for the position.

Hassett's emergence as a leading candidate has sparked renewed investor concerns about the Federal Reserve's independence. Peters points out that this concern is translating into a risk premium and being priced into global sovereign bonds. He emphasizes that the Fed's independence "remains a major concern for investors."

However, despite the market's high level of attention, U.S. Treasury yields remained stable on Thursday, with the benchmark 10-year Treasury yield holding at 4.08% and the policy-sensitive 2-year Treasury yield rising slightly by 1 basis point to 3.50%.

US Stocks Focus

Palantir partners with NVIDIA to develop a software platform to accelerate AI data centers. Construction

On Thursday (December 4) local time, data analytics company Palantir, Nvidia , and US utility company CenterPoint Energy announced that the three parties are jointly developing a new software platform to accelerate the construction of next-generation artificial intelligence (AI) data centers .

The software system, named "Chain Reaction," aims to help companies building AI data centers overcome challenges such as licensing, supply chain, and construction—data centers that can consume the equivalent of a small city's electricity.

Executives involved in the project stated that Chain Reaction will use AI tools to assist clients. Building on the collaboration announced last month between Palantir and NVIDIA, Chain Reaction will leverage AI to solve supply chain and logistics challenges for retailers such as Lowe's and other businesses.

The management team involved in the project pointed out that the goals of this collaboration are much broader, as it attempts to integrate the supply chains and construction processes of different types of companies. For example, Nvidia and TSMC... They collaborate with chip manufacturing partners, while CenterPoint is responsible for securing permits and carrying out construction for grid upgrades.

The European Union has launched another antitrust investigation into Meta, alleging that its introduction of AI features into WhatsApp could harm competition.

On Thursday (December 4) local time, the European Union announced the launch of a full antitrust investigation into Meta, citing concerns that the artificial intelligence (AI) features introduced by the company in WhatsApp could harm competition.

In March of this year, Meta integrated a chatbot into WhatsApp. Along with the virtual assistant Meta AI, it was launched in the European market.

The European Commission has expressed concern about WhatsApp's move to launch AI features, saying that Meta could prevent competitors from launching AI services through WhatsApp.

"We must ensure that European citizens and businesses fully benefit from this technological revolution and take action to prevent dominant digital giants from abusing their power and squeezing out innovative competitors," said Theresa Rivera, the EU's antitrust chief, in a statement on Thursday.

AI applications reinforce the "bull market narrative"! Intelligent agents drive a new round of growth for Salesforce.

AI intelligent agent This is contributing to Salesforce's new round of performance growth. Financial reports show that the company's Q3 revenue increased by 8.6% year-on-year to $10.3 billion, with adjusted earnings per share of $3.25.

The remaining performance obligations currently stand at $29.4 billion, representing a year-on-year increase of over 11%, exceeding market expectations of approximately $29.1 billion. Both core product lines—sales and service cloud software platforms—saw revenue growth of 8% after currency adjustments.

For fiscal year 2026, the company raised its full-year revenue forecast to $41.45 billion to $41.55 billion, with adjusted earnings per share of $11.75 to $11.77 and an adjusted operating margin of approximately 34%. As of press time, Salesforce shares were up nearly 2% in pre-market trading on Thursday.

(Article source: Hafu Securities) )