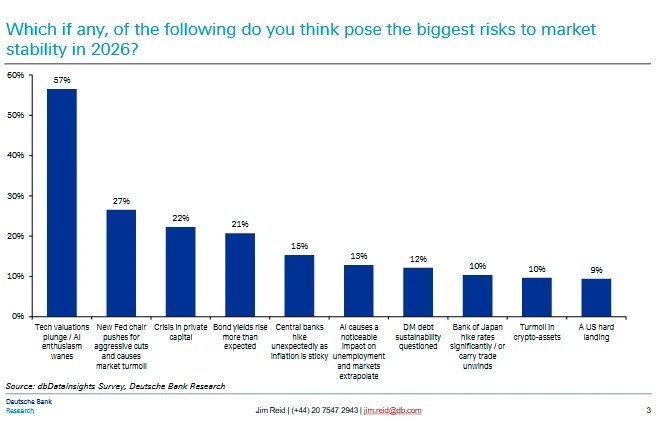

As the year draws to a close, Wall Street investment banks are currently making their own forecasts and assessments of next year's market performance. Deutsche Bank, for example... In a new report released this week, strategist Jim Reid listed the main risks that respondents in a Deutsche Bank client survey believed existed in the market over the next year.

Unsurprisingly, the bursting of the tech bubble topped the list: 57% of respondents cited "the collapse of tech valuations/ artificial intelligence" as the reason. "The fading of the boom" was listed as one of the three major risks. Reid pointed out that the bank had never seen a single risk so prominently represented at the start of a new year before, which is clearly the most prominent concern for 2026!

However, Reed also mentioned that some might argue that the prominence of bubble risk could actually trigger a contrarian reaction—given that so many investors are worried about it, the market frenzy may not have reached the extreme levels expected.

Unfortunately, it's not entirely possible to compare this to the market sentiment at the end of 1999: after all, there was both euphoria and bubble fears back then. But the key difference is that the bubble of the late 1990s was global, while the current potential bubble is highly concentrated in US artificial intelligence- related stocks.

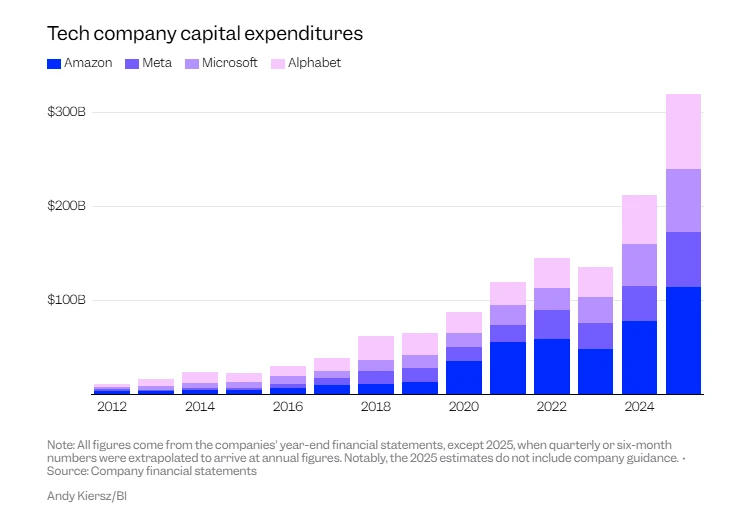

That said, today's leading AI companies are far larger than any single stock in 2000—and possess far greater systemic importance. In fact, some even argue that the systemic importance of current AI companies surpasses that of banks during the 2008 financial crisis. The system. And the outcome of that crisis is well known.

Looking further down the list, the second and third most risky risks for the coming year are the market turmoil caused by the new Federal Reserve Chairman's aggressive interest rate cuts (27%) and the private equity crisis (22%).

Reid also noted a significant increase in market concerns about the Fed's independence, given that convincing the entire board to support aggressive rate cuts is no easy task.

Private equity has become a frequently discussed topic among Deutsche Bank clients recently, especially in the US auto parts industry . Following the collapses of suppliers First Brands and Tricolor, a US subprime auto loan provider, some private lending firms suffered heavy losses. The core issue remains the lack of transparency in the sector, making it difficult to assess risk exposure and contagion risks.

In addition to the three major risks mentioned above, other risks next year include:

Unexpected rise in bond yields (21%), central bank unexpectedly raises interest rates due to inflation stickiness (15%), AI has a significant impact on unemployment and affects markets (13%), the sustainability of debt in developed markets is questioned (12%), Bank of Japan raises interest rates sharply/carry trades are unwound (10%), cryptocurrency volatility (10%), hard landing of the US economy (9%).

Reid points out that among the relatively lower-ranking risks, only 9% of respondents listed a hard landing for the U.S. economy as one of the top three, so if the U.S. economy does experience a recession, it would be a major surprise.

For reference, last year, the global trade war was listed as the primary risk by 39% of respondents, followed closely by the tech bubble at 36%—these were the two most popular answers at the time. After the DeepSeek incident at the beginning of the year and "Liberation Day" in early April, these consensus risks did briefly emerge, but then quickly subsided.

So, is the AI bubble that 57% of respondents are most worried about justified, or is the market simply not yet at a level of frenzy enough to burst? Only time will tell.

(Article source: CLS)