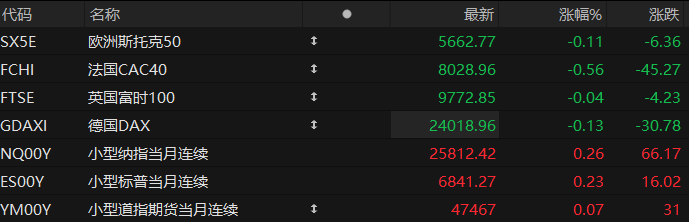

After several weeks of volatility, US stocks have gradually begun to stabilize. (Deutsche Bank) Bankim Chadha, chief U.S. equity strategist, recently stated that the ongoing upward trend in U.S. stocks is likely entering its fourth year, with an even stronger rally expected in 2026.

Chadha is optimistic that the S&P 500 will continue its upward trend in 2026, driven by further strong corporate earnings growth.

Despite the persistent concerns of market participants regarding artificial intelligence There are concerns about a potential bursting of the bubble, but Chadha predicts that the S&P 500 will rise to 8,000 points by the end of 2026, which means there is still 18% upside potential from current levels.

Chadha has long held a bullish view on the stock market and the U.S. economy, even during periods of short-term market corrections or increased recession fears. He recently stated that investors should expect a surge in profits next year, with growth spreading from the fastest-growing tech stocks to the rest of the market.

He pointed out, "The key logic is that market breadth will continue to expand starting from the third quarter. For the stock market to achieve a soft landing, it needs broad market support."

Regarding the price-to-earnings ratio of the US stock market, Chadha cautioned that by historical standards, US stock valuations are currently very high. However, Chadha does not agree with the "overvaluation concern," arguing that valuations are cyclical, not fixed, and merely reflect the market's position within the economic cycle.

He explained that the fundamentals supporting the valuation remain strong, suggesting that valuations may rise further.

He added that even if valuations don't rise, the market still has room to rise simply because investor positioning is neutral. "Investor positioning is not close to historical highs, and is even close to neutral. There is about 9% upside potential from the upper limit of positioning."

(Article source: CLS)