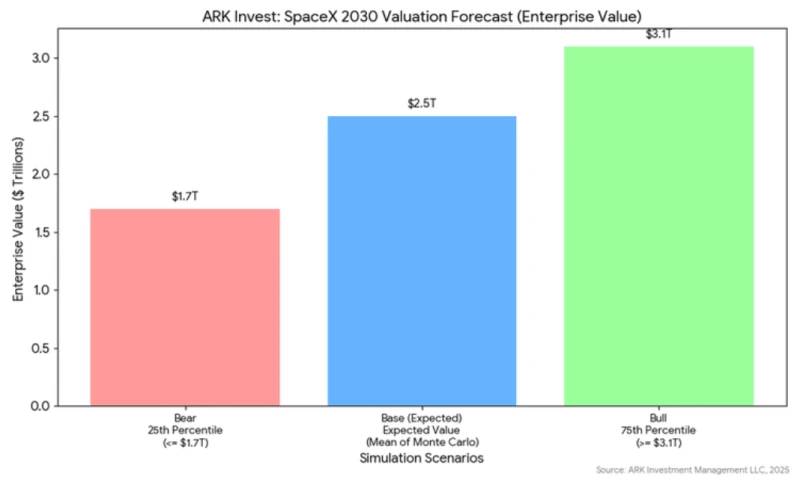

ARK Investment, the investment management firm of renowned tech investor Cathie Wood, recently predicted that SpaceX, Elon Musk's space exploration technology company, will be valued at approximately $2.5 trillion by 2030.

This estimate was derived using Monte Carlo simulation, a numerical method based on random sampling and statistical inference. According to ARK's open-source model, this model takes into account 17 key variables that reflect SpaceX's growth potential over the next two decades.

To this end, the model provides three potential valuation scenarios: in the baseline scenario, SpaceX's valuation will reach $2.5 trillion by 2030; in the pessimistic scenario, it will be $1.7 trillion; and in the optimistic scenario, the valuation will soar to $3.1 trillion.

These projected scenarios illustrate the potential differences that companies may experience due to strategic initiatives, such as the development and deployment of satellites and the company's level of commitment to Mars colonization.

According to ARK Investment's estimates, the cornerstone of SpaceX's future will be the full deployment of Starlink satellites, a step that is expected to be completed by 2035.

Once Starlink is operational, it is projected to generate up to $300 billion in revenue annually, accounting for approximately 15% of global communications spending. This expansion also underscores the need for affordable and high-speed satellite internet to be widely available globally. The transformative impact it brought about.

Furthermore, the reusability of Starship is another key factor in ARK's evaluation. By reducing the turnaround time of the Starship fleet and lowering launch costs, SpaceX aims to make significant strides in its Earth and Mars projects.

However, ARK Investment also pointed out potential risks, including interference from competitors and the challenges SpaceX faces in operational execution within the demanding field of space exploration.

Last week, reports indicated that SpaceX was launching a new round of secondary stock sales. If the transaction were to be completed successfully, the company's valuation would double to $800 billion. However, Elon Musk responded on Saturday (December 6th) that the reports about SpaceX recently raising funds at an $800 billion valuation were inaccurate. He emphasized that SpaceX has achieved positive cash flow for many years and provides liquidity to employees and investors through regular stock buybacks.

(Article source: CLS)