On December 9th local time, the two-day Federal Reserve interest rate meeting officially began in Washington, D.C.

The Federal Reserve is widely expected to cut interest rates for the third consecutive time, as the US job market is sending alarming signals. This meeting is highly anticipated, with the vote likely to see multiple dissenting votes again. The updated economic projections will likely predict employment and inflation prospects; the key dot plot will be closely watched; the change of leadership will influence policy direction; and how the balance sheet will manage liquidity.

Several dissenting votes

Since this summer, disagreements have gradually emerged among Federal Reserve policymakers. At that time, the process of inflation easing stalled, and job growth slowed at the same time, putting the two core objectives of "2% inflation" and "full employment" in direct conflict.

The subsequent government shutdown further complicated the situation—the release of data that could have clearly indicated the economic outlook was forced to be postponed, resulting in policymakers having largely solidified and deeply divided positions on the question of whether further interest rate cuts were needed to boost the job market before this week's meeting. Opponents argued that inflation was still high and that the risk of cutting interest rates was too great.

Federal Reserve Bank of New York Bank President Williams John Williams became the key figure in breaking the deadlock. At a meeting of the Central Bank of Chile, he stated that the US could cut interest rates without jeopardizing the Federal Reserve's inflation target, while simultaneously mitigating the risk of a job market downturn. "I believe current monetary policy is in a moderately restrictive range…therefore, I still believe there is room for further adjustments to the target range for the federal funds rate in the near term, bringing the policy stance closer to neutral."

However, dissenting voices cannot be ignored. Schmid, president of the Kansas City Federal Reserve Bank and a member of the hawkish camp, believes that inflation remains widespread and above target, economic growth is strong, and the labor market remains balanced. He views the economic slowdown as a structural problem and warns that inflation expectations could spiral out of control.

Another voting member, Boston Federal Reserve Bank President Susan Collins, said that given the resilience of the economy, she believes current monetary policy is at an appropriate level and is "hesitant" to cut interest rates further. The Fed's benchmark policy rate is currently in the 3.75%-4% range, a level she considers only mildly restrictive and currently very appropriate, maintaining some downward pressure on inflation.

Bank of Montreal Sal Guatieri, senior economist in capital markets, told CBN reporters, "Despite weakness in some sectors, the overall economy remains resilient. However, relatively manageable inflationary pressures and a slowing job market will likely create conditions for the Federal Reserve to cut interest rates again next week."

Regardless of the final outcome of this meeting, a majority of votes against the rate cuts is likely. A review by CBN (China Business Network) found that among the 12 voting policymakers on the Federal Open Market Committee (FOMC), which sets interest rate policy, as many as 5 have expressed opposition to or skepticism about further rate cuts, while 3 core members of the Federal Reserve Board of Governors have explicitly supported rate cuts.

ING ING Group believes that weak ADP employment data, Challenger job cuts data, and the Fed's Beige Book's pessimistic assessment of the economy have further supported calls for interest rate cuts, but a split is expected in the decision, with four members anticipated to vote to keep rates unchanged. (Bank of America Securities) It is anticipated that up to three dissenting votes may be cast against the rate cut. Meanwhile, Trump's new nominee, Milan, may also cast a dissenting vote advocating for a significant rate cut, thus creating a situation of two-way dissent once again.

What is the economic outlook?

If the Federal Reserve maintains its data-dependent policy stance, the direction of the economy next year will determine the potential scope for interest rate cuts, making the latest Quarterly Economic Outlook (SEP) report a key focus.

According to the latest survey by the National Association for Business Economics (NABE), the U.S. economy is expected to achieve moderate growth in 2026, but job creation is expected to remain weak, with a slight rebound in growth and persistent price risks.

Specifically, the median forecast for U.S. economic growth in 2026 is 2%, higher than the 1.8% projected in the October survey and also the same as the Federal Reserve's September forecast. Economic growth is expected to be supported by stronger consumer spending and business investment, but the Trump administration's new import tariffs could reduce growth by 0.25 percentage points or more. Economists also point out that stricter immigration enforcement policies are putting pressure on the economic outlook.

Respondents expect inflation to fall only slightly to 2.6% in 2026. Economists believe tariffs are a significant factor driving up prices. Job growth is expected to remain weak, with the unemployment rate rising to 4.5% in early 2026 and remaining at that level throughout the year. Both figures are in line with the Federal Reserve's September forecast.

Boris Schlossberg, macro strategist at asset management firm BK Asset Management, told CBN that consumption will continue to support the US economic expansion, with growth in service spending primarily driven by high-income households—whose wealth was significantly boosted by the previous stock market rebound. Meanwhile, the stagnant labor market has already impacted low- and middle-income consumers, and coupled with the squeeze from tariff policies, the US economy is exhibiting a so-called "K-shaped recovery."

He believes that combining the Institute for Supply Management (ISM) and S&P Global... Recent survey data suggests that the process of businesses passing on import tariff costs to consumers is not yet complete, and upward pressure on prices remains. The job market continues to exhibit a "neither hiring nor laying off" situation, while workers report that job opportunities are becoming increasingly difficult to obtain. Although initial jobless claims remain within a manageable range, private sector job vacancy indicators and small business surveys suggest weak labor demand, and private sector layoff indicators have risen. It is noteworthy that a larger share of the slowdown in job growth appears to stem from cyclical factors rather than structural ones. This means that a jump in the job market, or the unemployment rate, could become a leading indicator of a turning point in economic growth.

Forecast of interest rate cuts next year

Regardless of the Fed's decision in December, Powell will face greater internal resistance than at any other time during his nearly eight-year tenure. This disagreement could persist into next year, and simply changing the chairman does not guarantee further rate cuts.

The Federal Reserve may signal a hawkish stance on interest rate cuts. Bob Schwartz, a senior economist at Oxford Economics, previously told First Financial Daily that it's hard to recall a Federal Open Market Committee (FOMC) meeting where opinions on whether further rate cuts are needed were as evenly divided as the upcoming meeting. However, with the labor market stabilizing and inflation remaining high, the committee will pause rate cuts early next year, entering a policy observation period. Given that the current policy stance is already close to neutral, officials want to observe the impact of existing policy measures first.

Federal funds rate pricing indicates that the market currently believes the Federal Reserve has room to cut rates by about 52 basis points in 2026, equivalent to two rate cuts.

Morgan Stanley Last week, we revised our forecast, predicting a 25-basis-point rate cut by the Federal Reserve in December, based on dovish comments from policymakers, in line with JPMorgan Chase's projections. Bank of America The consensus among peers is that "Powell may use a rate cut as an exchange to adjust the wording in the policy statement, thereby signaling that the threshold for further rate cuts will be raised."

Most institutions believe the Federal Reserve will complete two rate cuts within the first three quarters, but the pace varies. Bank of America predicts June and July, ING predicts March and June, and Morgan Stanley currently expects the Fed to cut rates by 25 basis points each in January and April, ultimately bringing the rate down to 3.0%-3.25%. "We expect Powell to signal that the adjustment phase of monetary policy has come to an end. Any further policy adjustments will be based on a 'meeting-by-meeting assessment' principle, guided by the latest economic data."

However, considering the upcoming restructuring of the Federal Reserve, a new chairman will be appointed next May, with current National Economic Council Director Hassett being a leading candidate, as he has consistently advocated for low interest rates. If President Trump successfully removes Federal Reserve Governor Cook from his post, his successor may also favor lowering borrowing costs. At that time, five of the seven members of the Federal Reserve Board will have been appointed by Trump. Furthermore, next February, all 12 regional Federal Reserve presidents will face reappointment—candidates are nominated by the regional Federal Reserve Bank management but must be approved by the Federal Reserve Board. This means that the Federal Reserve may undergo a complete reorganization, and its policy approach may be drastically different from the current committee.

ING expects the inflation environment in the coming months to be more favorable for interest rate cuts, providing justification for further dovish action. While the threat of tariffs remains, their implementation speed and impact are less severe than previously feared. This buys more time for deflationary forces such as falling energy prices, slower housing rent growth, and declining wage increases, which will push inflation toward the 2% target more quickly, potentially faster than the Fed's forecasts. Given the reduced inflation threat and the increasingly fragile employment situation, the FOMC's stance may become further dovish, raising the risk of additional rate cuts later this year. In the context of tightening liquidity, the Fed still needs to manage liquidity effectively.

Potential variables: Balance sheet

Many market participants believe that the future direction of the Federal Reserve's balance sheet is just as important as interest rate decisions.

Given the pressure in the overnight funding markets, the Federal Reserve halted its balance sheet reduction process on December 1st. This move is significant because the Fed had previously stated repeatedly that it hoped to avoid a repeat of the 2019 repo market crisis. Nevertheless, even with increasing expectations of interest rate cuts, long-term Treasury yields rose sharply last week. The 10-year Treasury yield touched 4.14% at one point, meaning that even if short-term interest rates decline, borrowing costs for households, businesses, and the US government may remain high.

Bank of New York Mellon The bank argues that another challenge facing the Federal Reserve is maintaining a balance sheet of appropriate size. It analyzes the mechanisms of quantitative tightening and the risks of a "reserve shortage." The analysis explores how liquidity in the financial system's "pipeline" affects ordinary consumers by pushing up mortgage costs and discusses the crucial role of a well-liquid U.S. Treasury market in preventing crises like the Silicon Valley Bank collapse of 2023.

“Currently, monetary policy at the interest rate level is clearly still in a restrictive range,” said Michael Kelly, global head of multi-asset investments at PineBridge Investments. “But this situation has largely failed. High interest rates have impacted small and medium-sized enterprises, with layoffs occurring frequently in these companies; and in the context of a K-shaped economic recovery, high interest rates are also putting pressure on lower-income families.”

Recent credit card data confirms this trend. A report from Oxford Economics to First Financial Daily states that low-income consumers are more likely to hold onto their credit card balances for extended periods, facing the risk of reaching their credit limits; while high-income consumers, less likely to accumulate credit card debt, are becoming the main force behind consumer spending. Kelly argues that this "dual-track economy" makes any statement from the Federal Reserve regarding its $6.5 trillion balance sheet crucial for the market. "Will they maintain the size of their balance sheet, or will they begin to expand it?"

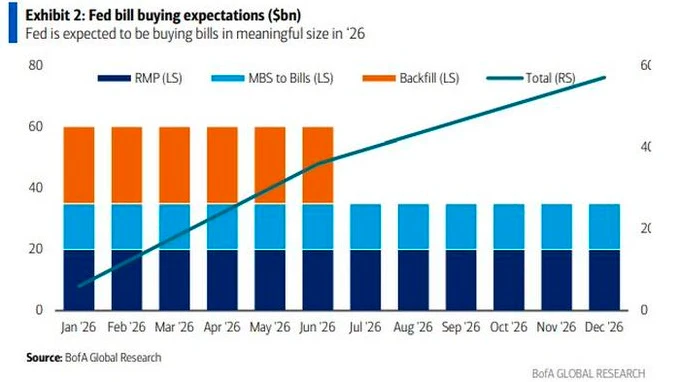

Bank of America's global interest rate strategy team expects the Federal Reserve to announce this week "reserve management-type Treasury purchases," targeting short-term Treasury bills with maturities of one year or less, with a monthly purchase scale of $45 billion starting in January next year. This plan will be converted into two parts of bond purchases: one is "balance sheet natural growth-type bond purchases" of at least $20 billion per month, and the other is "reserve excess outflow-type bond purchases" of $25 billion per month, and this scale will be maintained for at least 6 months.

Some institutions believe that the Federal Reserve may need more time to observe and that it can maintain smooth market operation without taking large-scale actions. "From a long-term perspective, the Fed will naturally start purchasing Treasury bills next year as part of its reserve management operations," said Roger Hallsm, global head of rates for fixed income at Vanguard Group. "As the economy's demand for reserves expands, the Fed will naturally meet it."

Harlem anticipates that the Federal Reserve may begin purchasing Treasury bills at a rate of $15 billion to $20 billion per month by the end of the first quarter or the beginning of the second quarter of next year. "This is a routine reserve management operation by the central bank and does not carry the significance of a monetary policy signal; it is simply a routine operation that the Fed should conduct to ensure sufficient liquidity in the system. Its purpose is to maintain stable funding rates," Harlem added.

(Article source: CBN)