On Monday local time, Berkshire Hathaway published CEO Warren Buffett's annual letter to shareholders on its website. The "Omaha legend" stated in the letter that he will "reduce public activity" after stepping down at the end of this year. Although this is likely his last statement as Berkshire's CEO, the 95-year-old currently has no plans to completely withdraw from the public eye.

Warren Buffett announced that he will no longer write the opening address of the company's annual report, but the "Oracle of Omaha" will continue to deliver an annual Thanksgiving message, a tradition that began in 1965. He will also "increase" his philanthropic efforts by donating the $149 billion worth of Berkshire Hathaway stock he still holds.

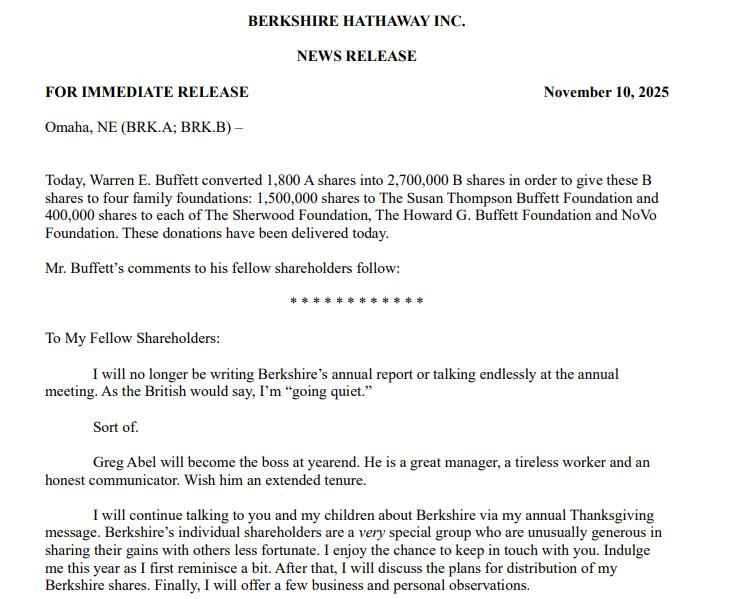

Buffett revealed that he has converted 1,800 shares of his company stock (worth $1.35 billion) into Class B stock and donated them to four foundations under his family's umbrella. He stated, "To increase the likelihood that these foundations can handle almost my entire estate before other trustees take over, I need to expedite the donation process to these three foundations while I am still alive."

Warren Buffett has become an iconic figure in the investment world. The billionaire has cultivated a friendly and approachable public image, which he has further reinforced, especially through his letters to shareholders. Although global investors closely follow his market moves, Buffett has consistently strived to position himself as a “supporter” of America, ordinary Americans, and the capitalist system.

Next year, Greg Abel will succeed Warren Buffett as CEO. The 63-year-old Abel is currently the non- insurance CEO of Berkshire Hathaway. The vice chairman of the business was designated as Buffett's successor as early as 2021. Buffett once again spoke highly of his successor, writing in a letter: "When I thought Abel should become the next CEO of Berkshire, I had high expectations for him, and his performance has far exceeded those expectations."

In addition, Buffett updated his health status, saying, "Surprisingly, I feel pretty good overall. Although I'm moving slower and reading is becoming more difficult, I still go to the office five days a week and work with a fantastic group of colleagues."

Berkshire Hathaway's stock price has risen more than 10% this year, pushing the company's market capitalization above $1 trillion. "Overall, the prospects for Berkshire's companies are slightly better than the industry average, including several 'star companies' with low business overlap and considerable size. However, in one or two decades, many companies will outperform Berkshire, as the sheer size of a company also brings its own set of challenges," Buffett wrote.

Entering the Abel era

Investors closely monitor Warren Buffett's every investment move because this legendary investor has proven his profound market insight over time—leading Berkshire Hathaway to outperform the market for nearly 60 years. During this period, the holding company achieved an annualized compound return of nearly 20%, while the S&P 500 index only achieved an annualized return of 10%.

Warren Buffett is a typical value investor. He tends to choose two types of stocks: those that are valued at a discount to their peers and those that are reasonably priced and whose true value he believes the market will eventually recognize. Buffett also favors companies that have a long history of paying dividends, such as Coca-Cola . (Coca-Cola) and American Express (American Express) – Both of these companies are among Buffett's top five holdings.

It is precisely through these investment philosophies and practices that Buffett has achieved remarkable success over the years, inspiring numerous investors to follow in his footsteps. However, this does not mean that Buffett is always optimistic about the market—as the S&P 500 approaches its historical high, he has issued a new warning to Wall Street. As of the third quarter of this year, Berkshire Hathaway has been a net seller of stocks for the 12th consecutive quarter, while its cash reserves have surged to a record $381 billion. Currently, the company's cash holdings far exceed the value of its stock portfolio (currently valued at $283 billion).

As Warren Buffett wrote in his letter to shareholders last year, "Most of the time, there are no attractive investment opportunities in the market; moments when we are 'deeply immersed in opportunity' are extremely rare." Does this mean investors should stop investing? The answer is probably not. In fact, Buffett has continued to buy some stocks in recent quarters. What this warning really wants to convey is that investors should not be blinded by market frenzy, but should carefully evaluate the company's valuation and long-term prospects before buying.

It's worth noting that in the nearly six months following the announcement of Buffett's resignation, Berkshire Hathaway's stock price fell by more than 10%, while the overall market rose by more than 10%. For years, investors have been willing to pay a premium for Berkshire's stock because Buffett manages the funds.

As Buffett prepared to leave, a decline in investor confidence in Berkshire Hathaway was perhaps inevitable. Buffett took a series of reassurance measures: he assured investors that his successor would be a better manager; he would not sell his shares; and he would continue to serve as chairman of the board, spending most of his time at the office. These positive statements, coupled with Abel's promise that "the investment philosophy will not change," further solidified his position.

CBN reporters noted that, as Abel stated at this year's shareholders' meeting, Berkshire Hathaway is increasing its investment in Japan. Reports indicate that Berkshire Hathaway has hired several banks... This is in preparation for a new round of yen bond issuance. The company also filed with a U.S. securities firm. The Securities and Exchange Commission (SEC) has filed a preliminary prospectus.

This will be Berkshire Hathaway's second issuance of yen bonds this year, a move that strongly suggests the company's intention to continue increasing its holdings of Japanese trading companies, which it has been buying since 2019. Currently, the share prices of all five major Japanese trading companies are at or near all-time highs.

Berkshire Hathaway's disclosed holdings of Japanese trading companies are worth nearly $33 billion, up from $31 billion just a month ago. Given that Berkshire may still be increasing its holdings in some stocks without public disclosure, the actual value of its holdings is likely higher.

Excerpt from shareholder letters

To all shareholders:

Going forward, I will no longer write Berkshire Hathaway's annual report, nor will I give lengthy speeches at the annual shareholders' meeting. In British terms, I'm going quiet.

Greg Abel will take over as head of the company at the end of the year. He is an excellent manager, hardworking and dedicated, and communicates with sincerity and frankness. May he have a long and successful tenure.

However, I will continue to discuss Berkshire-related matters with shareholders and my children through my annual Thanksgiving message. Berkshire's individual shareholder group is quite special; they are always exceptionally generous in sharing their profits with those who are struggling. I cherish the opportunity to stay connected with everyone. This year, please allow me to first briefly review the past, then explain my Berkshire stock allocation plan, and finally share some thoughts on business and personal matters.

With Thanksgiving approaching, I am grateful and deeply fortunate to be 95 years old and still healthy. I never imagined I would live to this age when I was young.

First, I must mention Charlie Munger, my best friend of 64 years. Charlie and I didn't meet until 1959—he was 35 and I was 28. After serving in World War II, Charlie graduated from Harvard Law School and then permanently moved to California. But he always said that his early life in Omaha shaped his life. For over 60 years, Charlie has had a profound influence on me; he is my best mentor and my most reliable "big brother." We've had disagreements, but we've never argued—Charlie has never said, "I told you so."

Next, I'd like to talk about another Omaha native—Stan Lipsey. In 1968, Stan sold the Omaha Sun (a weekly newspaper) to Berkshire Hathaway; ten years later, at my request, he moved to Buffalo. At the time, the Buffalo Evening News, controlled by a Berkshire subsidiary, was locked in a life-or-death struggle with a local morning paper that monopolized Buffalo's only Sunday newspaper market, and we were at a disadvantage. Ultimately, Stan spearheaded the launch of our Sunday edition. In the years that followed, this once heavily loss-making newspaper achieved a pre-tax return of over 100% annually on our $33 million investment. In the early 1980s, this revenue was significant for Berkshire.

Stan grew up about five blocks from my house. One of his neighbors was Walter Scott, Jr. You might recall that in 2009, Walter brought MidAmerican Energy to Berkshire Hathaway. He was one of Berkshire's most valuable directors and a very close friend of mine until his death in 2021. For decades, Walter was a leading figure in Nebraska philanthropy, leaving his mark on Omaha and throughout the state.

In 1959, Don Keough and his small family lived across the street from my house, about 100 yards from where the Munger family had once lived. At the time, Don was a coffee salesman, but he later became president of Coca-Cola and a dedicated director of Berkshire Hathaway. In 1985, while Don was president of Coca-Cola , the company launched "New Coke," an attempt that was a resounding failure. Don delivered a famous speech, apologizing to the public and announcing the reinstatement of "Old Coke," which led to a significant rebound in Coca-Cola sales.

Finally, I must mention Ajit Jain and his successor as CEO, Greg Abel: Ajit was born and raised in India, while Greg is Canadian. Both lived in Omaha for several years in the late 20th century. In fact, Greg lived on Farnam Street in the 1990s, just a few blocks from my home, but we never met then.

What will happen next?

Now, let's talk about my advanced age. My genes aren't particularly advantageous—before me, the longest-lived person in my family was 92. I was born in 1930, in good health and with a sound mind. For most of my life, Lady Luck has been on my side, but for someone in their nineties, there are more important things to do—luck has its limits.

Conversely, Father Time becomes increasingly "interested" in me as I grow older. And he never loses—to him, everyone eventually becomes his "trophy." When your balance, eyesight, hearing, and memory are all declining, you know that Father Time has come to visit you.

The timing of aging varies from person to person—but once it arrives, it's unavoidable. Surprisingly, though, I'm generally feeling pretty good. While I've become slower and reading has become increasingly difficult, I still go to the office five days a week and work with a fantastic group of colleagues. Occasionally, I come up with some useful ideas, or someone proactively offers us collaboration opportunities we might not otherwise have access to. Given Berkshire's size and the current market environment, good ideas, while not numerous, are not nonexistent.

My children are all past the normal retirement age, aged 72, 70, and 67 respectively. To increase the likelihood that they can manage almost my entire estate before a successor takes over, I need to accelerate the pace of lifetime donations to the three foundations they manage. Now, my three children are mature, intelligent, energetic, and discerning enough to manage the donation of such a large fortune. Moreover, they will still be alive after my death, and if necessary, they can develop forward-looking or reactive strategies based on federal tax policies or other changes affecting philanthropy. They will likely need to adapt to this rapidly changing world.

There's another factor to consider: I want to retain a significant number of Class A shares until Berkshire's shareholders trust Greg as much as Charlie and I have long done. Reaching that level of trust shouldn't take too long—my children already have 100% support for Greg, as do Berkshire's directors.

My accelerated lifetime donations to the foundation managed by my children are not due to any change in my view of Berkshire's future. Abel's performance has far exceeded my high expectations when I initially thought he should succeed me as Berkshire's next CEO. He now knows our many businesses and employees far better than I do, and he quickly grasps many things that even CEOs wouldn't consider. Whether CEO, management consultant, academic, or government official—regardless of their role—I can't think of anyone more suitable than Greg to manage the assets in our hands.

Overall, Berkshire Hathaway's businesses are performing slightly better than the industry average, including several independent and sizable "star companies" that are driving the group's growth. However, in ten or twenty years, many companies will inevitably outperform Berkshire—our sheer size will become a constraint.

Of all the companies I know, Berkshire Hathaway has the lowest probability of facing a devastating crisis. Moreover, compared to almost every company I know (and countless others I've met), Berkshire has a management team and board of directors that are more focused on shareholder interests. Finally, Berkshire's operating principle is always to "be an asset of America," resolutely avoiding any activities that could turn it into a "dependent." Given time, our management team should accumulate considerable wealth—after all, they bear heavy responsibilities—but they have no desire to build a family dynasty or pursue "eye-catching" wealth.

Berkshire Hathaway's stock price will fluctuate; it has fallen by about 50% three times during the current management's 60-year tenure. Don't despair: the U.S. economy will eventually recover, and Berkshire Hathaway's stock price will rebound accordingly.

Final Thoughts

Perhaps there's a slightly selfish feeling: I can say with satisfaction that I'm far more satisfied with the second half of my life than the first. My advice is: don't be too hard on yourself for past mistakes—at least learn something from them and move on. It's never too late to start improving. Find role models worth following and learn from them.

Don't forget Alfred Nobel—who later became famous for the Nobel Prize. It's said that when his brother died, a newspaper confused the situation and mistakenly published his obituary, thus revealing Nobel's own "death report." The content of the report deeply shocked him and made him realize he needed to change the course of his life.

Don't pin your hopes on the newspaper's mistake: you should first decide what you want written in your obituary, and then live your life to be worthy of such praise.

Greatness doesn't come from accumulating enormous wealth, gaining massive exposure, or wielding significant government power. You contribute to the world whenever you help others in any of the thousands of ways. Kindness costs nothing, yet is priceless. Regardless of your religious beliefs, the "Golden Rule" (Do not do to others what you would not have them do to you) is an excellent guideline for your actions.

As I write these words, I've made countless mistakes and lacked foresight, but fortunately, I've learned from some excellent friends how to better conduct myself in society (though there's still a long way to go before I'm perfect). Please remember, a cleaner, like a CEO, is a person with dignity.

Wishing everyone who reads this letter a happy Thanksgiving. Yes, even those who act rashly—it's never too late to change. Remember to thank America for the greatest opportunities it has offered you.

Choose your role models carefully, and then learn from them. You can never be perfect, but you can always improve.

(Article source: CBN)