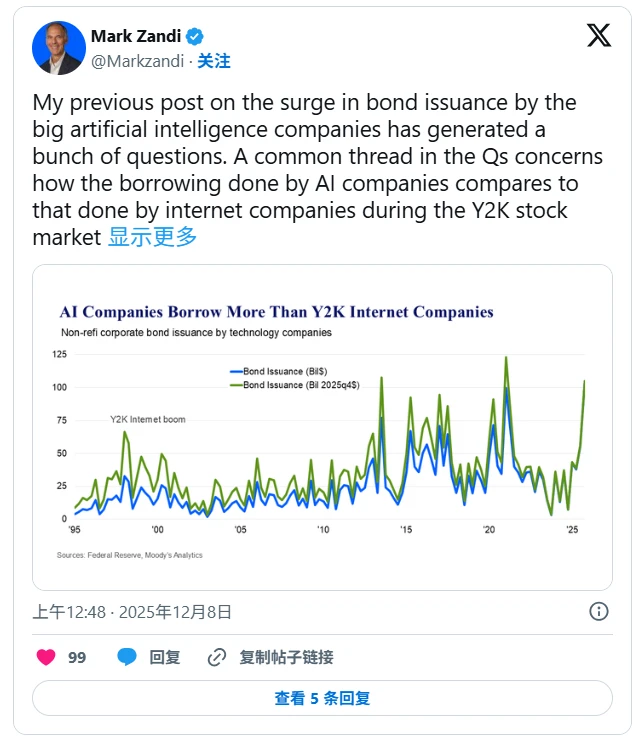

①Moody's Chief economist Mark Zandi recently stated that if the technology sector experiences serious problems, debt issues should be considered a risk to the entire financial system;② He pointed out that by 2025, artificial intelligence... Mega-corporations have accumulated massive debt through record bond issuances, exceeding the borrowing levels of tech companies before the dot-com bubble burst.

For those pessimistic about the artificial intelligence (AI) boom, debt is becoming an increasingly worrying factor. They fear that AI companies, currently heavily indebted, could not only collapse themselves if they fail in the future, but also trigger a wider crisis.

Mark Zandi, chief economist at Moody 's Analytics, recently expressed concerns about AI lending. He stated that if serious problems arise in the tech industry, debt issues should be considered a risk to the entire financial system .

Zandi has maintained a pessimistic view of the U.S. economy throughout the year, previously focusing on the potential threat of recession. Recently, he pointed to another worrying trend in the tech world: the escalating AI lending frenzy.

Zandi recently pointed out that by 2025, AI hyperscale companies will have accumulated massive debt through record bond issuances, exceeding the borrowing levels of tech companies before the dot-com bubble burst .

Zandi stated on X that so far this year, the total debt issued by all technology companies (including artificial intelligence companies and telecommunications companies that borrowed heavily around 2000 to expand their internet businesses) has far exceeded the levels seen during the bursting of the dot-com bubble.

He emphasized that these companies are not simply refinancing existing debt, but rather continuously expanding their borrowing to seize market share in artificial intelligence. Zandi believes that even after adjusting for inflation, the current level of borrowing in the tech industry is at a record high.

He also stated that the surge in debt poses a significant risk to the overall market and the macroeconomy . "Borrowing by artificial intelligence companies should be a concern as a growing potential threat to the financial system and the broader economy," he said.

Zandi points out that if a company's performance fails to meet market expectations, its stock price may fall sharply, dragging down the performance of other technology stocks and shaking market confidence across the entire industry .

Zandi also warned that the impact of the bursting dot-com bubble was primarily concentrated in the stock market; however, given the current high level of debt, the market turmoil triggered by artificial intelligence will spread to more sectors, further amplifying systemic risks .

Zandi's remarks reiterated his pessimistic view of the artificial intelligence market and economic prospects earlier this month. He warned at the time that unrealistic optimism was fueling an investment frenzy.

Other industry insiders also commented on artificial intelligence infrastructure and data centers. The enormous expenditures have raised concerns. Skeptics worry that even for industry leaders, the return on investment in artificial intelligence remains highly uncertain.

(Article source: CLS)